For remote workers, registering with the BIR is highly beneficial. You legitimize your practice, making it easier to get bank loans, apply for visas, and even qualify for government programs like the Pag-IBIG housing loan.

You can have smoother transactions and broader global opportunities because most foreign clients prefer to work with registered talents.

So how do you register? The first step is to get a TIN ID.

What is a TIN ID?

A Taxpayer Identification Number (TIN) ID is an official card from the Bureau of Internal Revenue (BIR) that is used for tax-related transactions, employment, and other official purposes.

The 9-digit TIN is used by the government to track your tax payments on various income-generating transactions. You can even use it as a valid government ID.

Who Needs a TIN ID?

First of all, what’s the importance of a TIN ID?

While it’s mainly tied to paying taxes, it also plays a big role in everyday transactions like job applications, opening bank accounts, and even securing government benefits:

- Employees & Job Seekers – Required when applying for or starting a job.

- Freelancers & Self-Employed – Needed to register and pay taxes.

- Entrepreneurs & Business Owners – Required for business registration and issuing receipts.

- Students & Fresh Graduates – One of the requirements when applying for internships or their first job.

- OFWs – Useful for government transactions, loans, and business matters in the Philippines.

- Anyone with Financial or Government Transactions – Needed for opening bank accounts, applying for loans, or claiming benefits.

In short: If you earn income or deal with government/financial transactions, you’ll need a TIN ID.

For traditional employees, if it’s your first time getting a TIN, HR usually registers your TIN ID for you. If you’re wondering how to apply for a TIN number as a freelancer, the Bureau of Internal Revenue (BIR) provides both in-person and online application options to make the process easier:

Step-by-Step Guide to Getting Your TIN ID

Getting this government ID is a simple process, so long as you know the TIN ID requirements and follow the correct steps.

Prepare the Following

Before registering, you need to prepare the following TIN ID requirements:

- Accomplished TIN ID BIR Form 1904

- 1 Valid ID

- 1 PSA-issued birth certificate

- 1 Community Tax Certificate

- 1 1×1 ID picture

- Marriage contract (for married women)

These are also the requirements for TIN number for unemployed individuals, since they don’t have employer-provided documents.

Online Application via ORUS

The BIR’s ORUS (Online Registration and Update System) makes it easier for freelancers and remote workers to apply for a TIN ID without visiting an RDO in person.

If you’re searching for how to get a TIN ID card online, this is the official process:

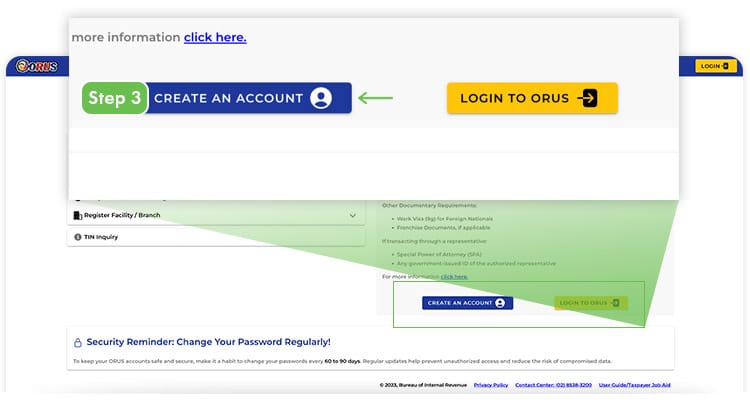

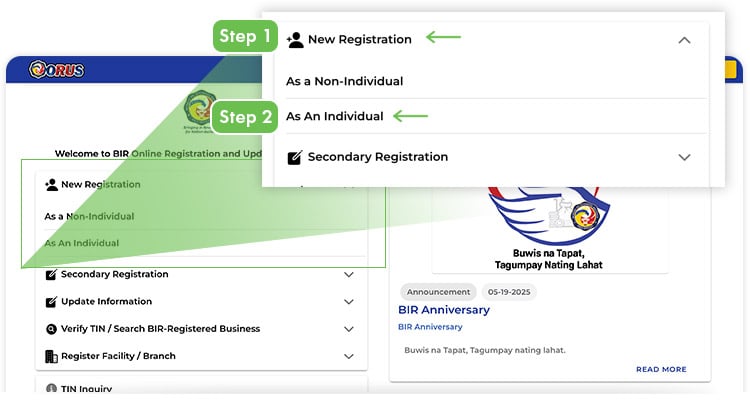

Access ORUS and register as a new user

- Visit the ORUS portal and select “New Registration.”

- Afterwards, choose “As an Individual.”

- Then, click “create an account”

- Choose “Without Existing TIN” if you’re completely unregistered.

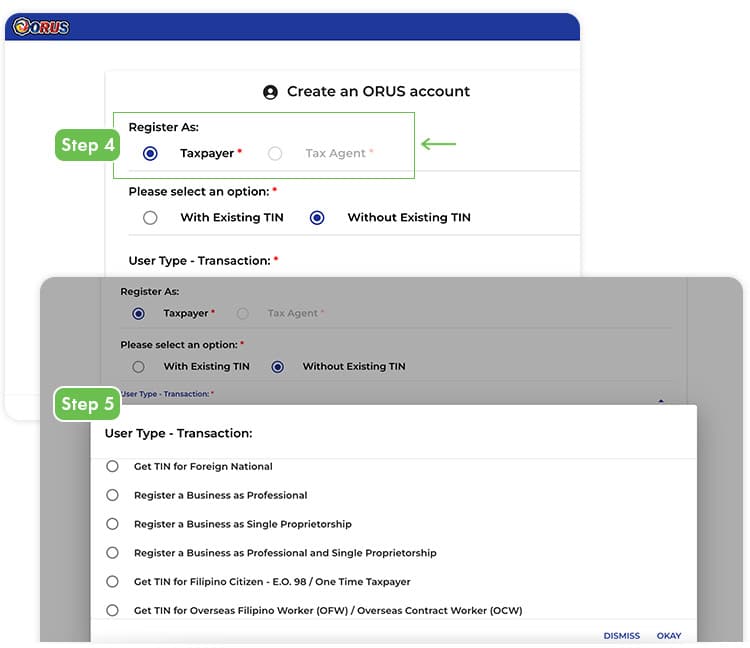

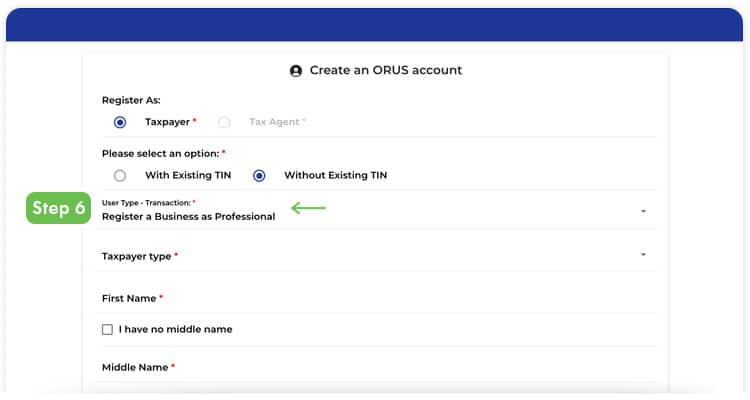

Select your taxpayer type

Options include Professional, Single Proprietor, OFW, EO 98 (one-time taxpayer). As a freelancer, you can choose “Register as business as a Professional.”

As of writing, there is no choice for unemployed.

Verify your email

You’ll receive a confirmation link—click it within 24 hours to activate your ORUS account.

Submit your application

Log in, verify your details, and continue submitting the application.

Receive your TIN

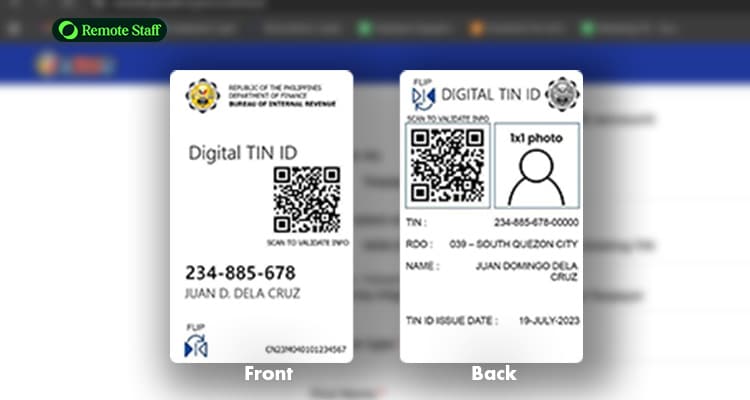

Once approved, your TIN will be available in the ORUS system. A notification will usually be sent via email.

After uploading your TIN ID picture, you can download your digital TIN, which can be used as a valid ID for certain transactions.

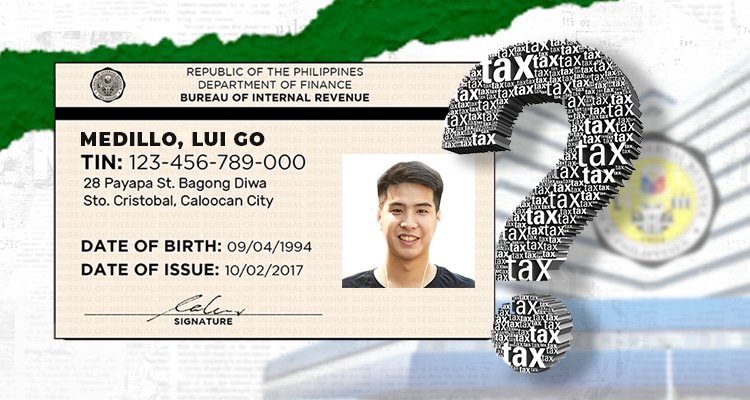

Here’s a sample of the new TIN ID:

However, if you need a physical TIN ID card, you must visit your assigned RDO to request it.

In-Person Application

You can also apply your TIN in-person with these steps:

Go to Your Assigned Revenue District Office

With your requirements, go to the assigned Revenue District Office (RDO) based on your residence (for the unemployed), or your business address.

If you’re employed, you can apply at the RDO of your employer’s business.

Remember, when it comes to where to get a TIN ID, you must apply and request it at your designated RDO.

Since remote workers don’t report to a traditional office, they typically register at the RDO nearest to their home address.

You can look up your RDO by calling the customer assistance division hotline at 8538-3200 or emailing contact_us@bir.gov.ph.

Submit the Requirements

The next step is to submit the requirements to the assigned personnel.

You can also ask the officer of the day if you have any questions about the application form or other concerns.

Claim your TIN Card

Usually, you can get your TIN Card on the day of submission.

Once your TIN card is released, you can attach your 1×1 ID picture and laminate it so you can present it as a valid ID.

Here’s a TIN ID sample:

Cost and Processing Time

Getting a TIN ID is free of charge if it’s your first time applying, as long as you submit the correct TIN ID requirements to the Revenue District Office (RDO).

Some offices can release the TIN ID on the same day, while others may take a few days to a couple of weeks, depending on workload.

What to Do If You Already Have a TIN

You are only allowed one TIN for life. Applying for multiple TINs is illegal and may lead to penalties of up to Php 1,000 or imprisonment of 6 months to 2 years under the Tax Code.

If you already have a TIN:

- Do not apply for a new one. Instead, try to retrieve your old number.

- You can check your records by logging into the ORUS system or by visiting the nearest BIR Revenue District Office (RDO).

- If your TIN is inactive, you may request reactivation or updating of records at the RDO where you are registered.

- Bring a valid government-issued ID and any old documents (like a BIR Form 1902/1904 or old TIN card, if available) to speed up the process.

How Long Is a TIN ID Valid?

A TIN ID never expires since your TIN is permanent. You only need a replacement for the physical ID if it gets lost, damaged, or if your details change.

To replace it, visit your Revenue District Office (RDO), file a request, and provide the necessary documents.

Difference Between TIN ID and Other Government IDs

The TIN ID is mainly meant to prove your tax identity with the BIR.

Unlike other government IDs such as the UMID, PhilHealth, or Driver’s License, which serve broader purposes and are widely recognized, the TIN ID is not always accepted as a primary ID.

It’s valid, but works best when paired with another government-issued ID if you’re trying to establish proof of identity.

Common Problems & How to Avoid Them

While getting a TIN ID is usually straightforward, small mistakes can cause unnecessary delays or complications.

Knowing the common issues ahead of time helps ensure a smooth application or replacement process, saving you time and effort at the RDO.

Knowing the common issues ahead of time helps ensure a smooth application or replacement process, saving you time and effort at the RDO.

Applying to the wrong RDO

Submitting your application to the incorrect Revenue District Office (RDO) can cause delays since the BIR requires you to apply only at the RDO where your records are registered.

Your RDO is usually determined by your registered residential address or business location.

To find the correct RDO, check the BIR website or call their hotline at 8538-3200 or email contact_us@bir.gov.ph.

Missing or Incomplete Documents

Incomplete requirements often result in rejected applications or repeat visits.

Double-check the list of needed forms, IDs, and supporting documents before heading to the BIR.

Errors during online application (ORUS)

Applying online through the ORUS system can save time, but mistakes such as entering the wrong address (e.g., inputting your province address instead of your actual residence) may direct your application to the wrong RDO and complicate the process.

If you’re checking how to apply for a TIN ID online, make sure you prepare your documents in advance and review each step before submission to reduce errors.

If your application was directed to the wrong RDO or contains wrong details, you can contact the BIR via hotline or email, or you can visit the correct RDO to fix the issue.

Data entry mistakes and misspellings

Incorrect details, such as misspelled names or wrong birthdates, can cause record mismatches in the BIR database and may prevent retrieval of your file.

To avoid this, double-check that all information matches your government-issued IDs before submission.

If errors are already recorded, bring valid IDs and request a correction at your RDO.

The BIR will update its records once supporting documents are provided.

Duplicate TIN creation

Accidentally applying for a new TIN instead of requesting reactivation or replacement can lead to having multiple TINs, which is illegal and subject to penalties.

Always check if you already have a TIN by calling the BIR hotline or verifying with your RDO before submitting an application.

If you already created a duplicate, report it right away so the BIR can cancel the extra record and keep your original TIN on file.

What If You Lose Your Physical TIN ID?

Losing your TIN ID doesn’t mean your TIN itself is gone. It remains valid and is still recorded in the BIR system.

To get a replacement, head to your registered Revenue District Office (RDO) and submit the following:

- BIR Form 1905, for “Registration Information Update/Correction/Replacement”

- Notarized Affidavit of Loss

- A valid government-issued ID for verification

Fees to Expect:

- Php 100 replacement fee for the lost or damaged TIN card

- Affidavit of Loss Notarial Fee: Typically ranges from Php 100 to Php 500, depending on the notary and location

Once you’ve submitted these, the BIR will issue a replacement card with your original TIN.

Getting Your TIN ID Is Just the Beginning

Take note that this is just the first step of registering your practice. You still need to go through the following steps to register with BIR as a remote worker or freelancer to operate legitimately.

However, before you register, it’s better if you can find an online job first.

Otherwise, you’ll be required to file the tax forms even if you don’t earn any income yet.

However, if you sign up with Remote Staff, we will assist you when you register your remote working practice – on top of the competitive pay and support.

Register today!