As remote workers, we built our careers online. We can operate and give value to our clients even in the comforts of our homes. And why not apply this to our banking and financing needs as well?

Arguably, the most popular ones today are Maya and Gcash. They are powerful mobile wallets that allow you to do more like paying bills, insurance, government obligations, and even investing with just a few clicks. And here’s how you can open one.

How to Open a Maya Account

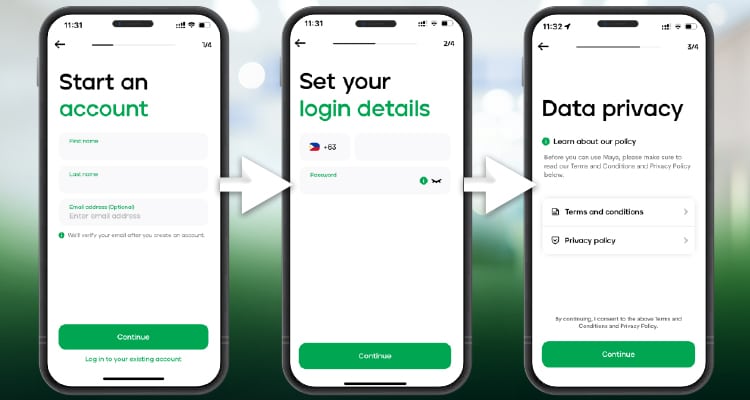

First, download the app (iOS and Android) on your device.

After downloading, just click “Create Account.”

First, input your name and then set your login details connected with your phone. Take note; you can use all numbers from any telecommunications network. Afterwards, you will be prompted with a data privacy policy condition.

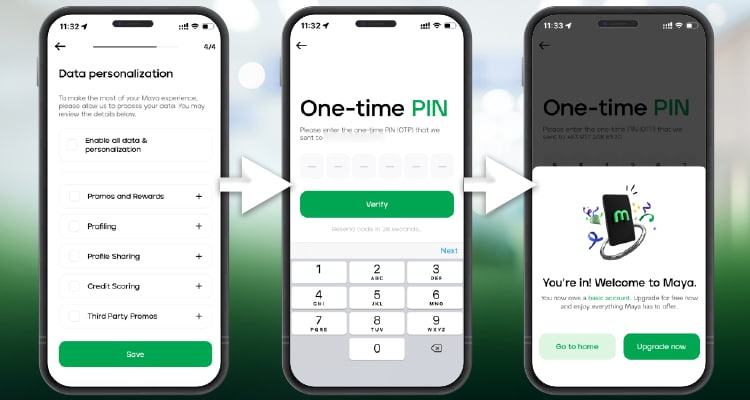

Set your data personalization, where you can choose what information is important to you. Afterwards, you will receive a one-time pin. And you are now registered with Maya with a basic account.

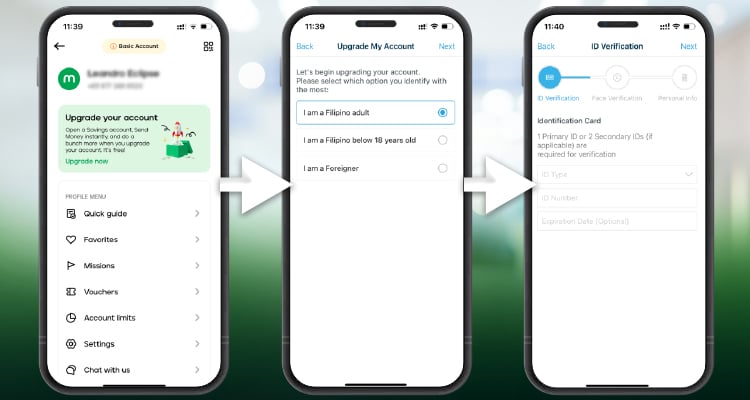

Upgrading Your Maya Account

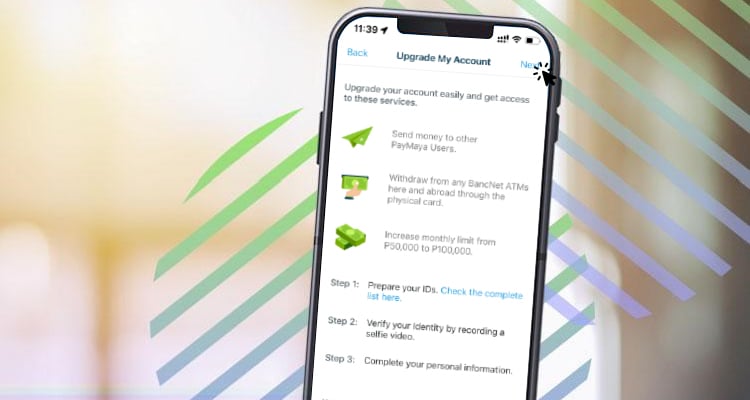

Why do you want to upgrade your account? If you use a basic Maya account, it can only be used as a portal for bills payment. That’s it. But if you upgrade it, it can be an online wallet with a higher maximum top-up.

You can top-up money and then withdraw money from any Bancnet ATM and also have the option to transfer money to other banks and Maya users. Your mobile phone is now your mobile wallet. And it’s quite easy to do.

First, click the upper left corner. And then choose “Upgrade Your Account.” And then, choose if you’re a Filipino adult, below 18 years old, or a foreigner.

And then go through the identification process. Afterwards, Maya will review your documents within 72 hours. That’s it! You can enjoy additional perks from your Maya wallet.

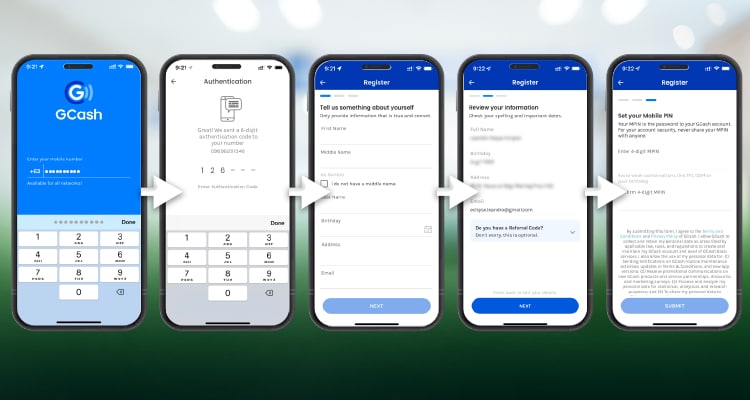

How to Open a Gcash Account

Registering in Gcash is similar to opening a Maya account. First, download the application for your mobile device (iOS and Android).

And then, register your number. You can use other networks aside from Globe to open a Gcash account. Afterwards, type your information and then assign a mobile pin. That’s it! You now have a Gcash account.

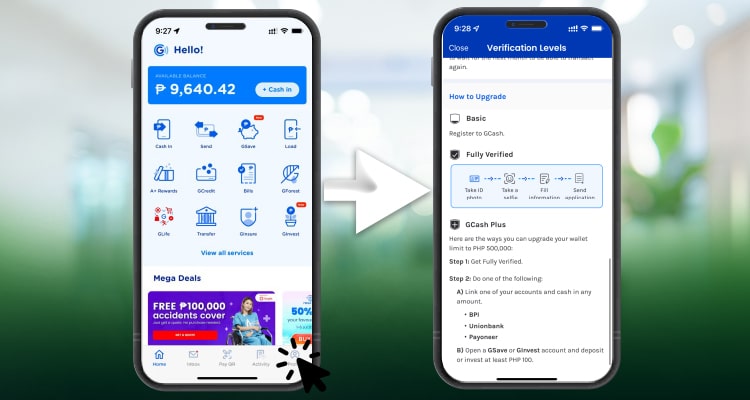

Verifying Your Gcash Account

Similar to Maya, verifying your GCash account will give you a lot of perks like higher wallet balances, transferring money to bank accounts, and their investment feature, to name a few. And it’s quite easy as well.

Just click your profile in the lower right corner. And then click the verify button. With just a few steps after, you can now use your account to its full potential. Nifty, right?

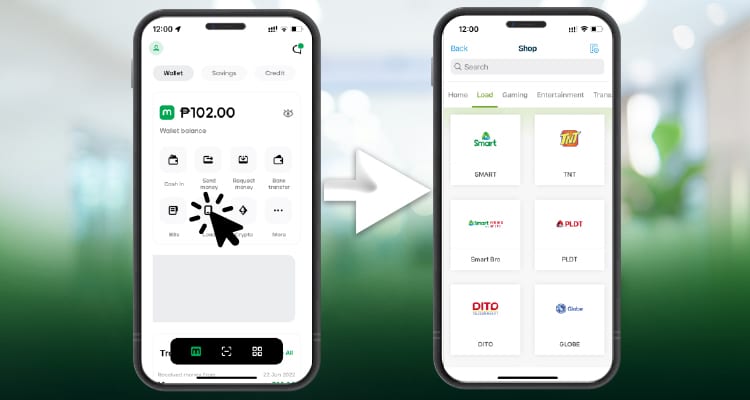

Buying Data

Sometimes, our broadband and DSL connection is not enough. With the Internet in the Philippines, you surely need to have a backup source. Maya and Gcash offer that!

You can top up your mobile account with exclusive data packages from Maya. Just click “Load.” And then pick the best data packages for you.

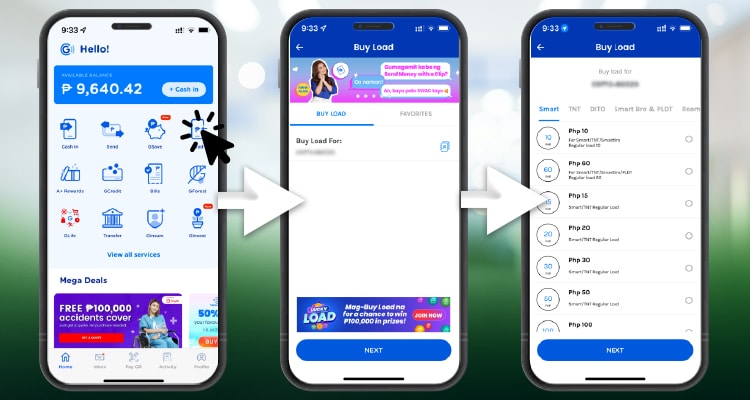

Gcash has a similar process. But the choices shown are just for the number and network you will buy for. You just need to click “Buy Load” and input your number. Afterwards, choices will show up. In the example above, only Globe promos are present.

Paying Bills

With your Maya and Gcash account, you can directly pay your bills with a few simple clicks.

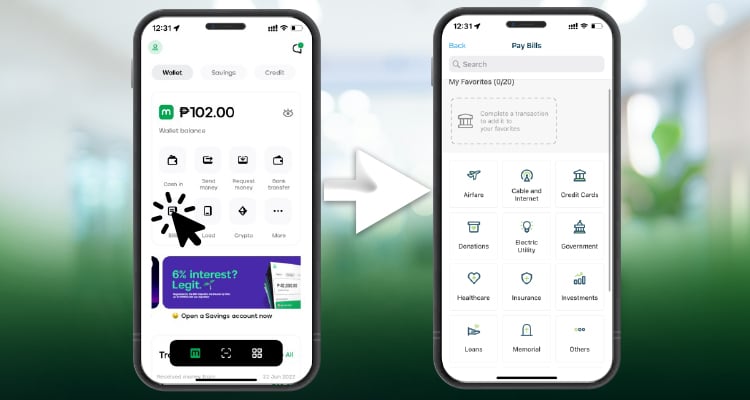

For Maya, just choose “Bills.” And then choose the company that you need to pay. Remember, though, that payments will reflect after 2-3 days. Some bills have transaction fees. So check accordingly.

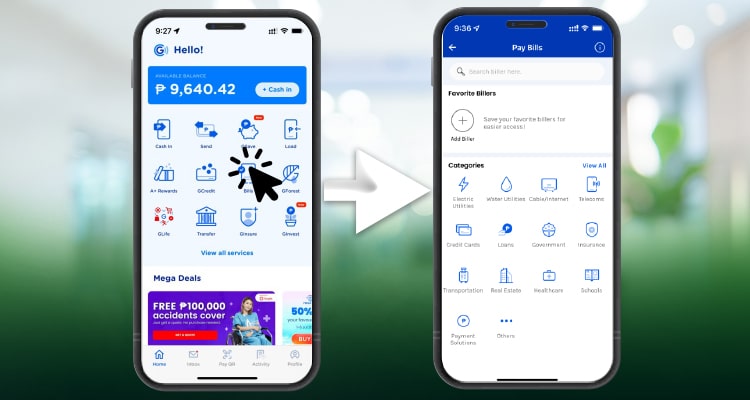

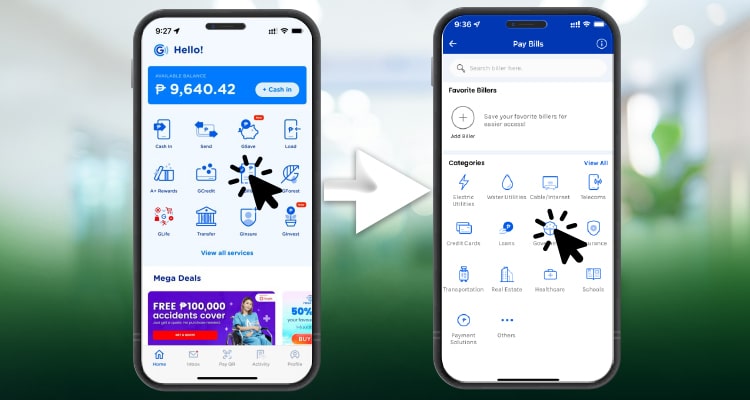

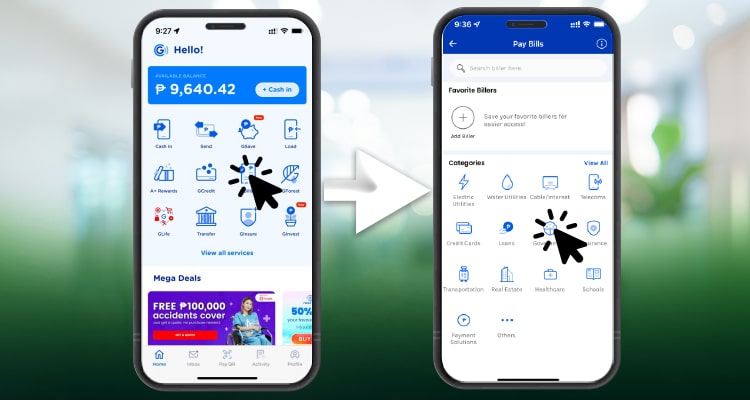

While for Gcash, just click “Pay Bills.” And choose the biller. Payments might also reflect around 2-3 days. For both virtual wallets, some billers might charge a small convenience fee. But that beats lining up outside, right?

Paying for Government Requirements

With both digital wallets, you can pay your SSS, PAGIBIG, and Taxes. But for Philhealth, you can only do that with Gcash through their website. And here’s how you can do it for both.

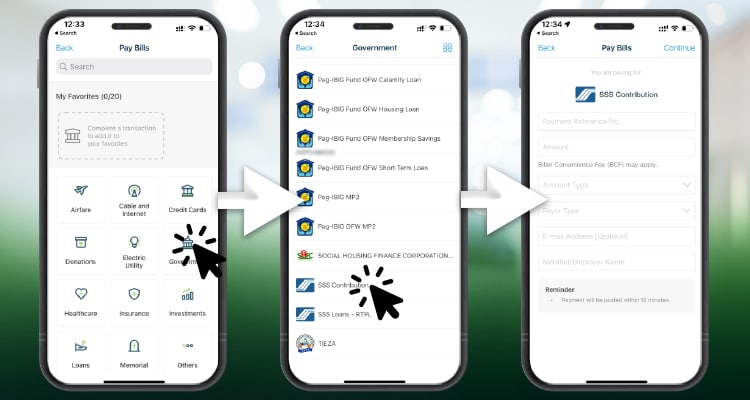

SSS (Maya)

It’s pretty similar to paying your bills. Just choose “Government.” And then, click SSS. Afterwards, input your SSS information. And then, pay the amount. That’s it!

PAGIBIG (Maya)

Paying PAGIBIG is similar to paying SSS. Just choose bills. Click “Government.” Afterwards, pick PAG-IBIG Membership Savings. And then, input the details of your payment.

SSS (Gcash)

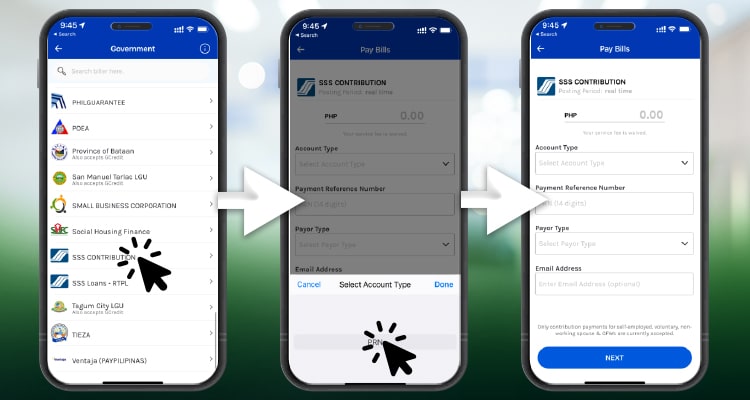

If you have paid for bills on your Gcash account, it’s pretty similar to when you pay your mandatory contributions.

Just click pay bills. And then, choose “Government.”

Choose SSS. Select “PRN” as the account type. And then, type the details after. Your payments will be posted in real-time.

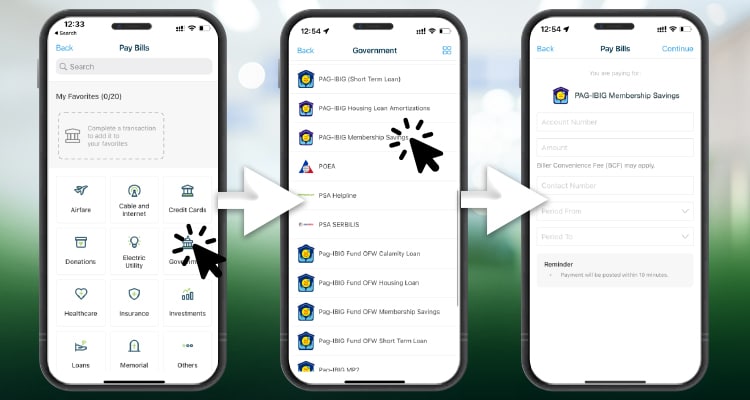

PAGIBIG (Gcash)

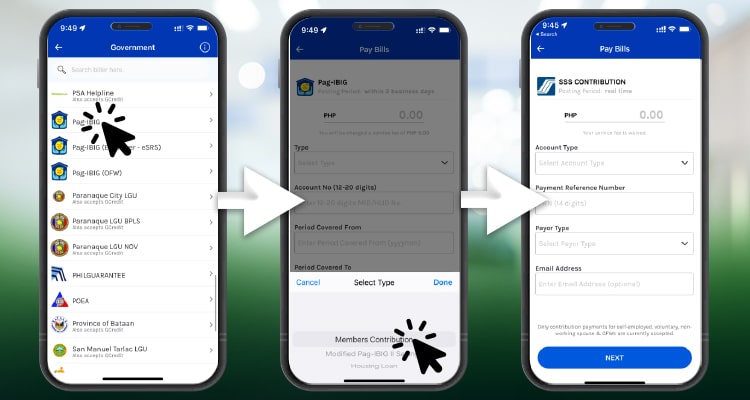

For PAGIBIG, it’s quite similar to SSS payments.

Just click pay bills. And then, choose “Government.”

From the list, pick PAGIBIG. And then, choose “member’s contribution” in the “select type” field. And then, fill out the other details after. You will be charged around 5 PHP convenience fees for every transaction.

Philhealth

For Philhealth, your only option as of writing is paying through Gcash. So if you use your Maya account, you can transfer the funds to Gcash and finish the transaction from there. Here’s how to do it.

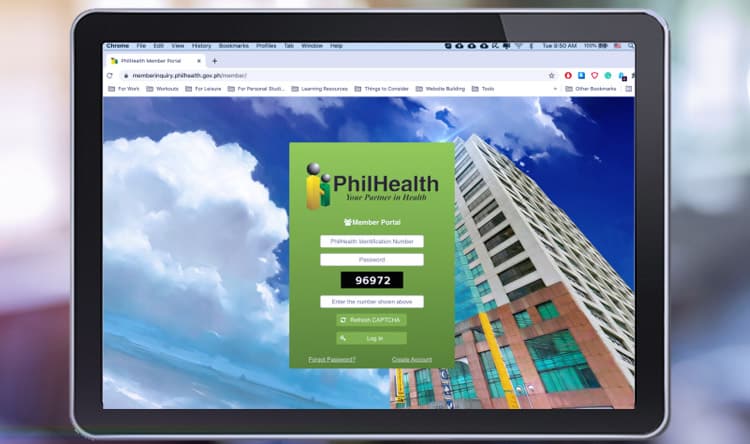

Log in to your Philhealth account.

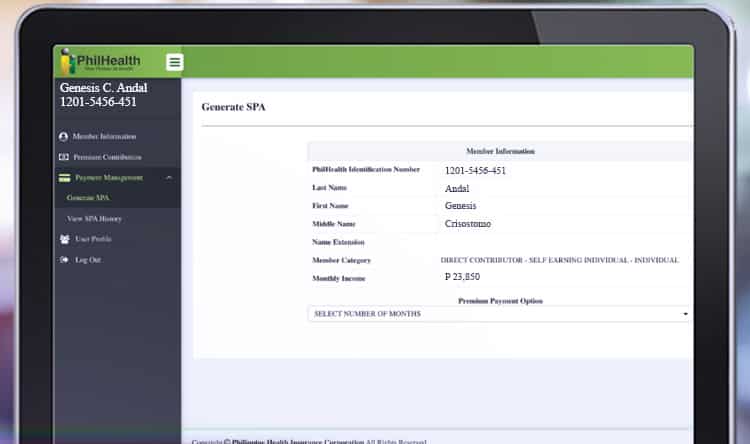

You will see the Philhealth dashboard. And on the left side, click payment management and generate SPA. SPA means “Statement of Premium Accounts.”

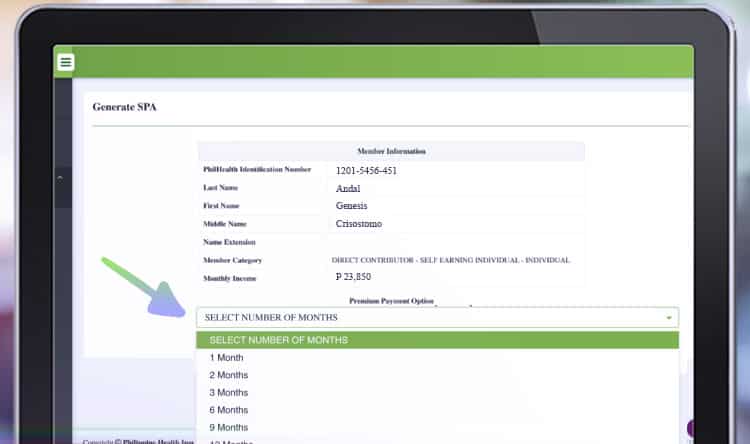

Afterwards, select the number of months that you wish to pay for. You can pay up to 36 months of premiums.

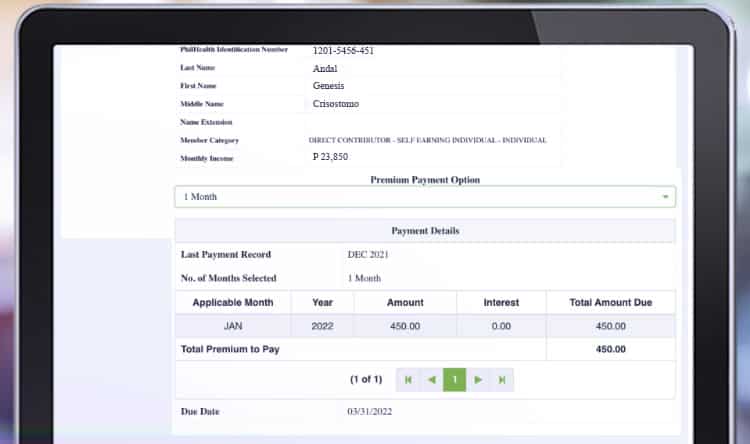

And then, click “Generate Statement of Premium Account.”

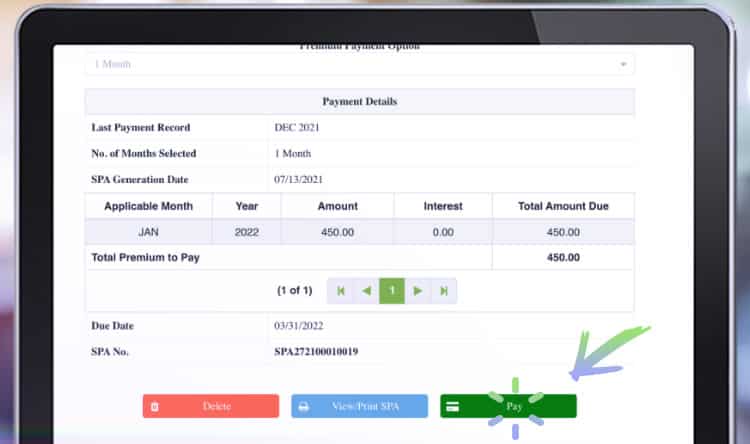

Now that the SPA is generated, you can click “Pay” to go to the payment channels.

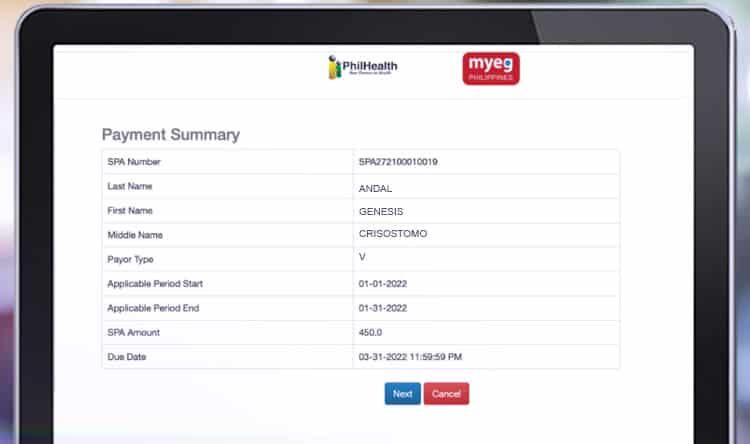

You will see the payment summary.

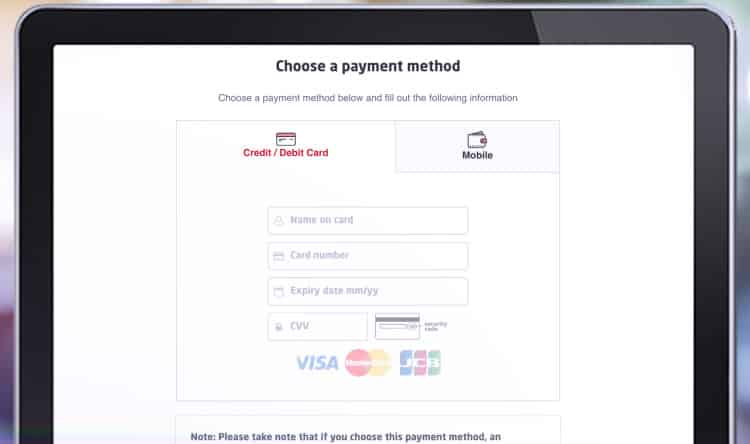

When you click next, you will arrive at the payment method. You can pay via credit/debit card or mobile.

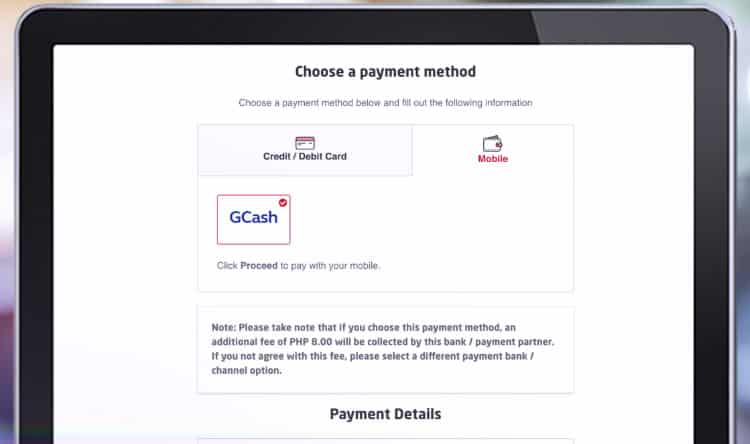

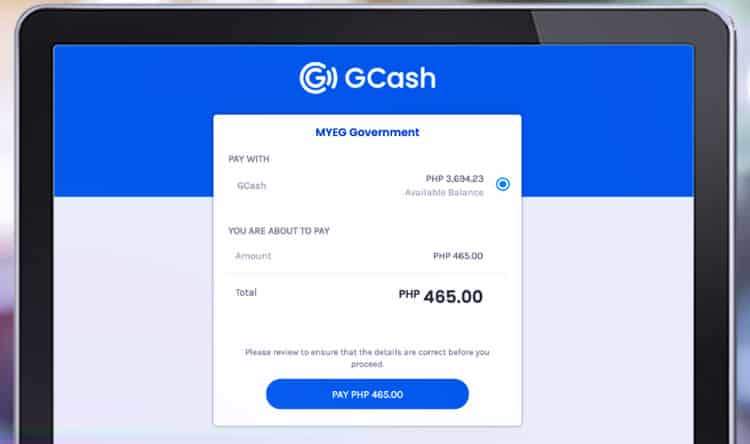

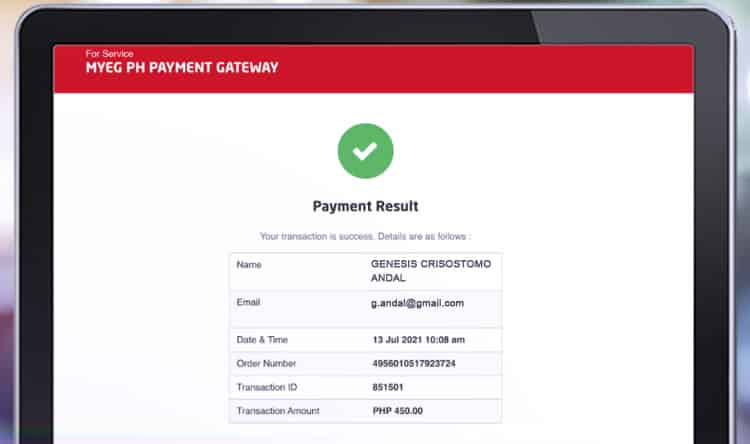

You can choose Gcash on the mobile tab. And a summary of the payment details will show with the additional convenience fee.

Afterwards, log in to your Gcash account and pay the balance.

A successful payment result will show after the transaction. Your payment will reflect around 1-3 days.

Receive Money From Abroad

If your clients are from abroad, you can also receive payment directly to your Maya account.

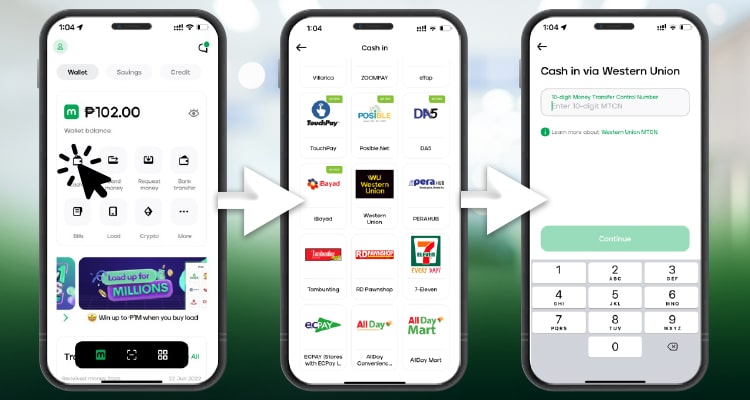

Just click add money. And choose the remittance partner. In this case, Western Union is the choice for those sending from abroad.

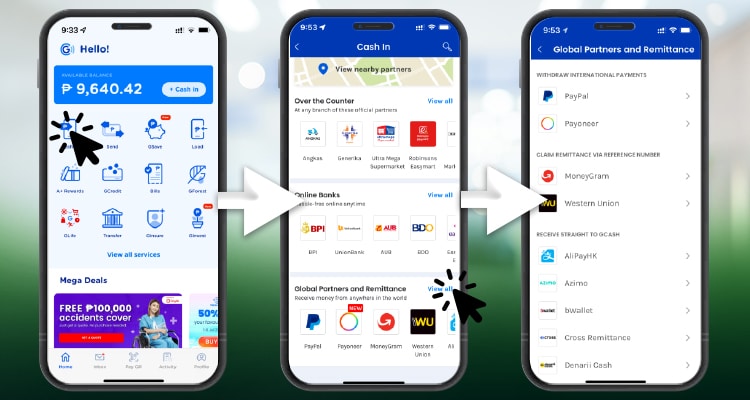

While for Gcash, it’s pretty similar but there are more choices. You can receive money from Western Union and Moneygram. And you can also link your Paypal and Payoneer account with it. Sweet!

Insurance

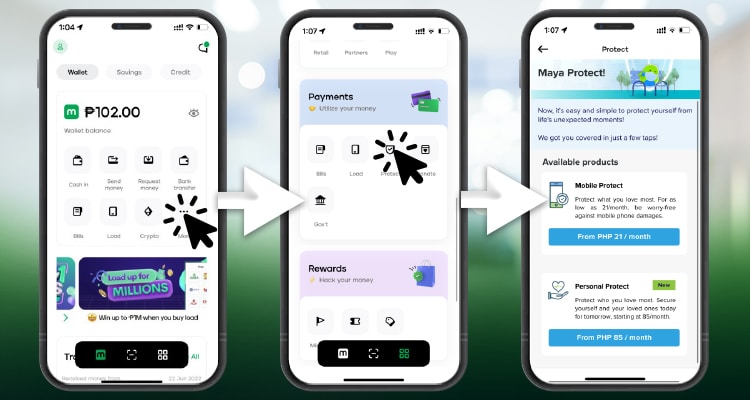

Who says your insurance should be expensive? Different insurance products are now accessible at an affordable price for both Maya and Gcash.

With Maya, you can buy insurance coverage for different purposes like “Mobile Protect” insurance for your mobile phones and “Personal protect”.

Just click the “More tab.” Look for payments and click the “Protect icon.” Lastly, choose the insurance that you would like to purchase.

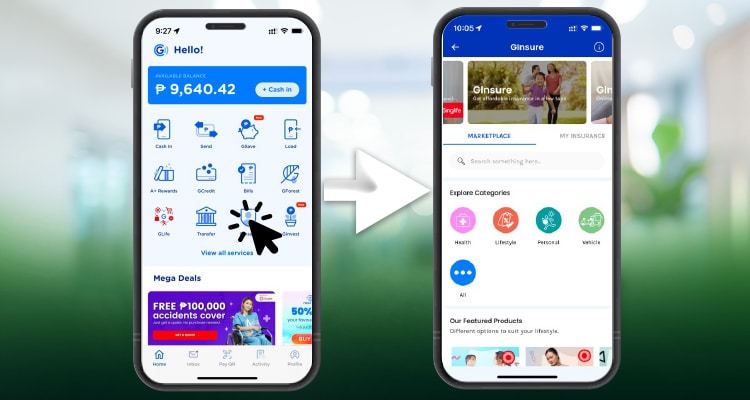

On the other hand, Gcash has already partnered with multiple insurance companies for various lifestyle, mobile, car, and health insurance. Some of these cover Dengue and COVID and protection against income loss. Just click GInsure. And then, choose the right insurance for you.

Promos, Vouchers, and Cashback

On top of the convenience, Maya also offers vouchers and cashback that you can use when transacting or paying for services. Gcash as well has these perks for using their app. You can also apply these promos on the go.

Just check their website for the updated deals that you can take advantage of.

Savings and Investments

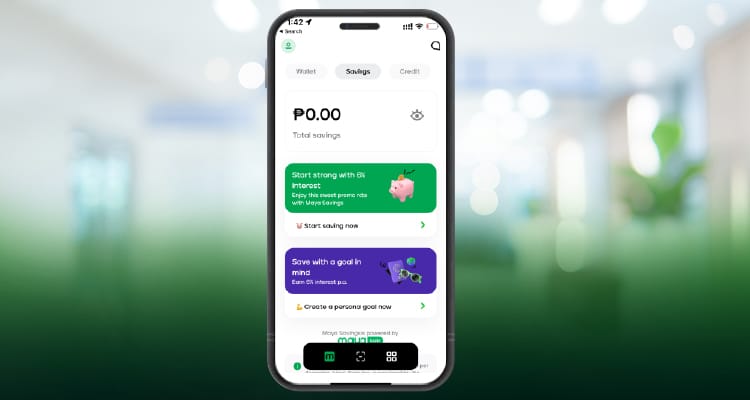

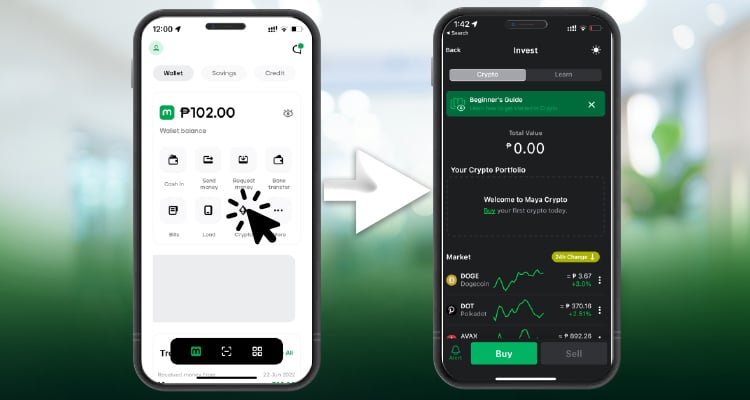

Both Gcash and Maya have savings and investment options for you.

Currently, Maya just launched its savings account, where you can earn roughly 6% PA.

Also, it can be used as a crypto wallet if you want to invest in cryptocurrencies.

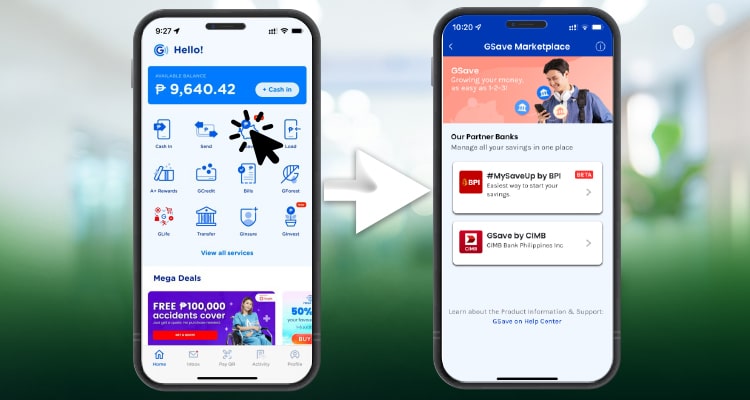

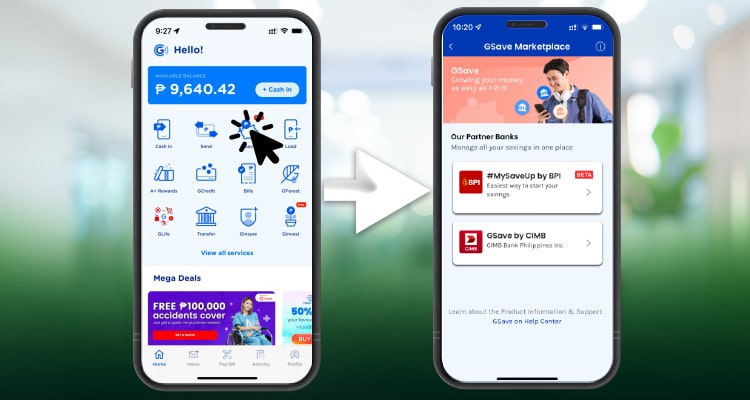

On the other hand, Gcash partnered up with CIMB Bank (founded in Malaysia and one of the biggest banks in Southeast Asia), forming Gsave!

Gsave has 2 options, BPI and CIMB. The BPI is like your normal BPI account while the CIMB-connected variant offers higher interest rates.

It offers competitive interest rates at around 2.6% per annum with an additional 1.4% (making it 4%) during promotions when you reach specific balances. Just click Gsave to open your account. You can also link your CIMB account to your GCash account to have better perks with it.

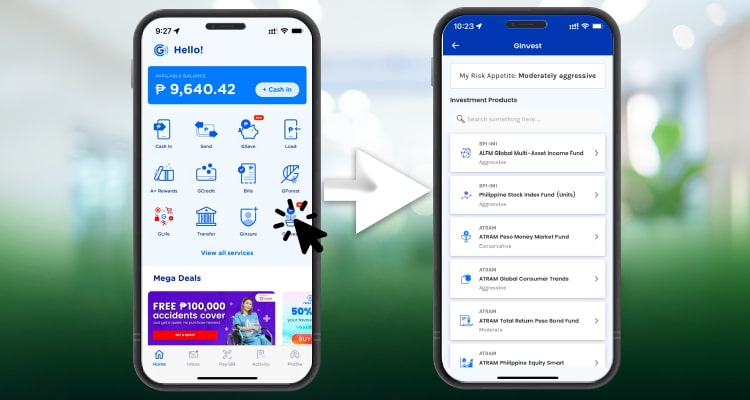

Also, you will have access to numerous investment opportunities with their partnership with ATRAM through Ginvest. Currently, they have managed funds comprising safe Peso money market funds up to more aggressive funds with US-listed stocks (like Apple, Google, Shopee, Amazon, and more)

Just click “GInvest.” And then, you will be prompted to take a risk appetite survey. And afterwards, the funds you can invest in will show up.

Choosing which fund to invest in is dependent on your personal preference.

Conclusion

So which is better, Maya or Gcash? Well, Gcash surely has advantages over Maya. But it really depends on your needs. But both will surely make your life easier as a remote worker or freelancer. Cheers!