Most banking and financial institutions are charging for their interbank transfers and services starting October 1, 2020. As freelancers and remote workers heavily relying on these services, what do we do?

How do we get about our finances from our online jobs? What banks and services are expected to have fees? Don’t panic. Here is what we know so far.

What’s Instapay and Pesonet?

Almost all banks have the Instapay and Pesonet option that facilitates minimal interbank transfers in the Philippines. It connects almost all banking institutions into one network. It allowed individuals and businesses to transfer money from any bank account smoothly.

During the pandemic, the charges were waived to help Filipinos handle their finances better during these trying times. Check out these simple online banking service to receive payments, remittances, & checks without going outside your home.

But right now, banks and e-money issuers will chargeback for the service. It just depends if it will start on October 1, 2020, or January 1, 2020. Here is the list.

Banks and E-money Issuers Charging back by October 1, 2020

-

BDO Unibank**

-

Metrobank

-

BPI

-

RCBC

-

China Bank

-

Bank of Commerce

-

Robinsons Bank

-

PS Bank

-

PBCom

-

Equicom

-

GCash

-

Paymaya

Banks and E-money Issuers Charging back by January 1, 2021

-

Union Bank

-

AUB

-

Land Bank

-

DBP

-

Security Bank

-

Sterling Bank

-

Standard Chartered

-

East West Bank

-

UCPB

-

Maybank

-

HSBC

Take though; charges differ for each bank and e-money issuer.

**Take note, though that BDO has FREE transfers to local banks and wallets for a time window from 8PM to 6AM. Transfers occurring from 6:01AM to 7:59PM has a charge of PHP 25. This is valid from Oct 12 to Oct 31, 2020.

GCash Fees

Of all the financial institutions above, GCash is widely used by Filipino freelancers and remote workers. Banking functions and bills payment is now accessible for everyone with a mobile number. Yes, even numbers outside the Globe network.

And for online jobs, we can now receive remittances and Paypal deposits straight to our GCASH account with no fees. In turn, we can transfer our Gcash balances to our local bank accounts, or we can pay bills directly from the app.

But starting October 1, 2020, there will be changes. And some of the services we enjoy will have fees. Here are the following changes.

As you can see, over-the-counter cash in is still free up to 8,000 PHP. More than that will be charged a 2% fee. But cash-in from their partner banks BPI & Unionbank still remains free.

Remittances from Paypal, Payoneer, and international remittance such as Western Union & Moneygram are still free of charge.

On the other hand, bank transfers will also have a convenience fee of 15 PHP per transfer. And withdrawals still cost 20 PHP via Mastercard. If you will make over-the-counter withdrawals, that’s 20PHP per 1000 PHP.

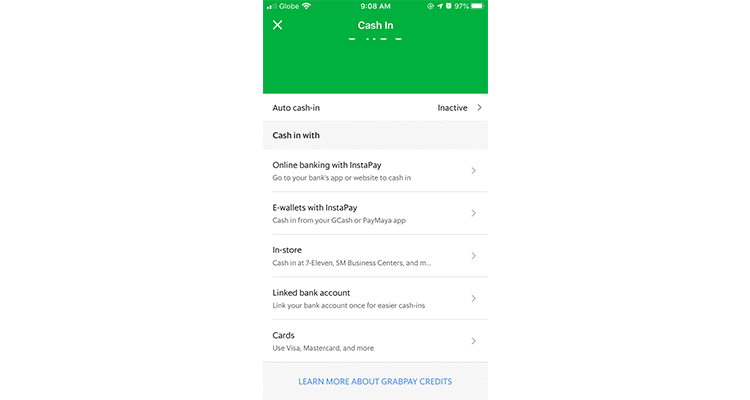

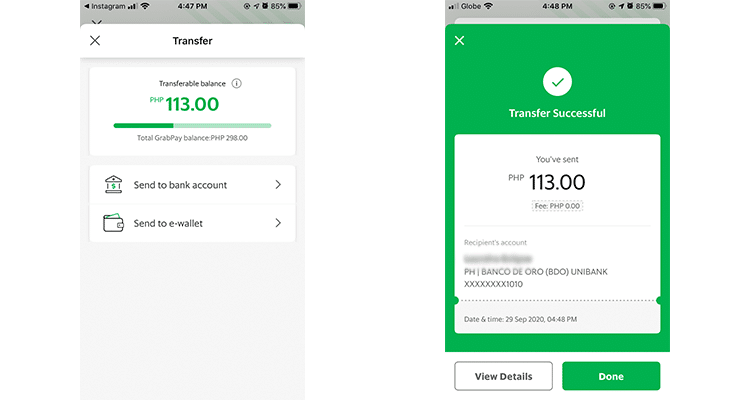

Grab Pay as an Alternative

For today, there’s not really much of an option, especially if you have been used to transferring from your Bank’s Instapay, GCASH, or Paymaya account. But there’s a promising service from Grab Pay that might be beneficial for the Filipinos soon.

Grab Pay opens its own financial services that can rival Gcash. You can now do more things on top of just paying your grab transactions.

For premium accounts (verified accounts), you can now pay bills, purchase from online stores, and many more using the accompanied MasterCard. You just have top-up your account through the following channels.

Another awesome feature is you can transfer your Grab Pay balance to any PH bank account for free. Take though; you can’t send money that you’ve top up using credit card.

So if you’re heavily reliant on the free transfers of GCASH, you can replace it with Grab Pay instead.

Conclusion

Financial institutions will soon charge for common financial services as the waiver for these transactions expire. Let’s hope for the best and prepare for these changes. Good luck!