One income is not enough. What will happen if you lose your only source? That’s what a lot of Filipinos experience during the pandemic. Now, on top of their jobs, more and more are open for remote work and freelancing. I mean, you gotta do what you gotta do to earn that money and peace of mind.

But with every income earned, there should be taxes paid for it. How do you file taxes for it? Here’s how to file your taxes for mixed income earners as a remote worker or freelancer.

Mixed Income Earners

Generally, there are three types of people earning income. There’s income from a profession, income from a business, and income from compensation (employment). If you are employed and earning from a side-hustle or side-business, you are a mixed income earner.

You still need to pay:

- Registration Fee

- Percentage Tax

- Quarterly Income Taxes

- Annual Income Taxes

For the registration fee, percentage taxes, and quarterly income tax (graduated rates), it will be the same process as our previous comprehensive tax filing guide.

The only difference is filing your quarterly income tax (8% rate) and annual income tax returns because you are now deriving from mixed sources. And the 250,000 PHP exemption will not be credited in the computation.

(If you want to know which is better between graduated taxes versus 8% rates or if you don’t know what it is, you can check this link for the guide.)

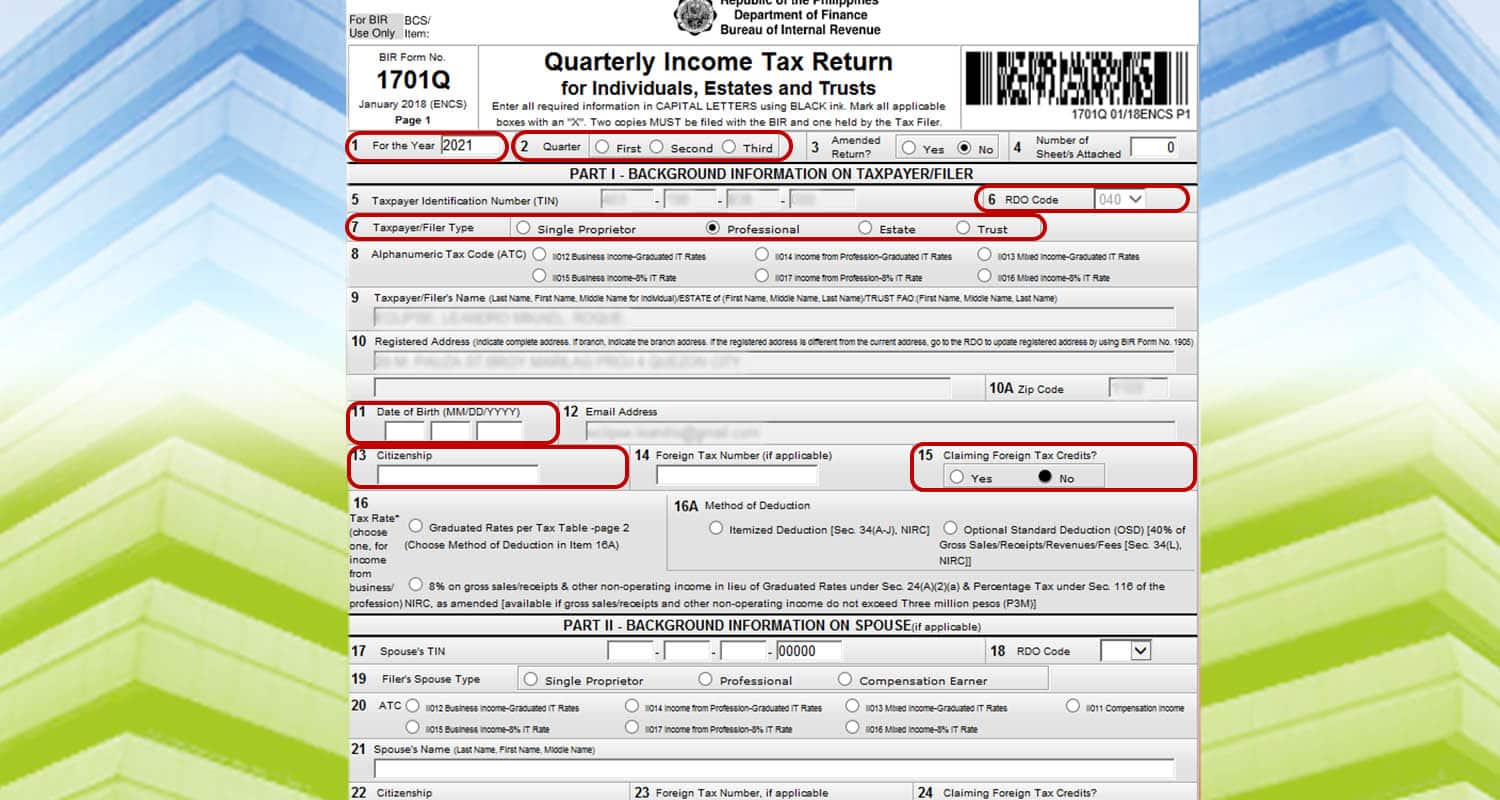

Quarterly Income Tax

For the quarterly income tax, filing taxes remains quite similar. And here’s how to do it.

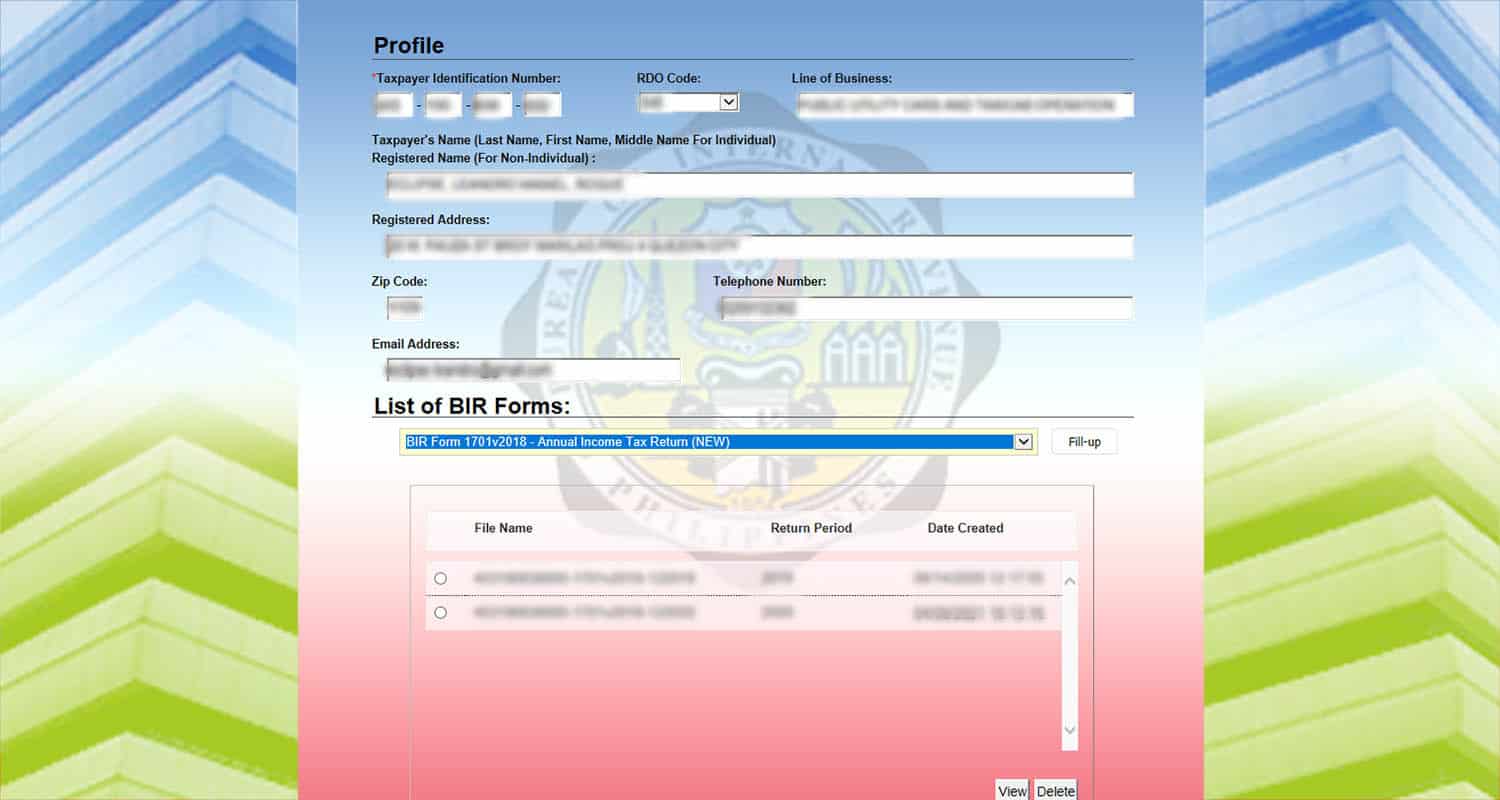

Choose BIR Form 1701Qv2018.

Afterwards, input the following information:

- Line item 1: Input the year you will pass the form.

- Line Item 2: Choose the quarter.

- Line Item 6: Choose your RDO Branch Code.

- Line Item 7: Tick “Professional.”

- Line Item 5, 9, 10, 10A, 12 will be automatically filled up with the information on the main menu.

- Line Item 11: Your date of birth.

- Line Item 13: Your Citizenship

- Line Item 15: Click No.

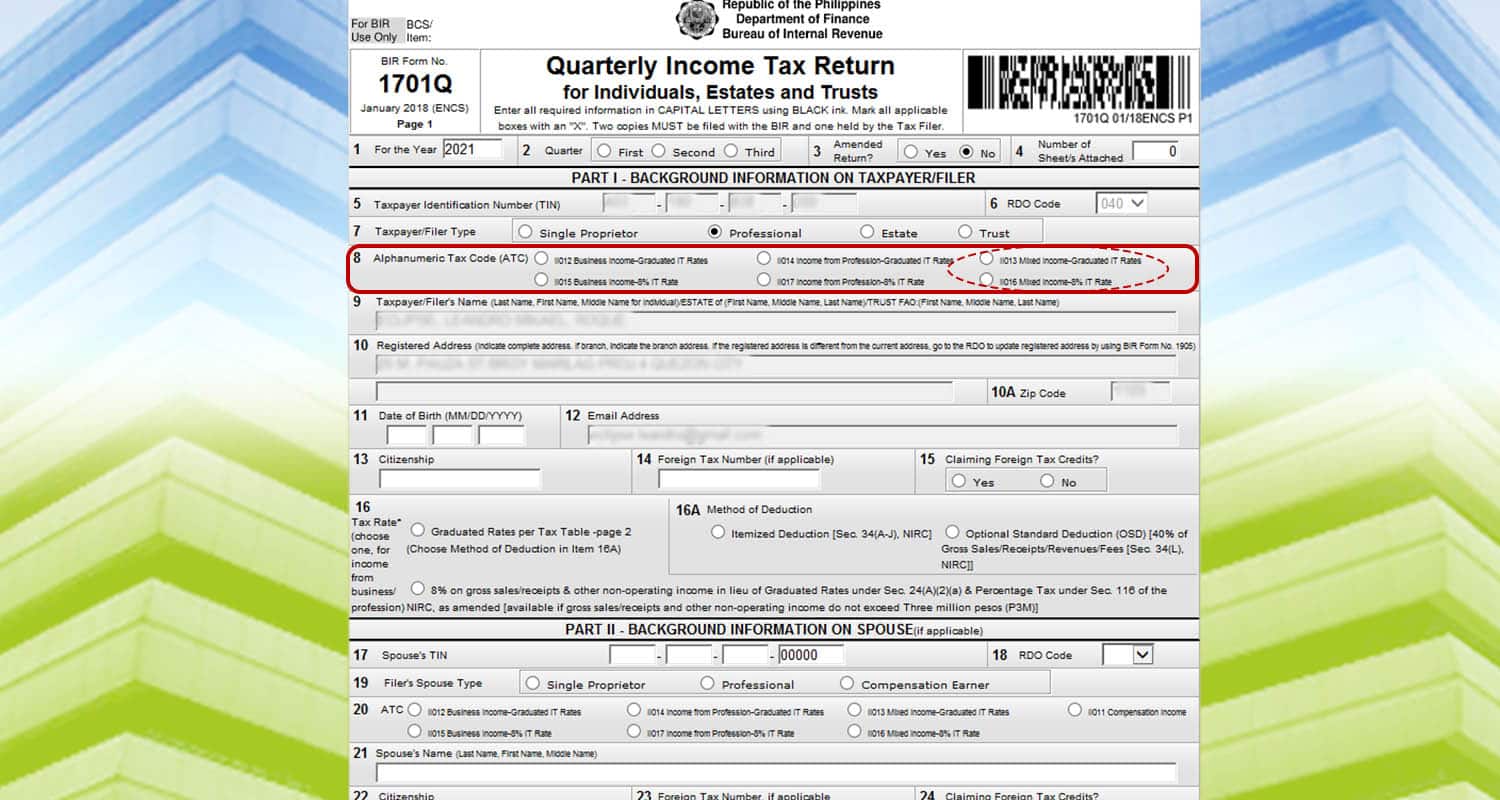

For line item 8, choose between “Mixed Income – Graduated IT rate” or “Mixed Income – 8% IT rate.”

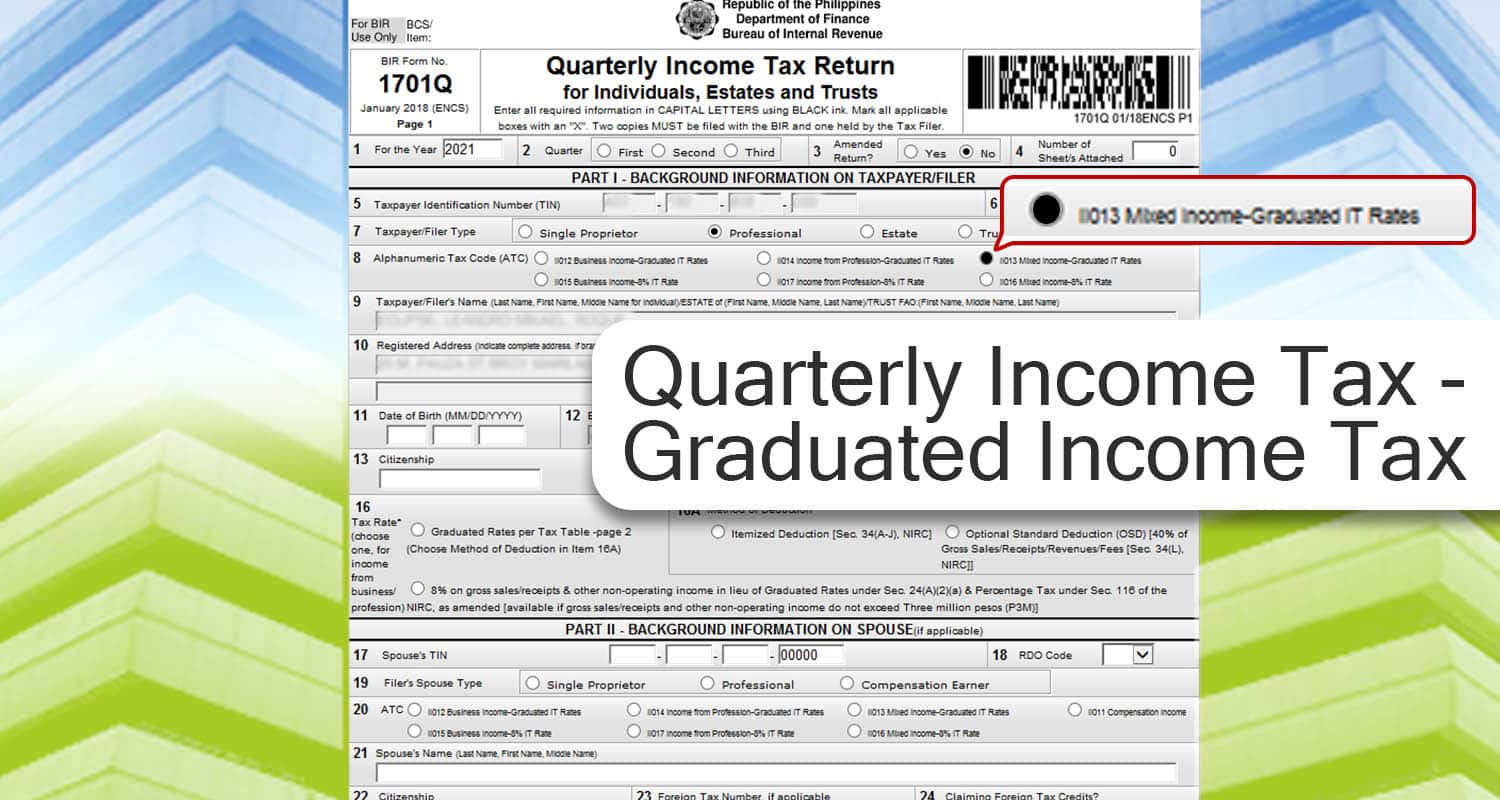

Quarterly Income Tax – Graduated Income Tax

If you choose the graduated income tax rate, here’s what you need to fill out.

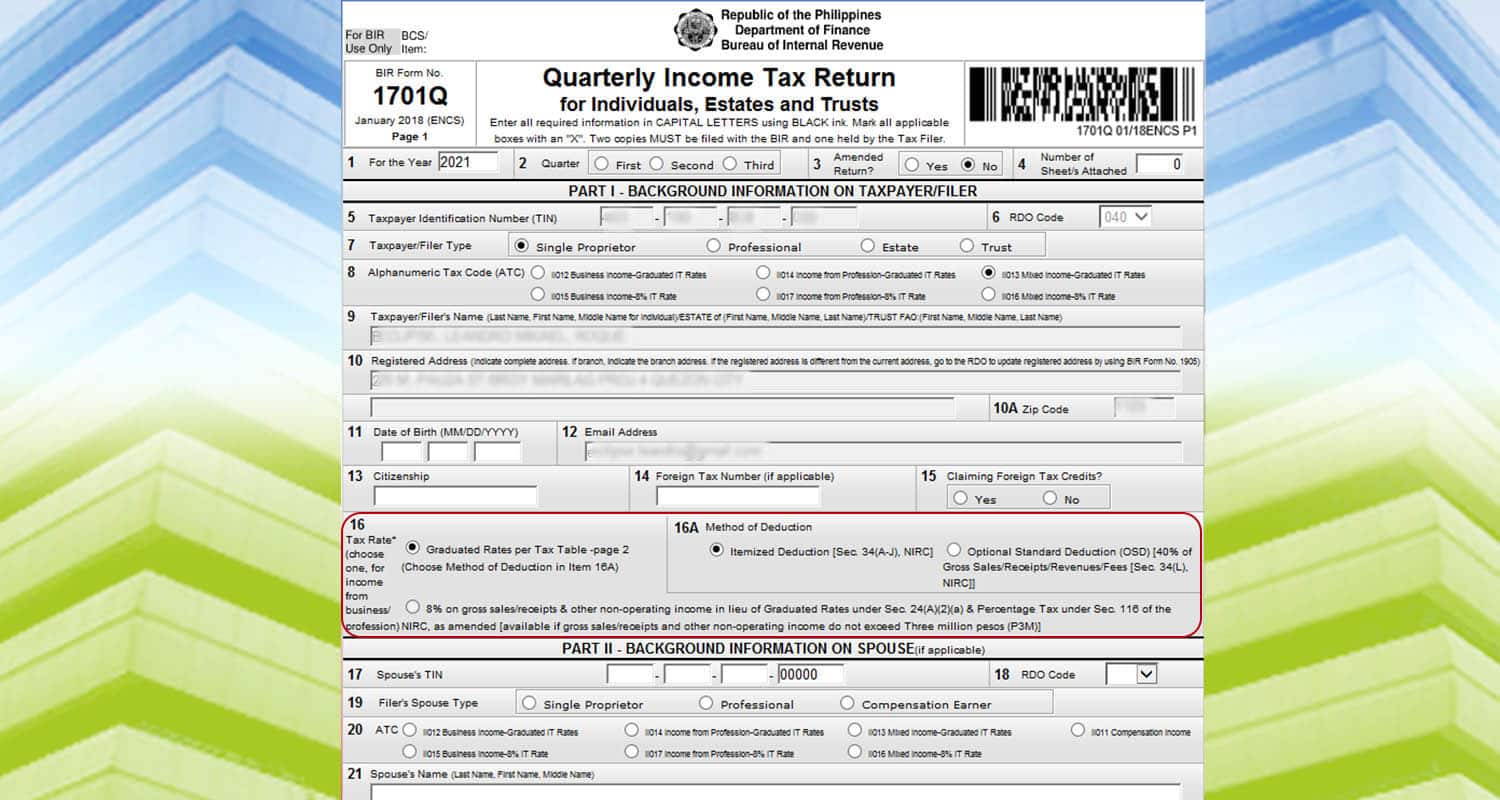

On line item 16A, choose between itemized deduction or the optional standard deduction. This will indicate how your expenses will be deducted. Also, what you have chosen for the first quarter will be the deduction scheme applicable for the whole taxable year.

On line item 16A, choose between itemized deduction or the optional standard deduction. This will indicate how your expenses will be deducted. Also, what you have chosen for the first quarter will be the deduction scheme applicable for the whole taxable year.

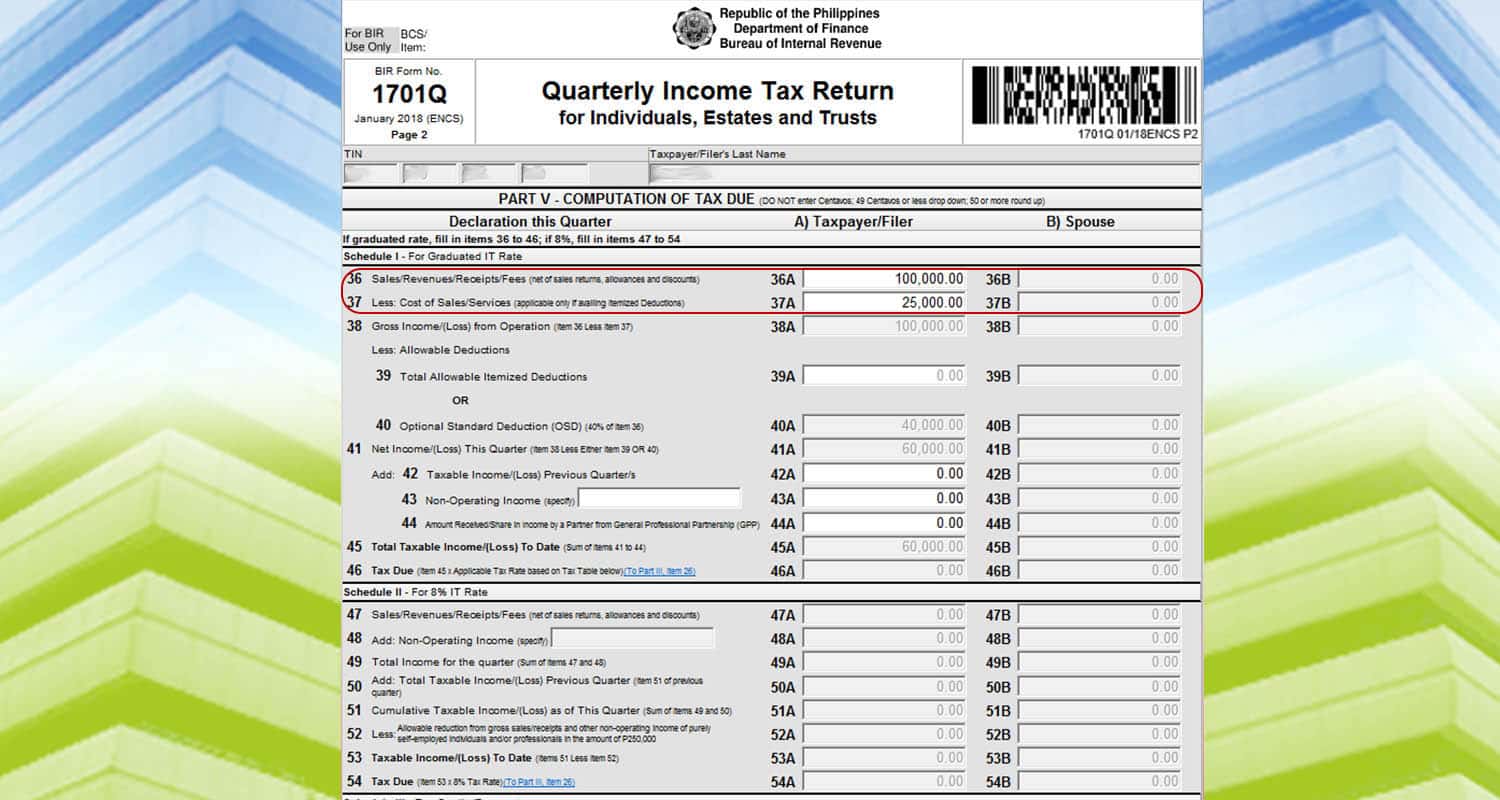

Itemized Deduction

For itemized deductions, you need to go back to all your expenses incurred during the period. Only expenses that are necessary and normal for the operations should be included. For example, electricity and internet bills can be deducted. But your dog food expense can’t.

Let’s say you have a total income of 100,000 PHP and expenses of 25,000 PHP. Input the amount on line items 36 and 37. And your tax due will be automatically computed.

Let’s say you have a total income of 100,000 PHP and expenses of 25,000 PHP. Input the amount on line items 36 and 37. And your tax due will be automatically computed.

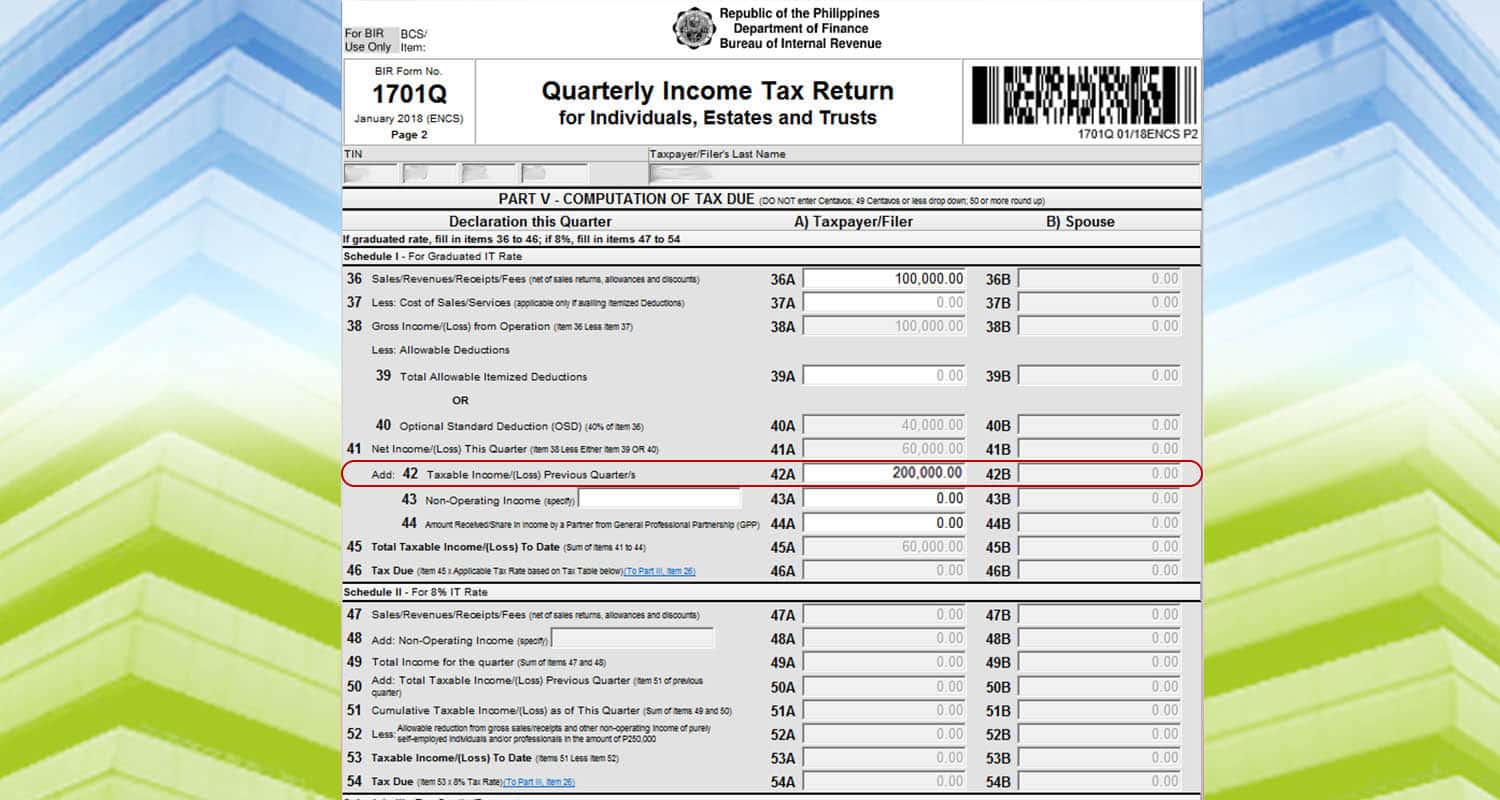

If you’re paying for the 2nd and 3rd quarters, go to line item 42 to add your taxable income from previous quarters. In this example, we assume that you have a taxable income of 200,000 PHP. Input it on the field provided.

If you’re paying for the 2nd and 3rd quarters, go to line item 42 to add your taxable income from previous quarters. In this example, we assume that you have a taxable income of 200,000 PHP. Input it on the field provided.

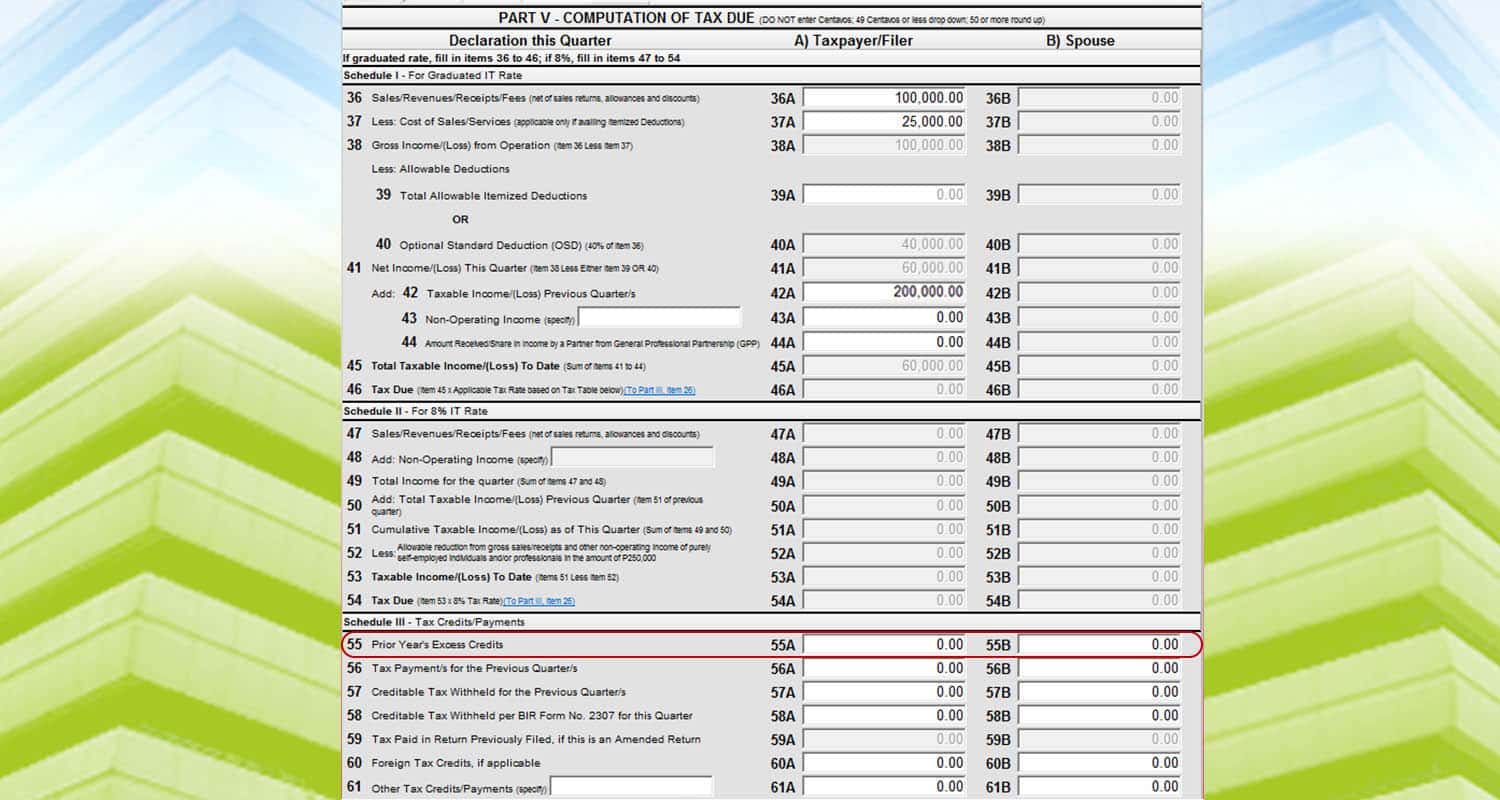

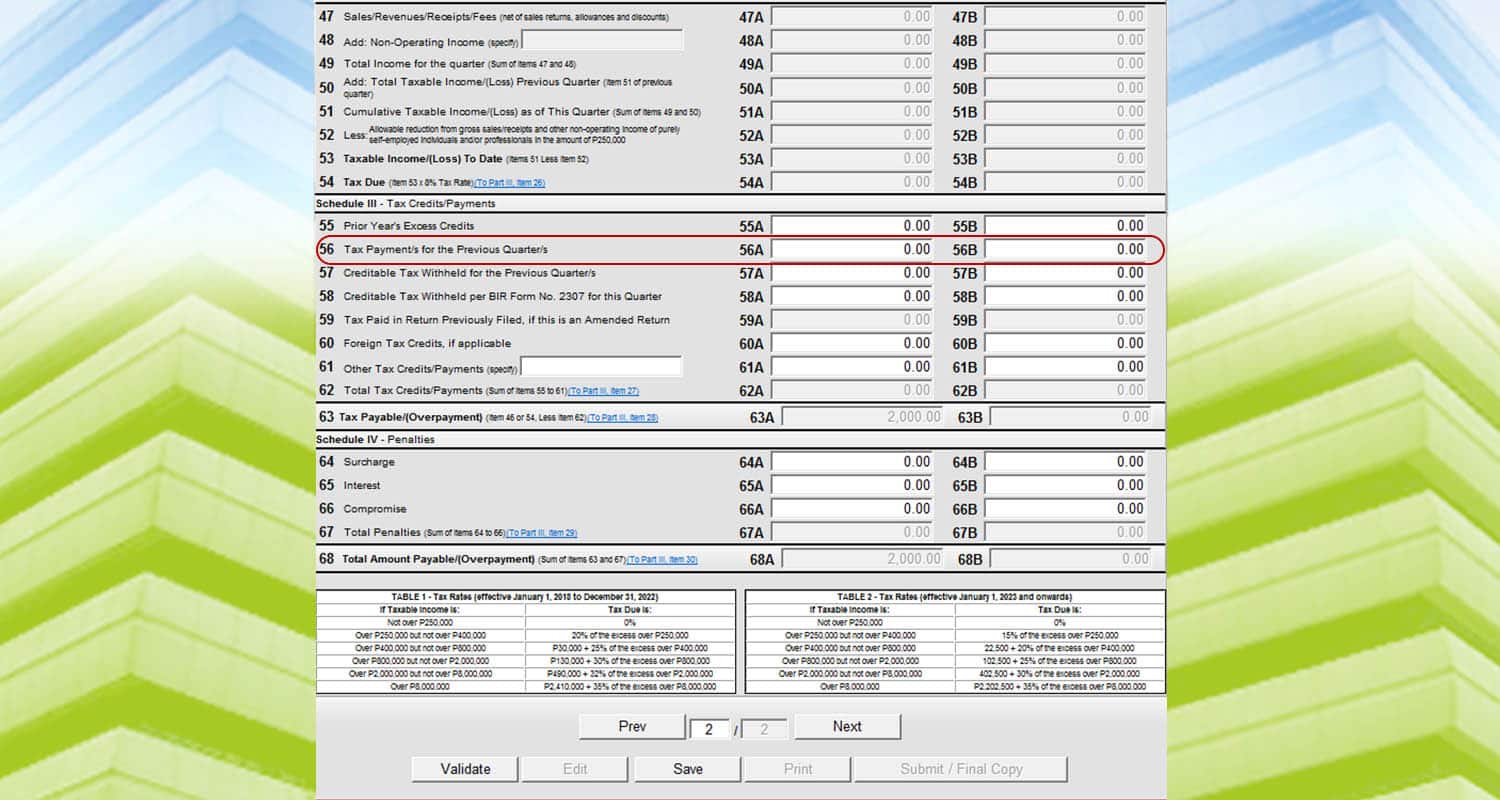

Lastly, if you paid any quarterly income tax from the previous quarter, input it on line item 55. We will assume that there was no payment for this example. So it will remain zero.

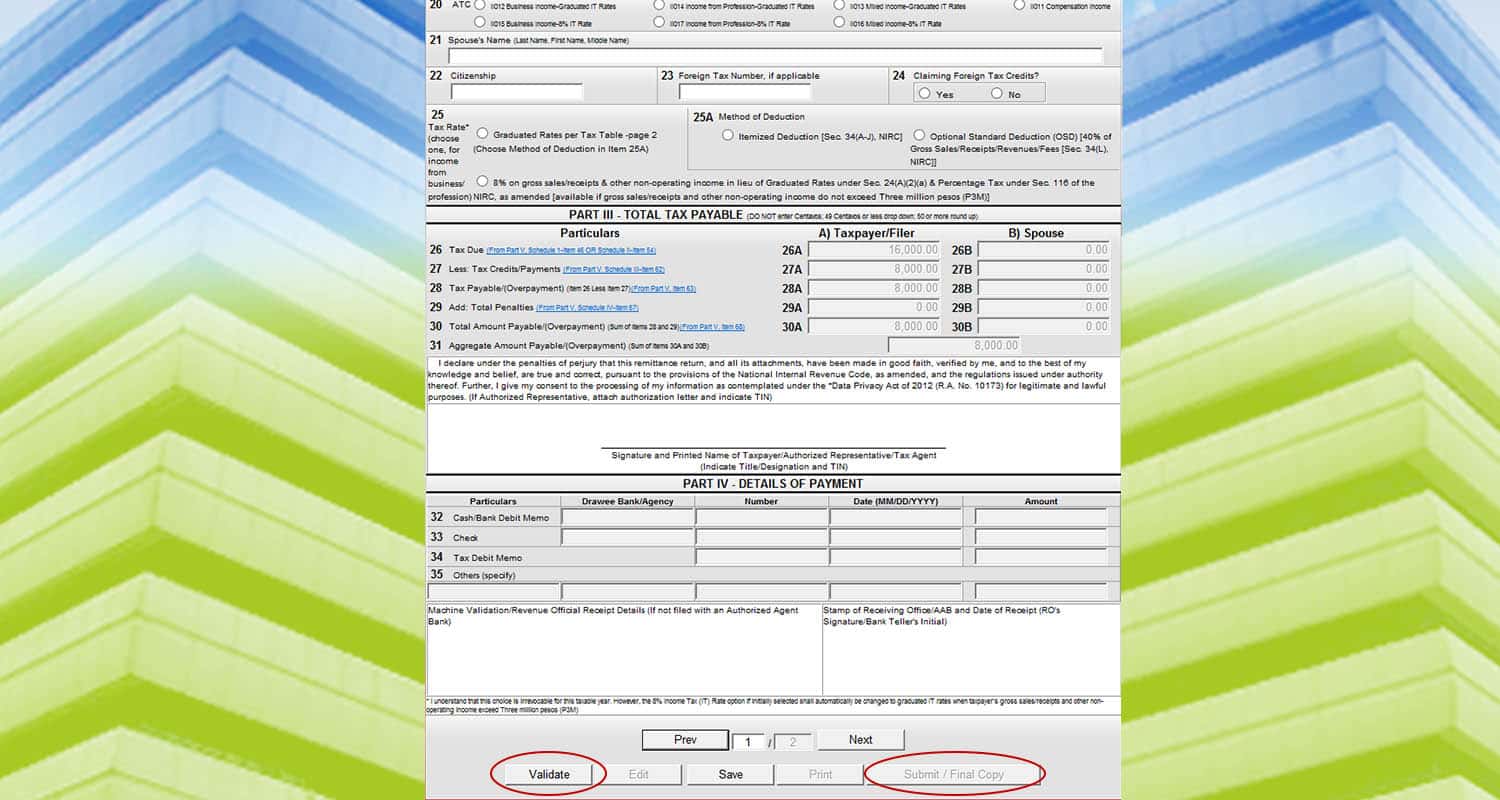

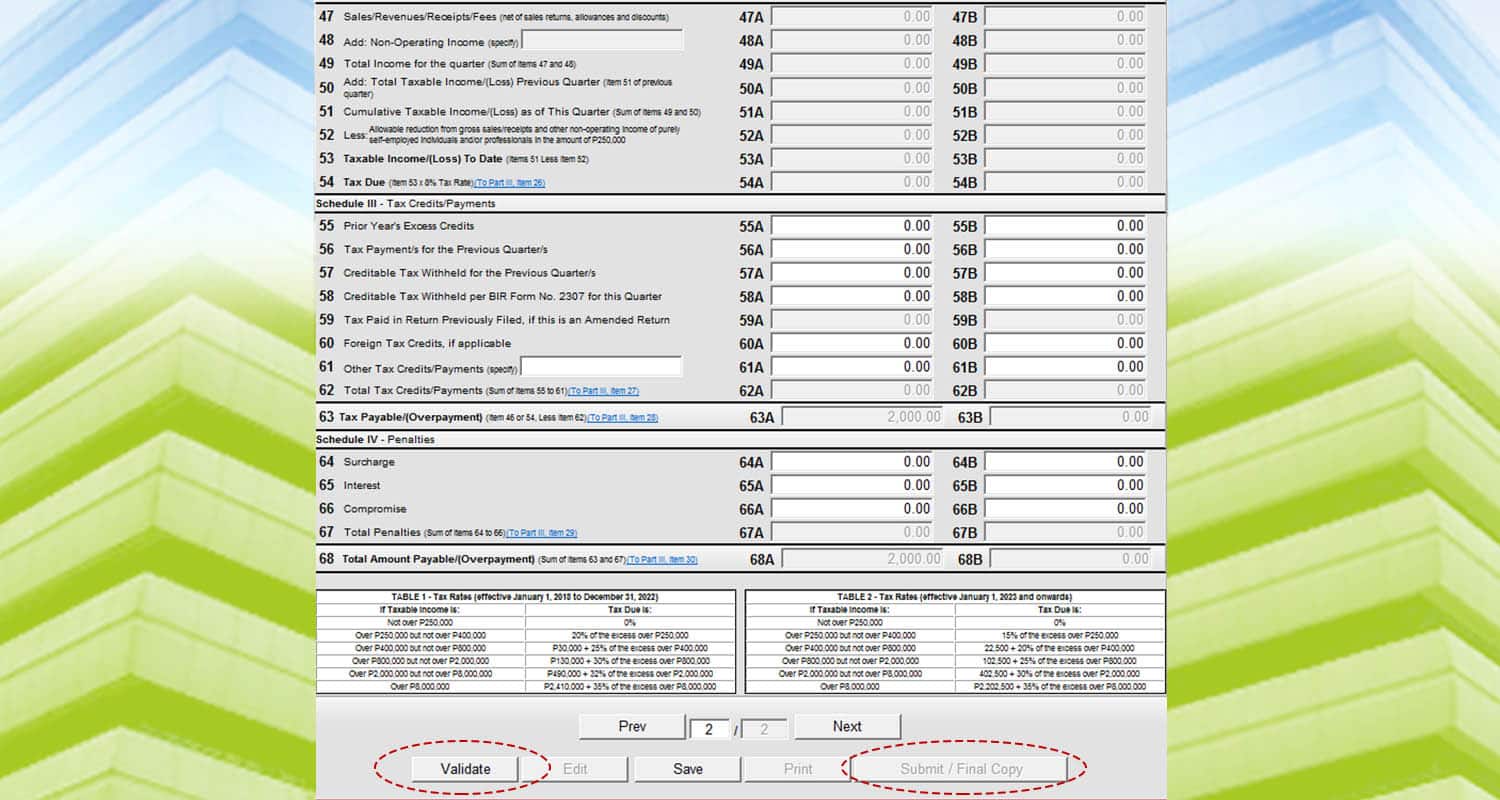

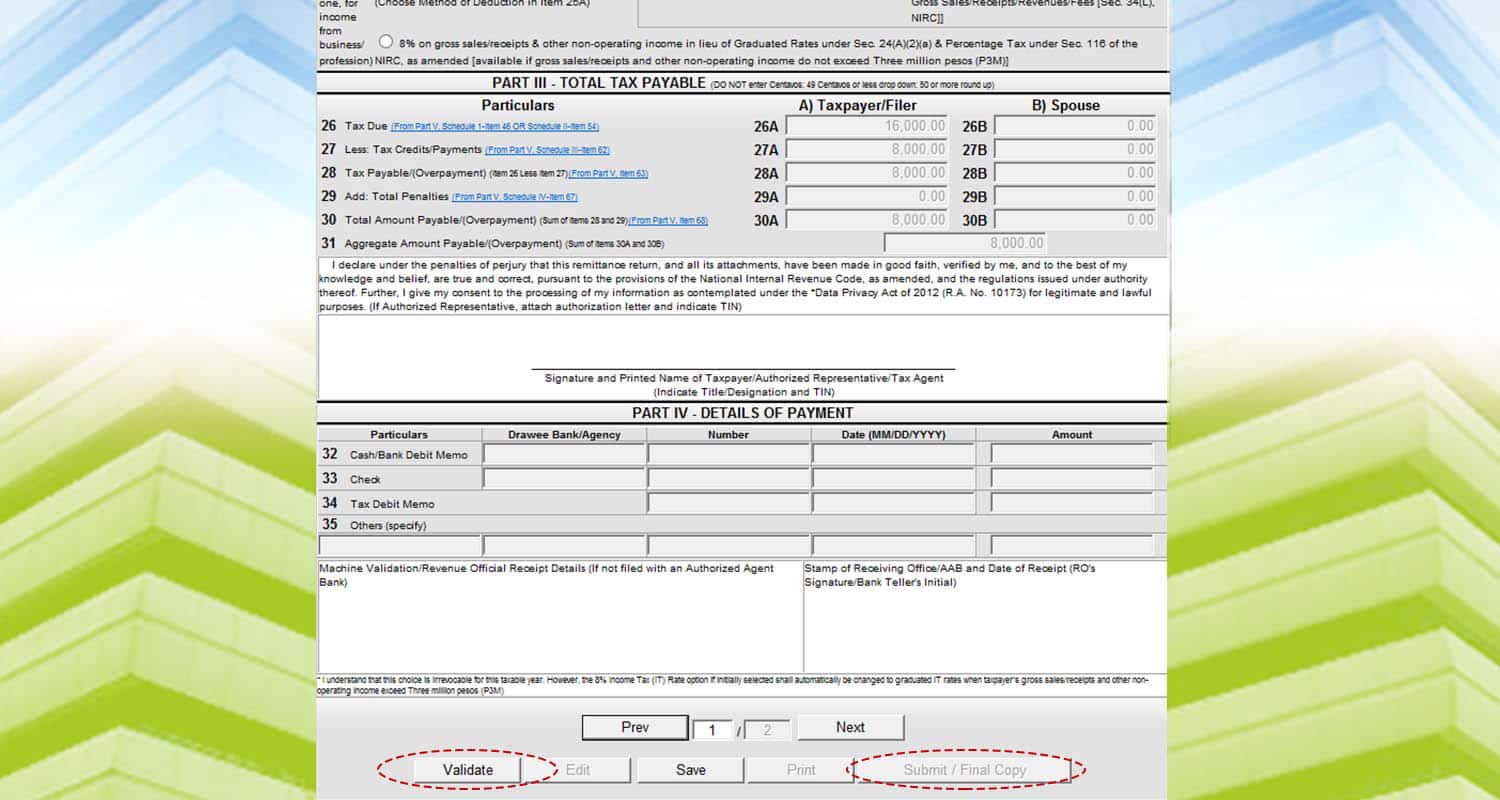

Go back to the first page. And you will see the summary of the payments. Click “Validate” and “Submit/Final Copy” to file your tax return.

Go back to the first page. And you will see the summary of the payments. Click “Validate” and “Submit/Final Copy” to file your tax return.

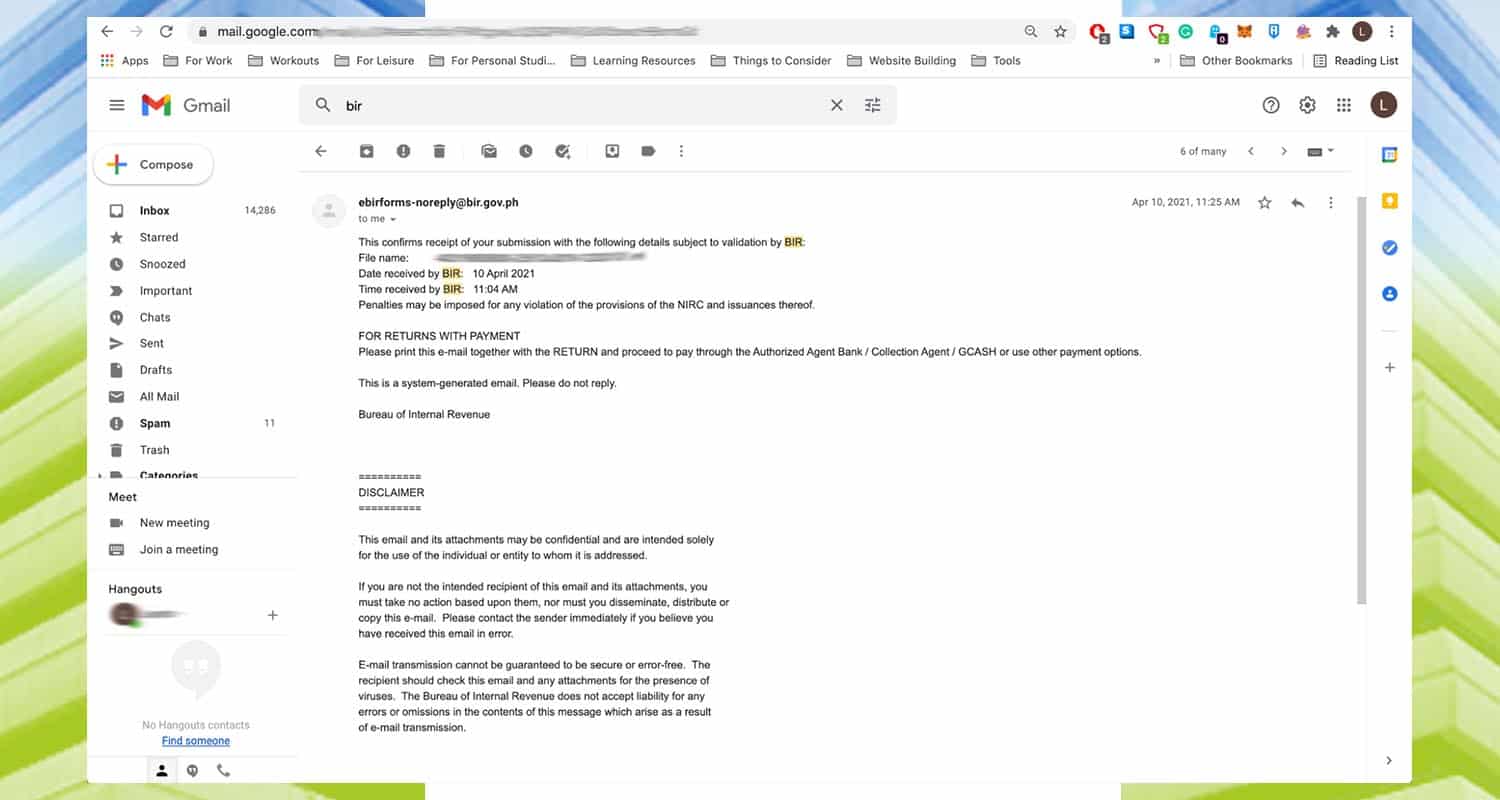

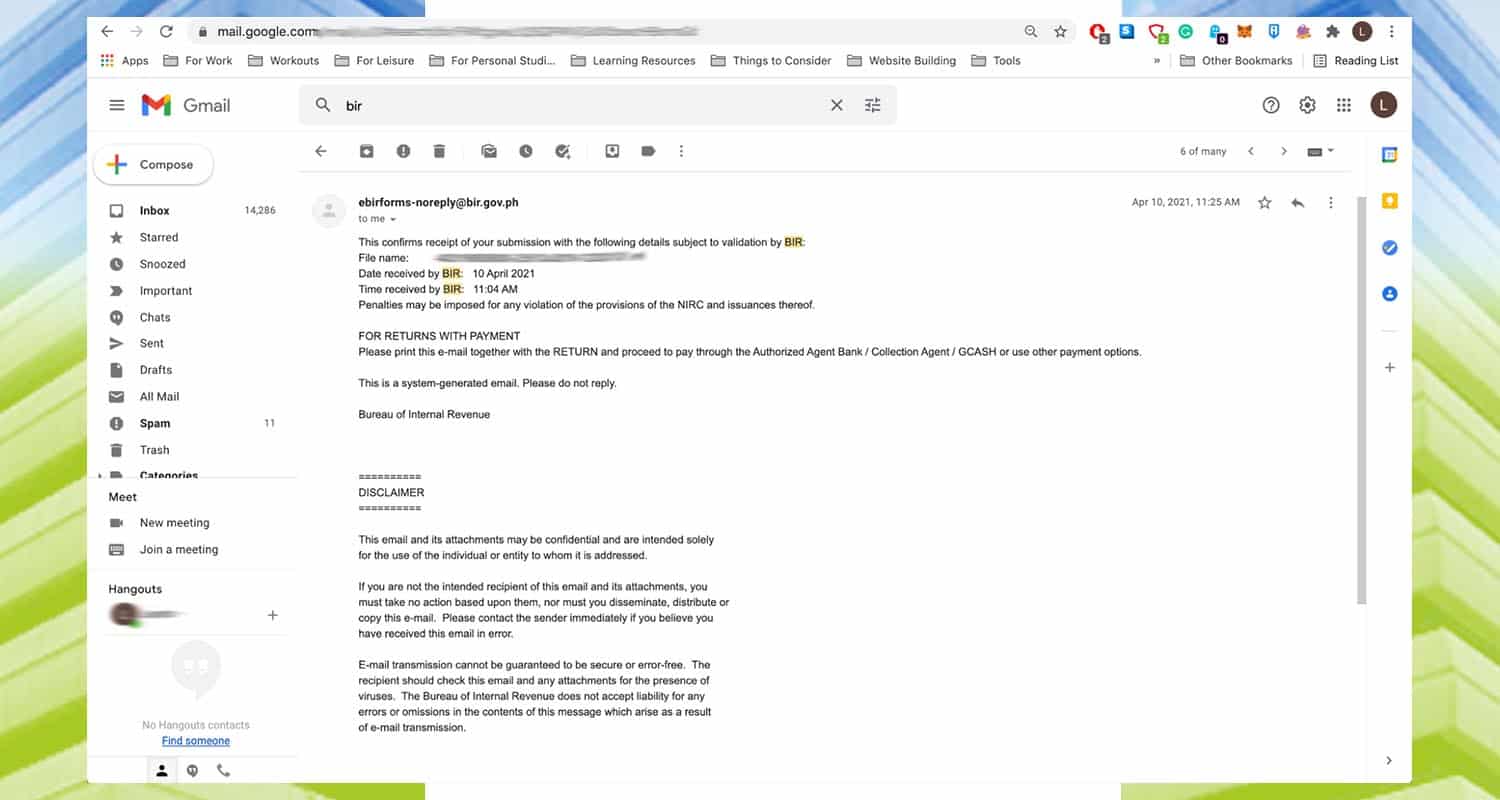

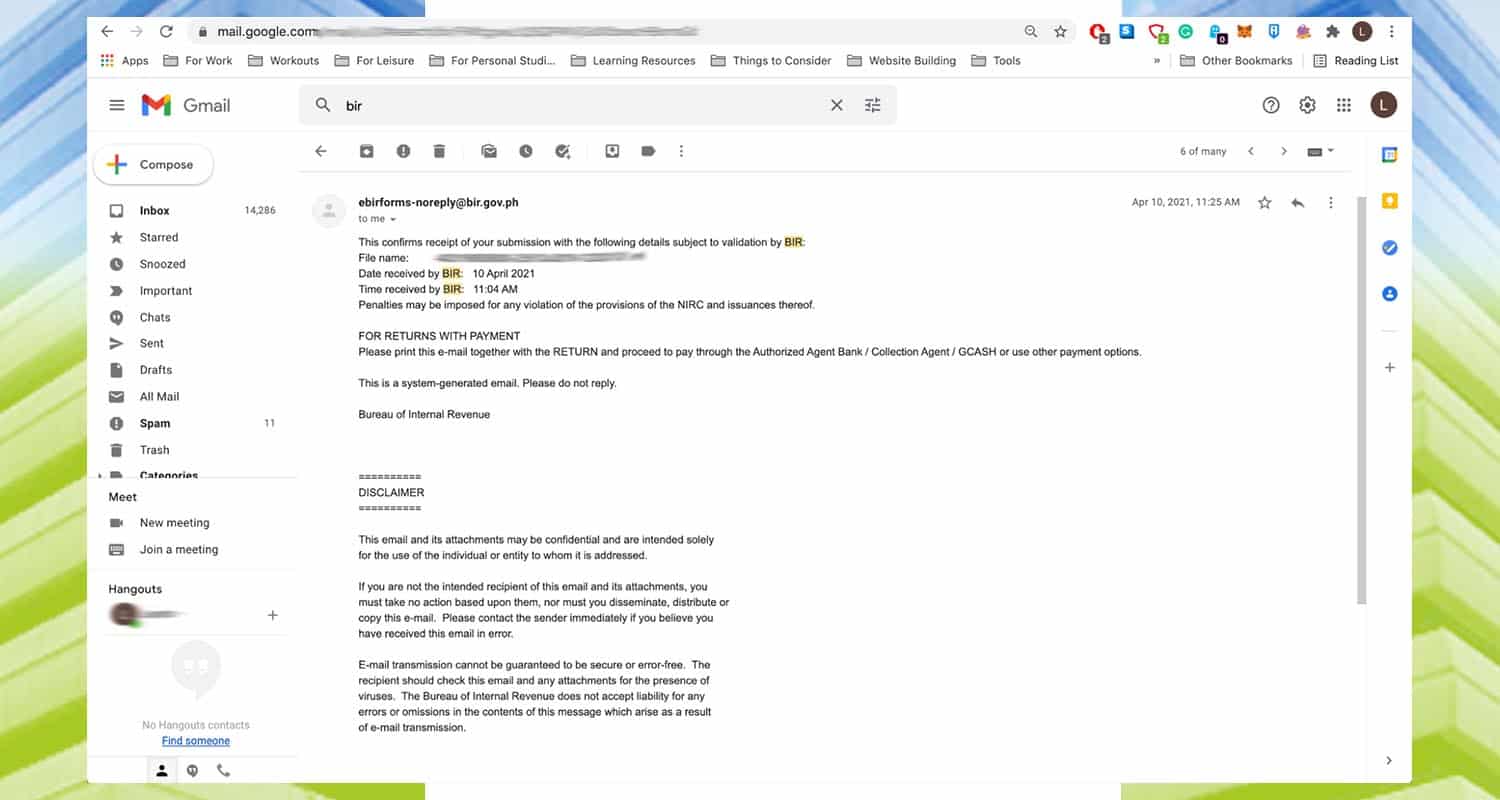

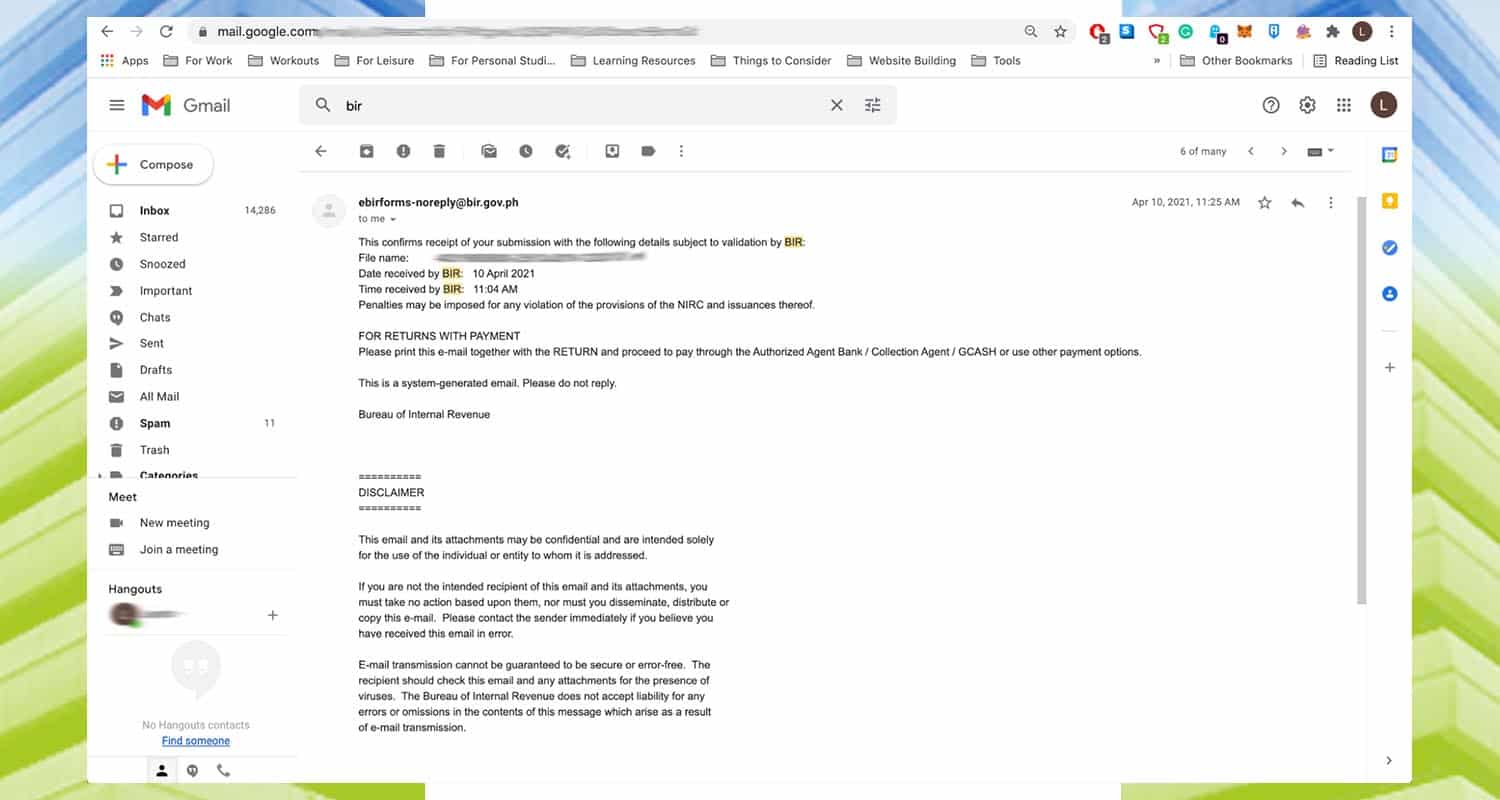

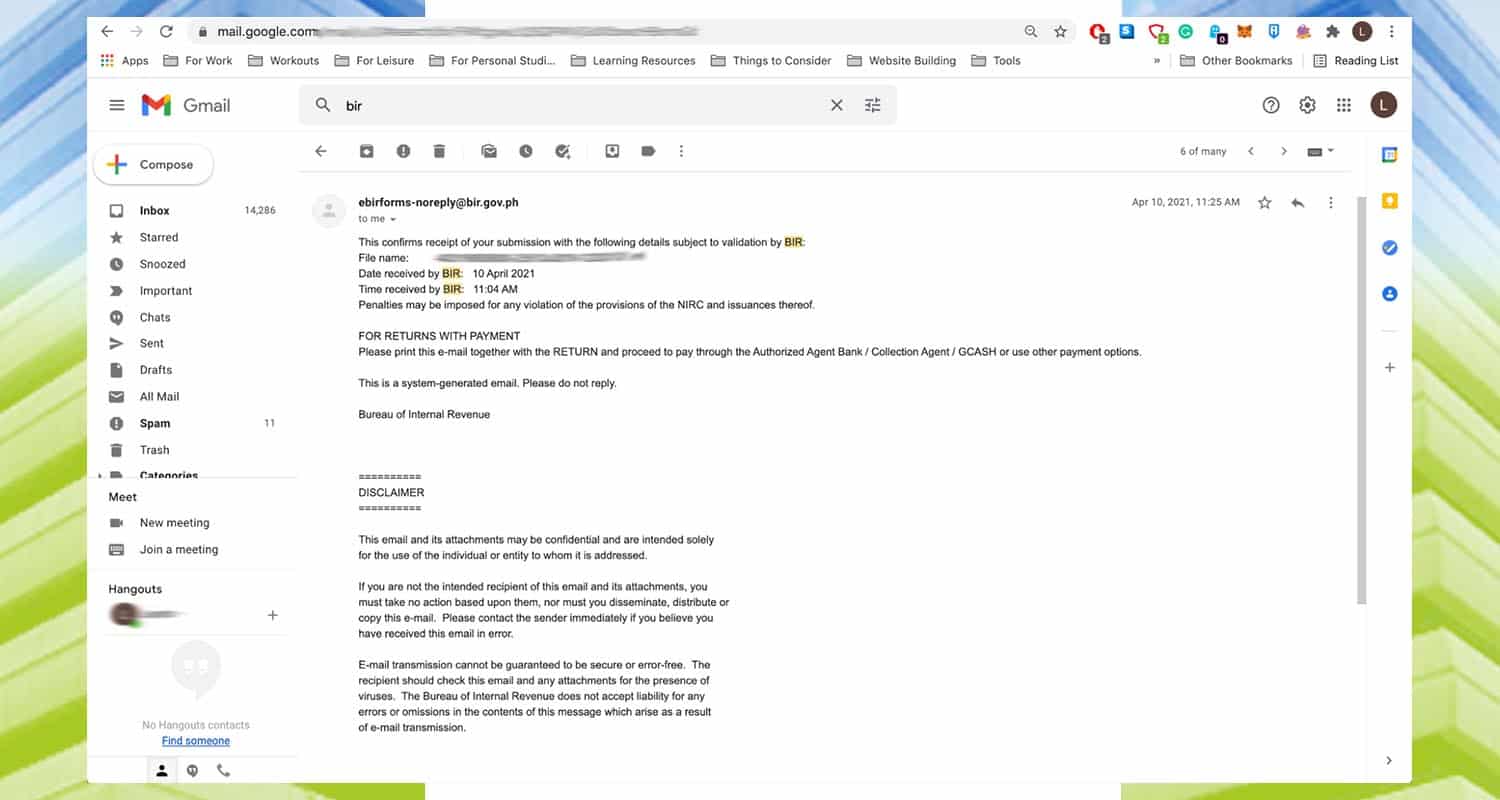

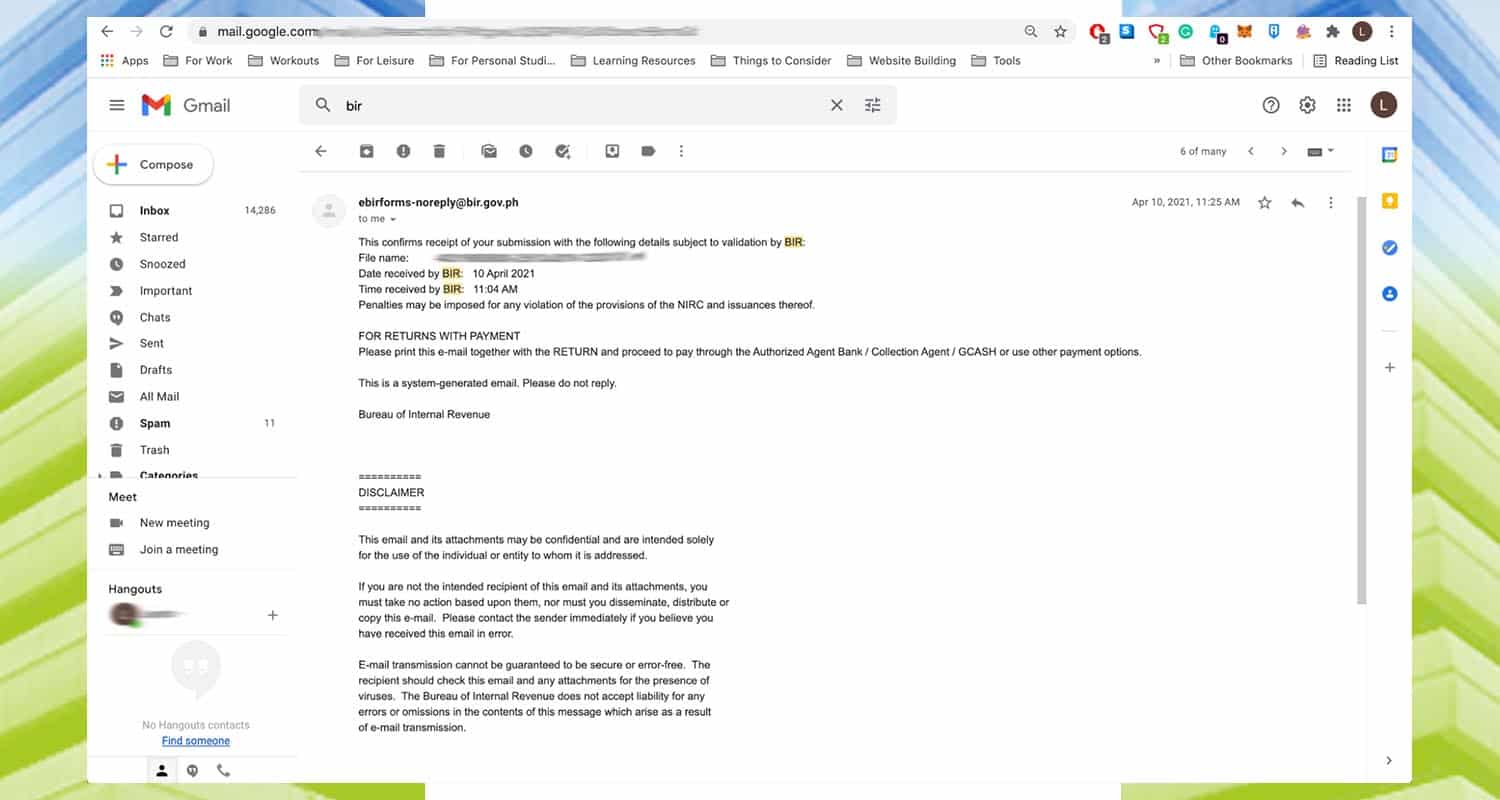

An email will be sent to you for the filing. This will serve as a confirmation and can be used as proof when you submit this file to government requirements.

An email will be sent to you for the filing. This will serve as a confirmation and can be used as proof when you submit this file to government requirements.

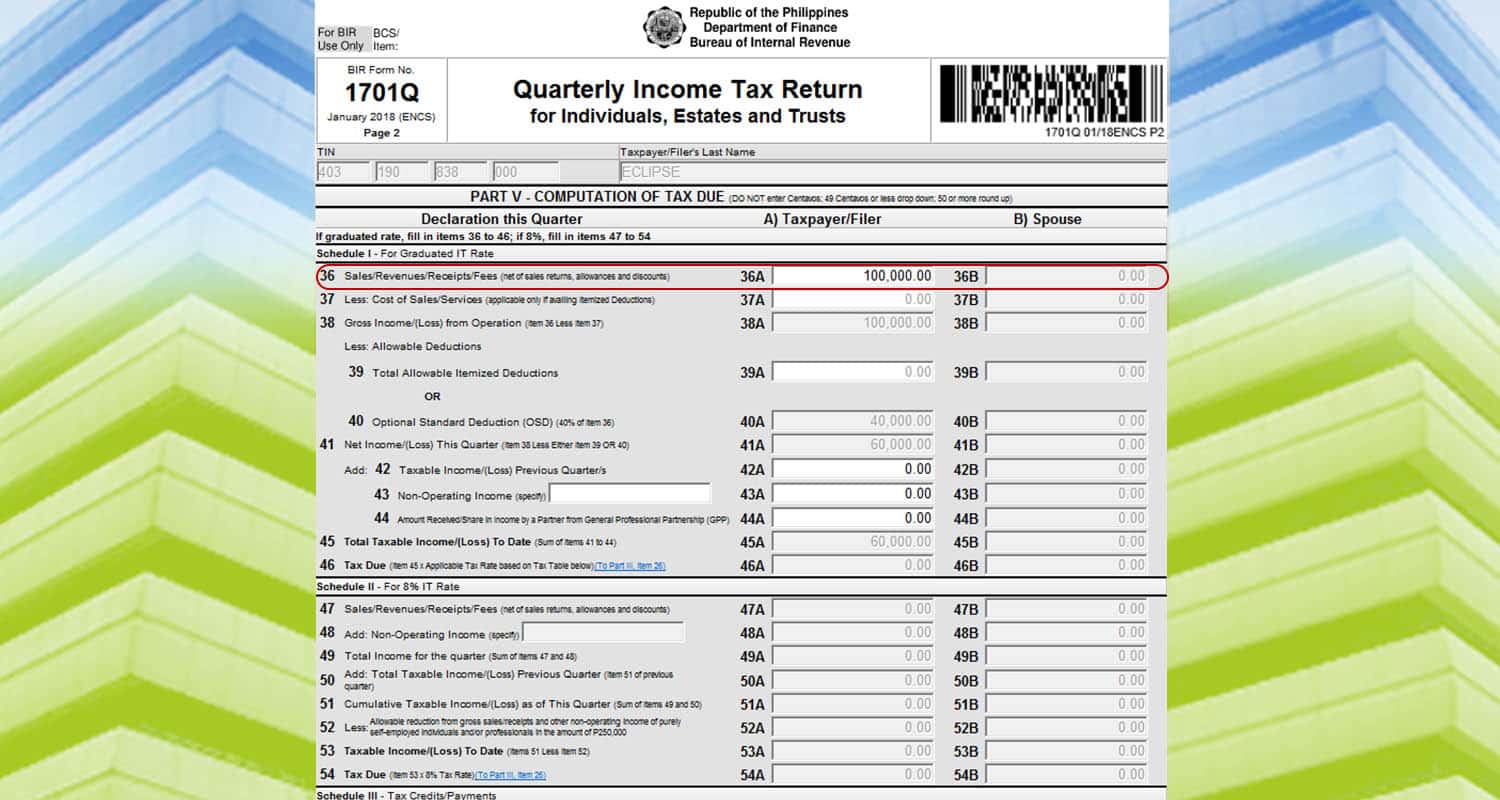

Optional Standard Deduction

If you choose the optional standard deduction, you don’t need the list of all your expenses. The program automatically deducts 40% of your gross sales as the “standard” expense. It’s good for practices that do not have many attributable expenses compared to their income.

And here’s how to file it.

Assuming you have the same 100,000 PHP income. Input the amount on line item 36. And then, the program automatically calculates the tax due.

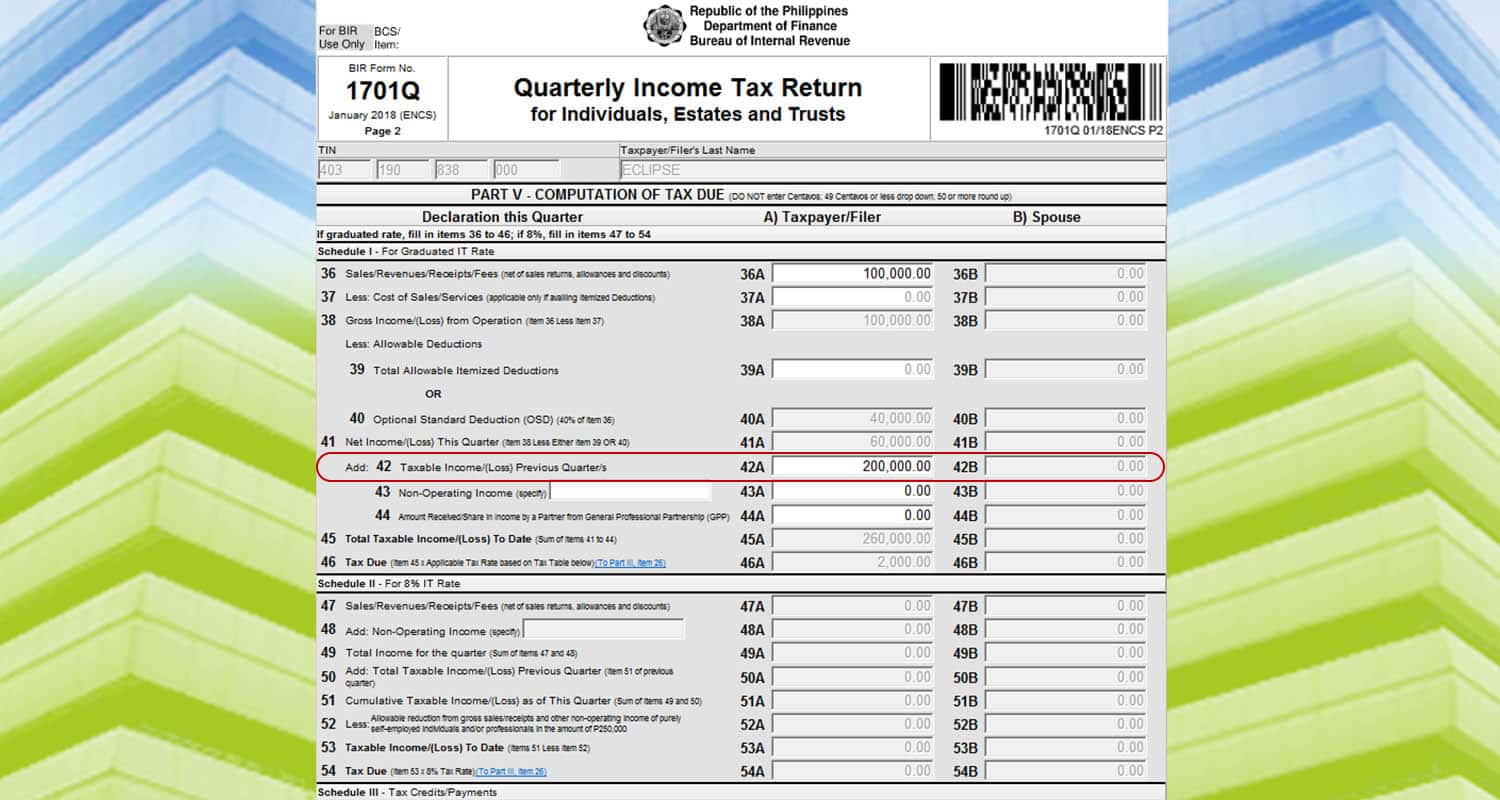

If you are paying for the 2nd or 3rd quarter, you need to report it as well. Suppose you have an income of 200,000 PHP from the past quarters. Go to line item 41 and input the amount.

If you are paying for the 2nd or 3rd quarter, you need to report it as well. Suppose you have an income of 200,000 PHP from the past quarters. Go to line item 41 and input the amount.

Lastly, input any payments you made for the past quarter on line item 56.

Go back to the first page. And you will see a summary of your tax due. Click “Validate” and “Submit/Final Copy” to file your return.

Go back to the first page. And you will see a summary of your tax due. Click “Validate” and “Submit/Final Copy” to file your return.

An email will be sent to you for the filing. This will serve as a confirmation and can be used as proof when you submit this file to government requirements.

An email will be sent to you for the filing. This will serve as a confirmation and can be used as proof when you submit this file to government requirements.

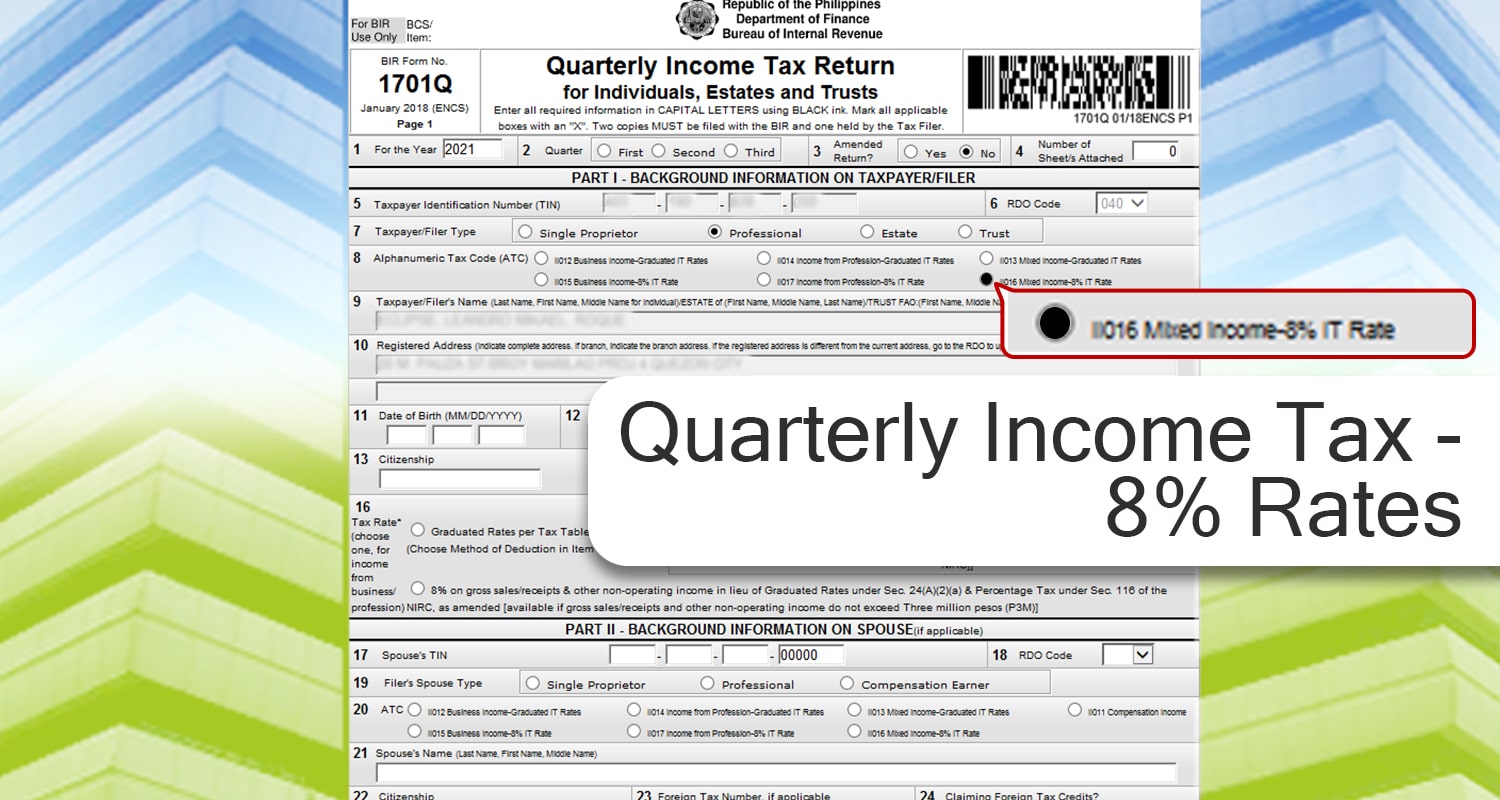

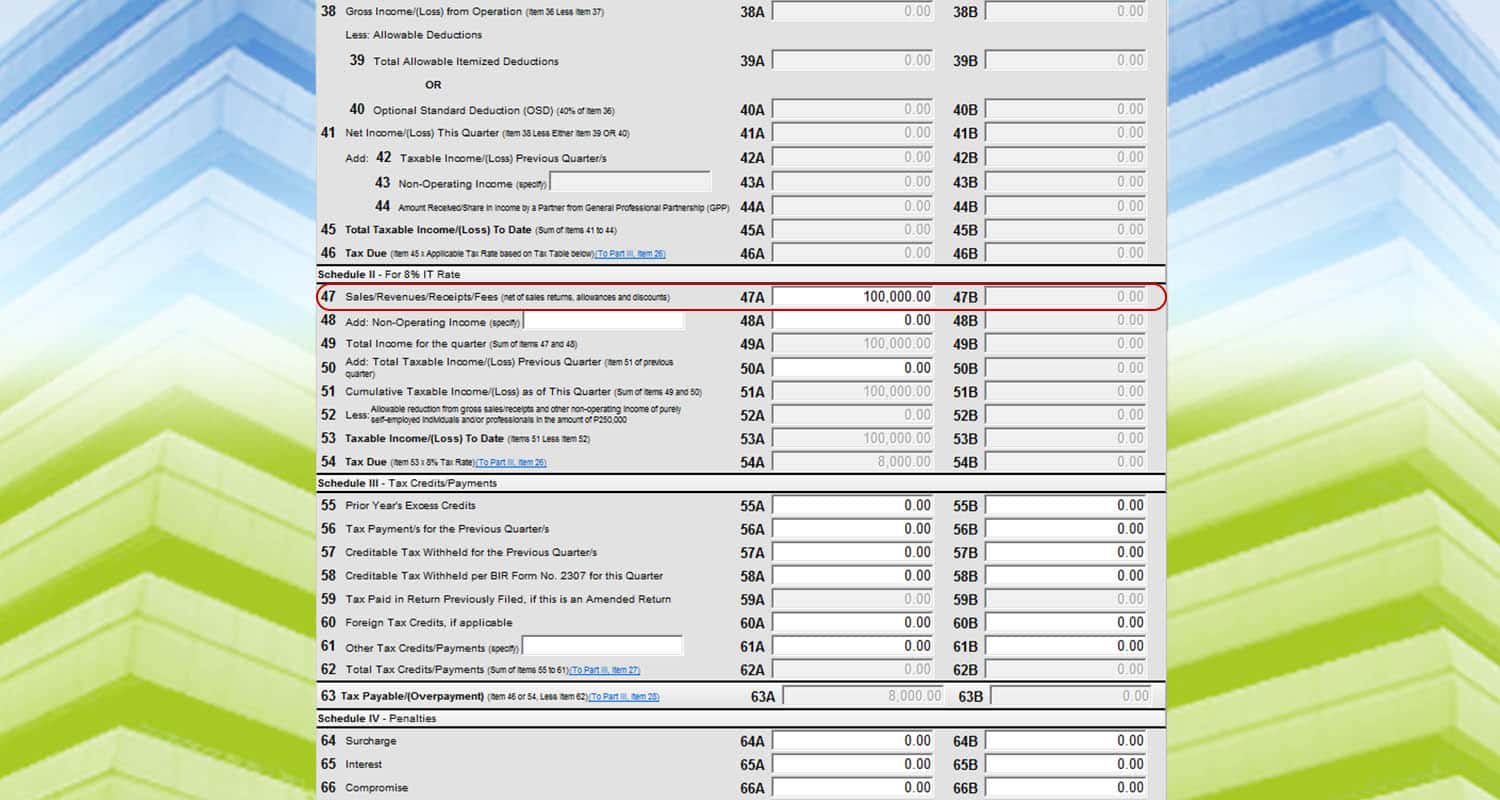

Quarterly Income Tax – 8% Rates

If you choose the 8% tax rate, here are the steps.

Go to the second page in “Schedule II – for 8% IT rate.”

Go to the second page in “Schedule II – for 8% IT rate.”

Let’s say you have 100,000 PHP income from your side hustle. Input the amount on “line item 47. And the program will compute the tax you need to pay.

The main difference between filing mixed income versus income from profession is that you can’t input the 250,000 PHP tax-exempt on line 52. It’s because the 250,000 PHP is assumed to be already used up in computing your compensation income from your job.

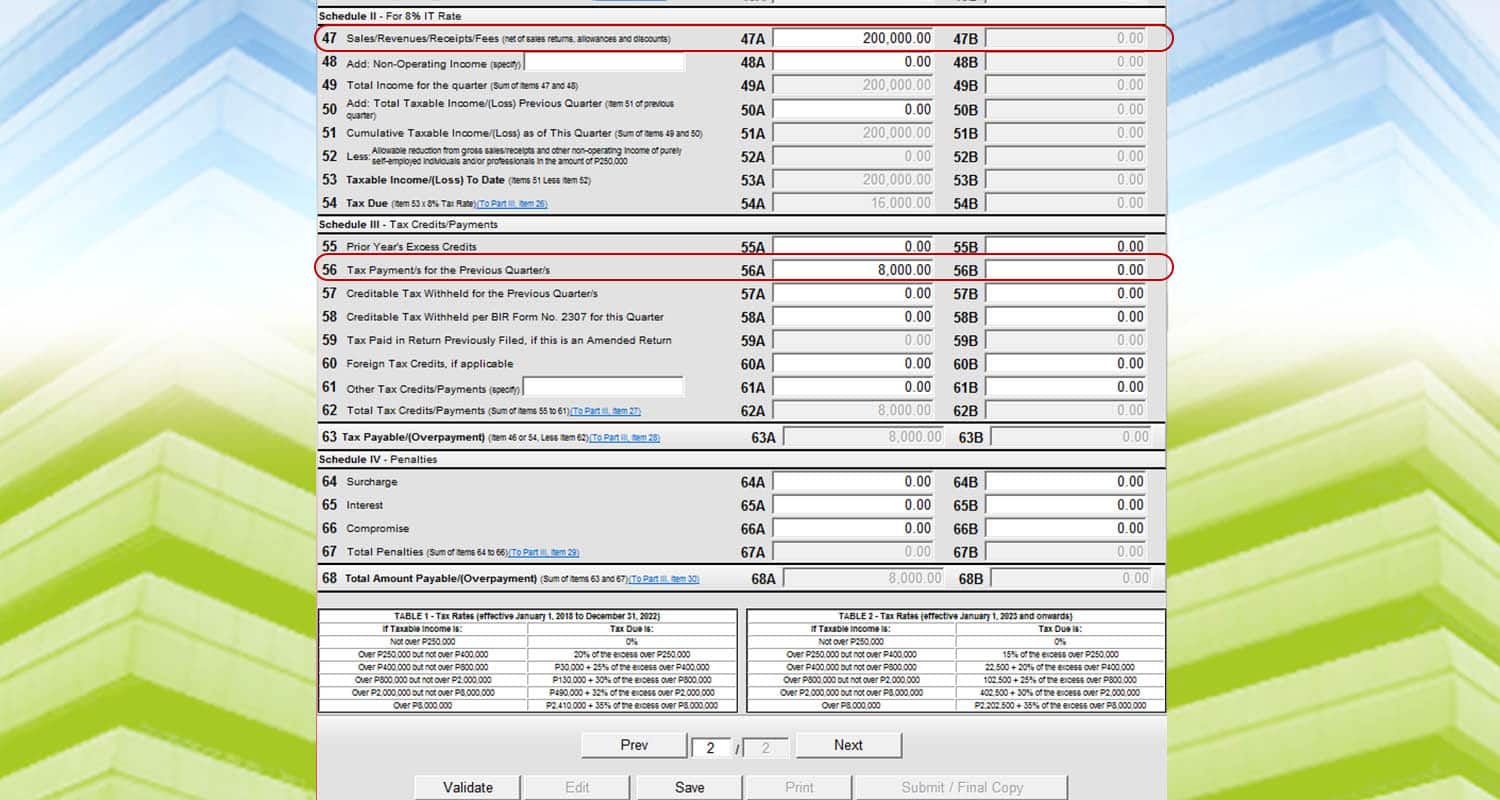

Just in case you will file for the 2nd or 3rd quarter, and you have paid for the previous quarters, you have to fill out “Schedule III – Tax Credits/Payments.”

Just in case you will file for the 2nd or 3rd quarter, and you have paid for the previous quarters, you have to fill out “Schedule III – Tax Credits/Payments.”

Let’s say you have 200,000 PHP total income for the past quarters. And then, you have paid 8,000 PHP in the past.

Just input 200,000 PHP on line item 47. And then input the 8,000 PHP on line item 56. The program will automatically compute your tax due.

Afterwards, go to page 1. And then, the summary of the payment will show. Lastly, click validate and submit/final copy to file your return.

Afterwards, go to page 1. And then, the summary of the payment will show. Lastly, click validate and submit/final copy to file your return.

An email will be sent to you for the filing. This will serve as a confirmation and can be used as proof when you submit this file to government requirements.

An email will be sent to you for the filing. This will serve as a confirmation and can be used as proof when you submit this file to government requirements.

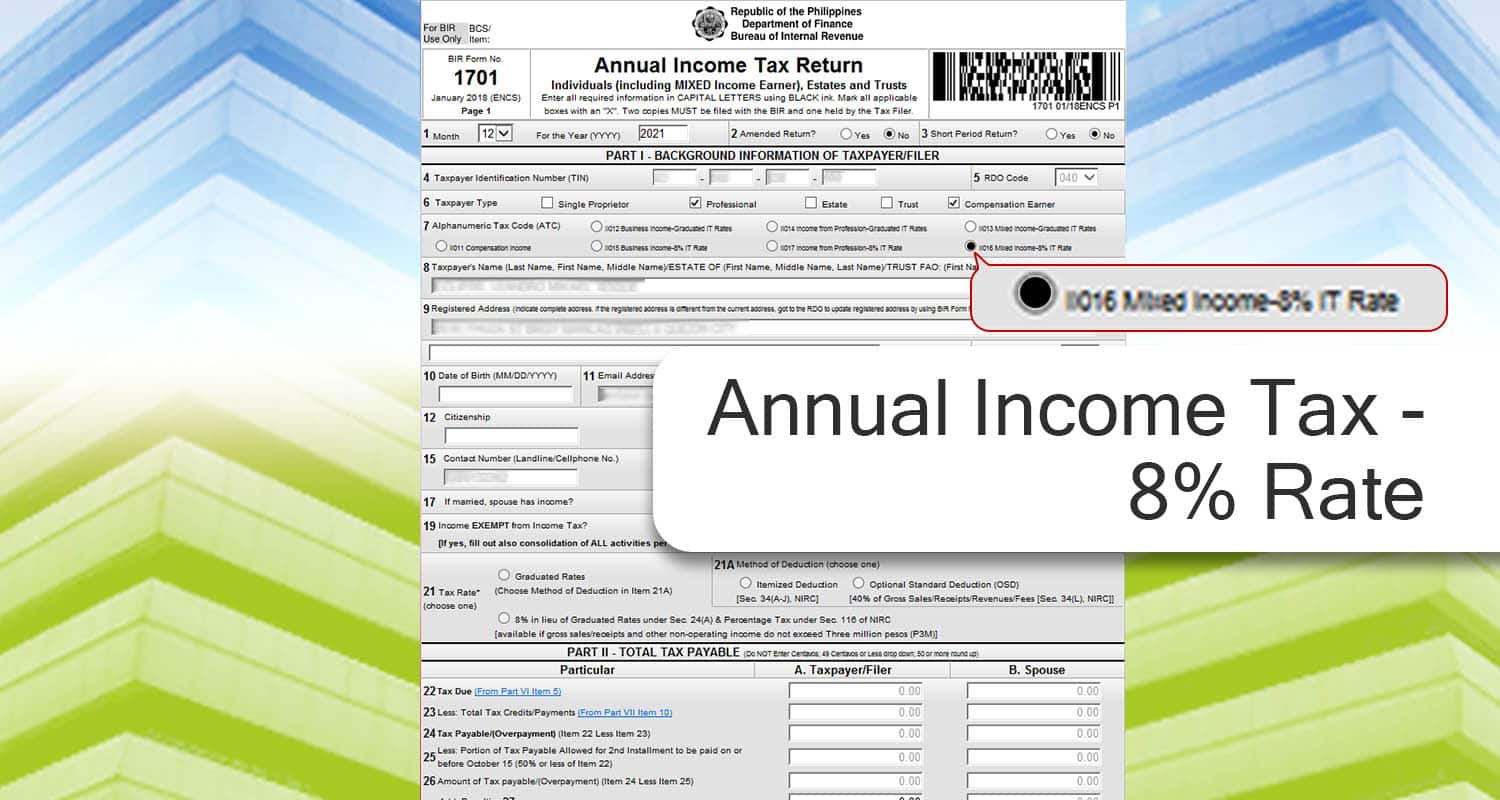

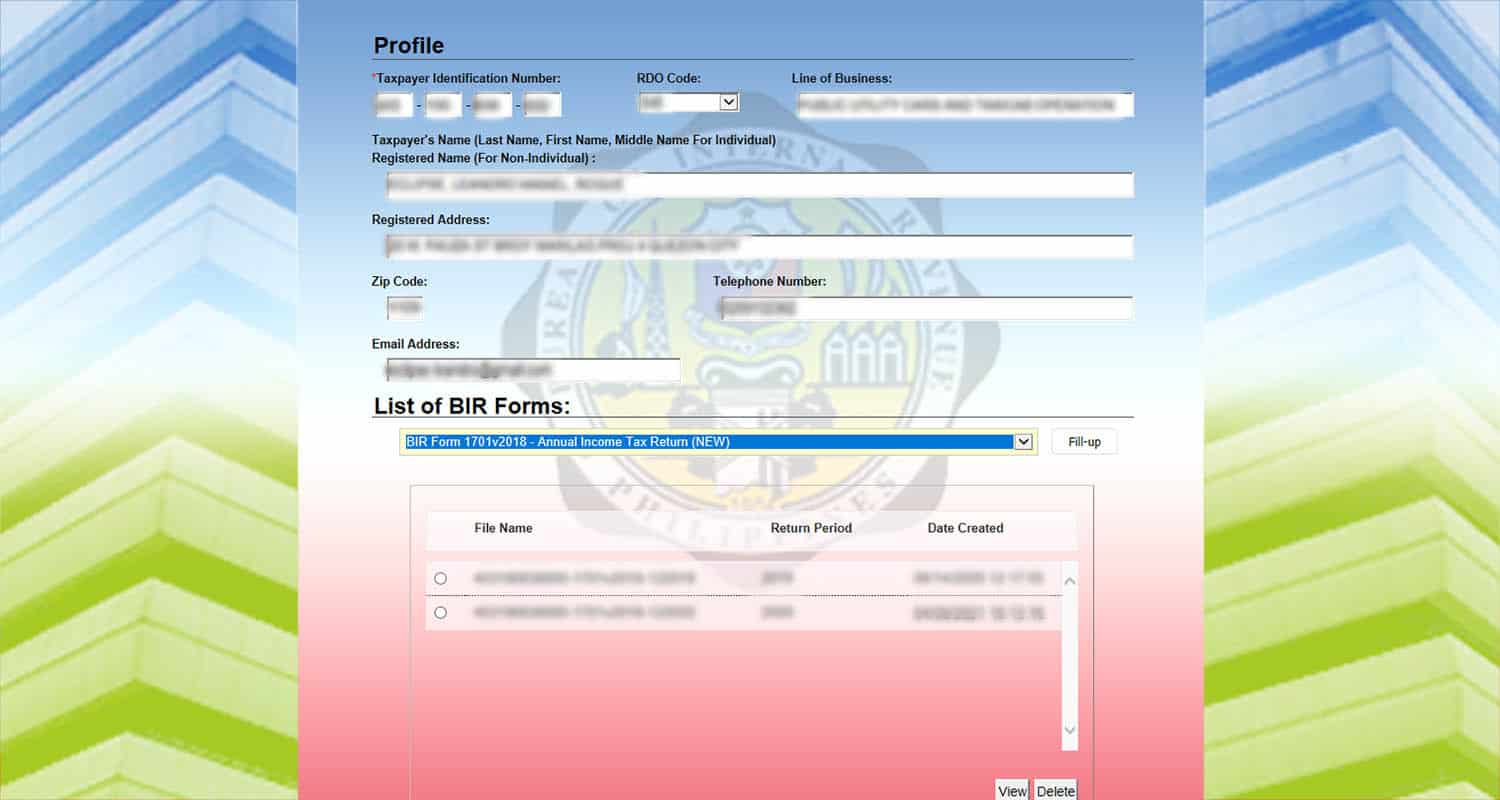

Annual Income Tax

For the annual income tax, it’s quite similar as well. The difference is you’re declaring both your compensation income and professional income. So there’s an additional section that you have to fill up. You also need your BIR Form 2316 as a supporting document. It shows all the income you earned from your job and all the withholding taxes paid.

And here’s how to file it.

First, choose “BIR Form 1708v2018 – Annual Income Tax Return.”

And then, input the following information.

And then, input the following information.

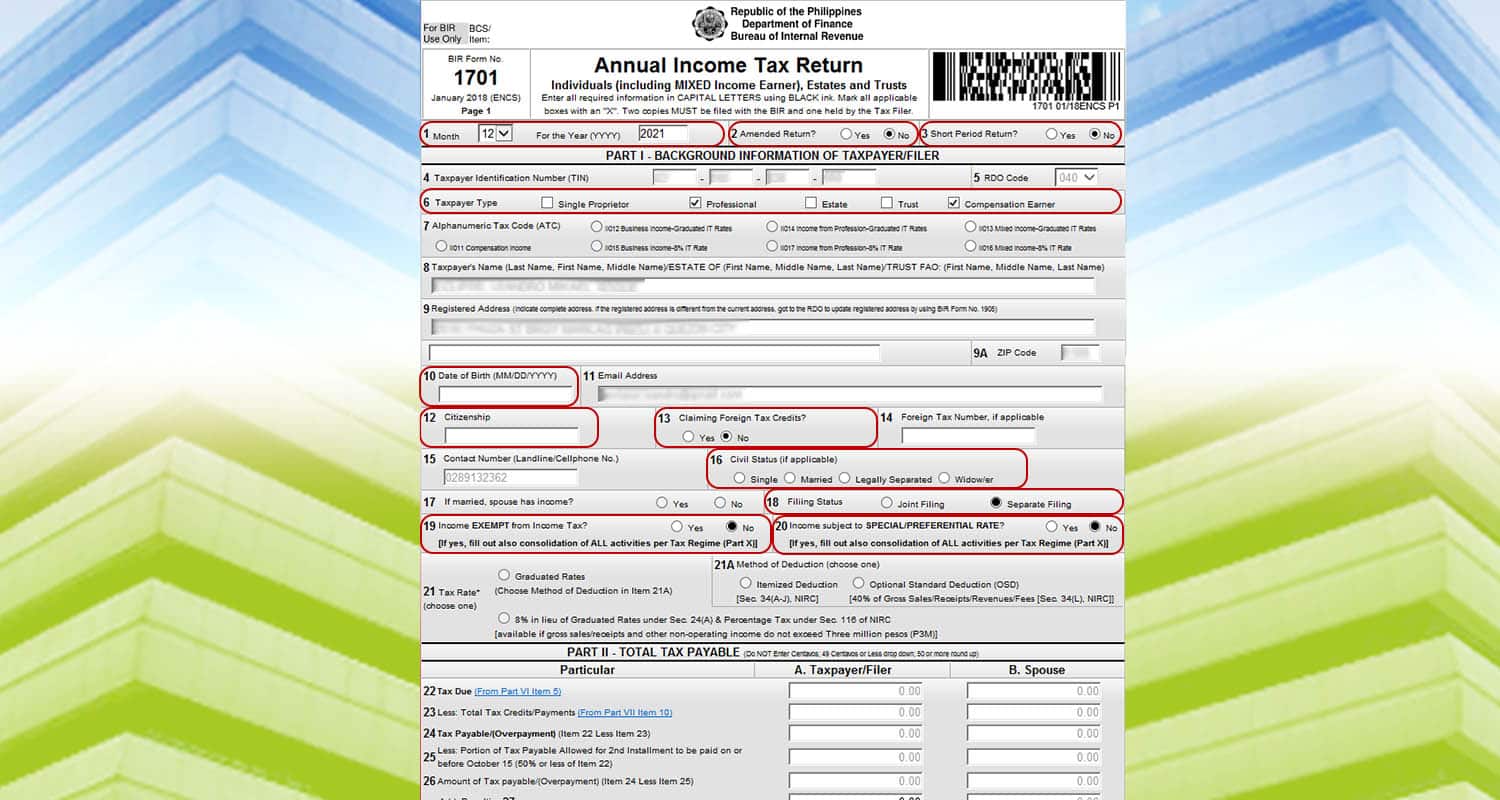

- Line Item 1: Pick 12 for the month and input the year

- Line Item 2: Choose No.

- Line Item 3: Choose No.

- Line Item 6: Choose Professional and Compensation Earner.

- Line Item 10: Input your date of birth.

- Line Item 12: Input your citizenship.

- Line Item 13: Choose No.

- Line Item 16: Choose your Marital Status. For the purpose of this article, we will choose Single or Married with Separate Filing for Line Item 18.

- Line Item 19: Choose No.

- Line Item 20: Choose No.

- Line Item 4, 5, 8, 9, 9A, 11: These line items will be automatically filled by your information in the main menu.

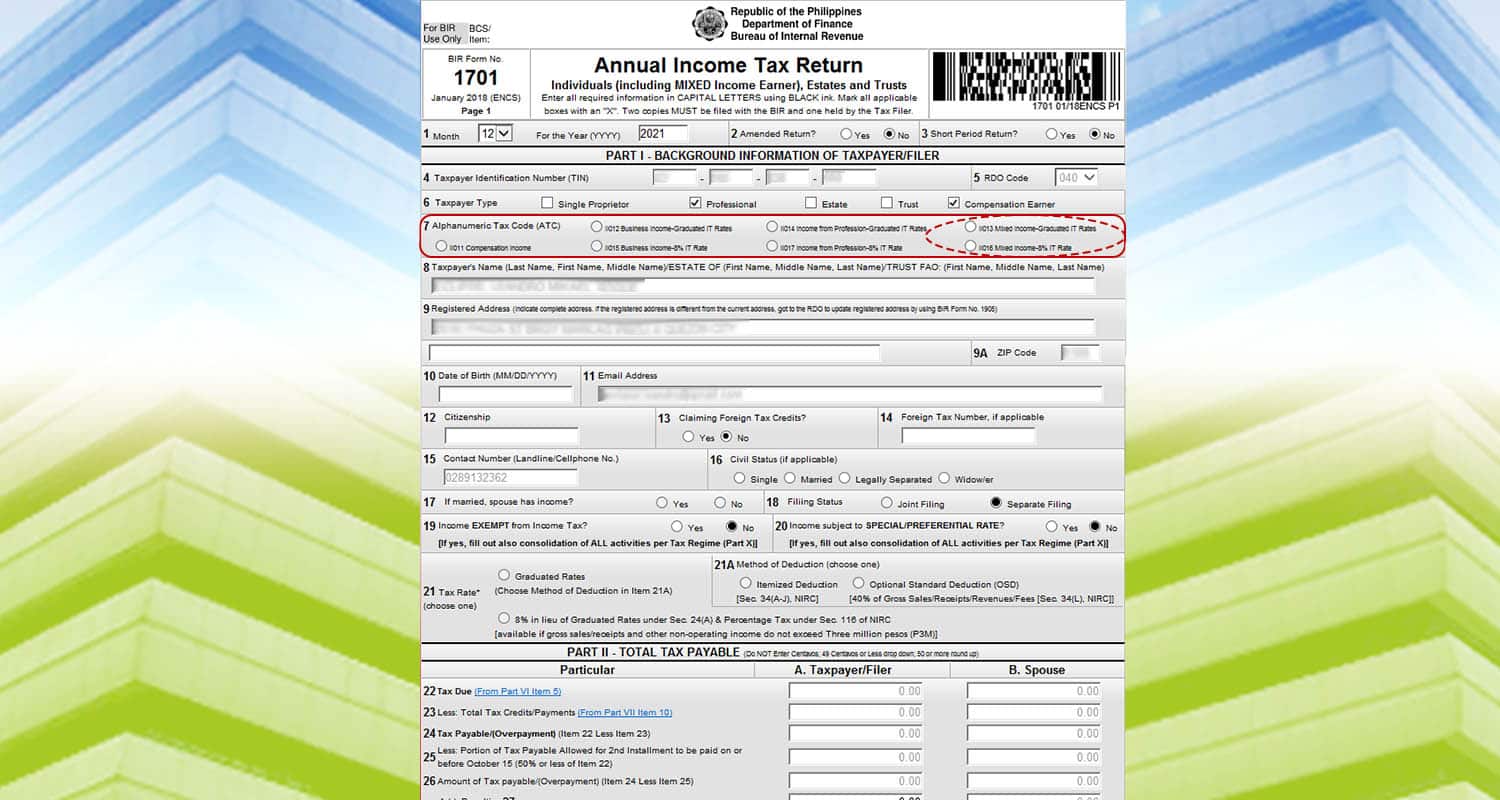

For line 7, you can either choose “Mixed Income – Graduated Rates” or “Mixed Income – 8% Tax Rate.”

Compensation Income

Regardless of which one you pick, you need to input your compensation income.

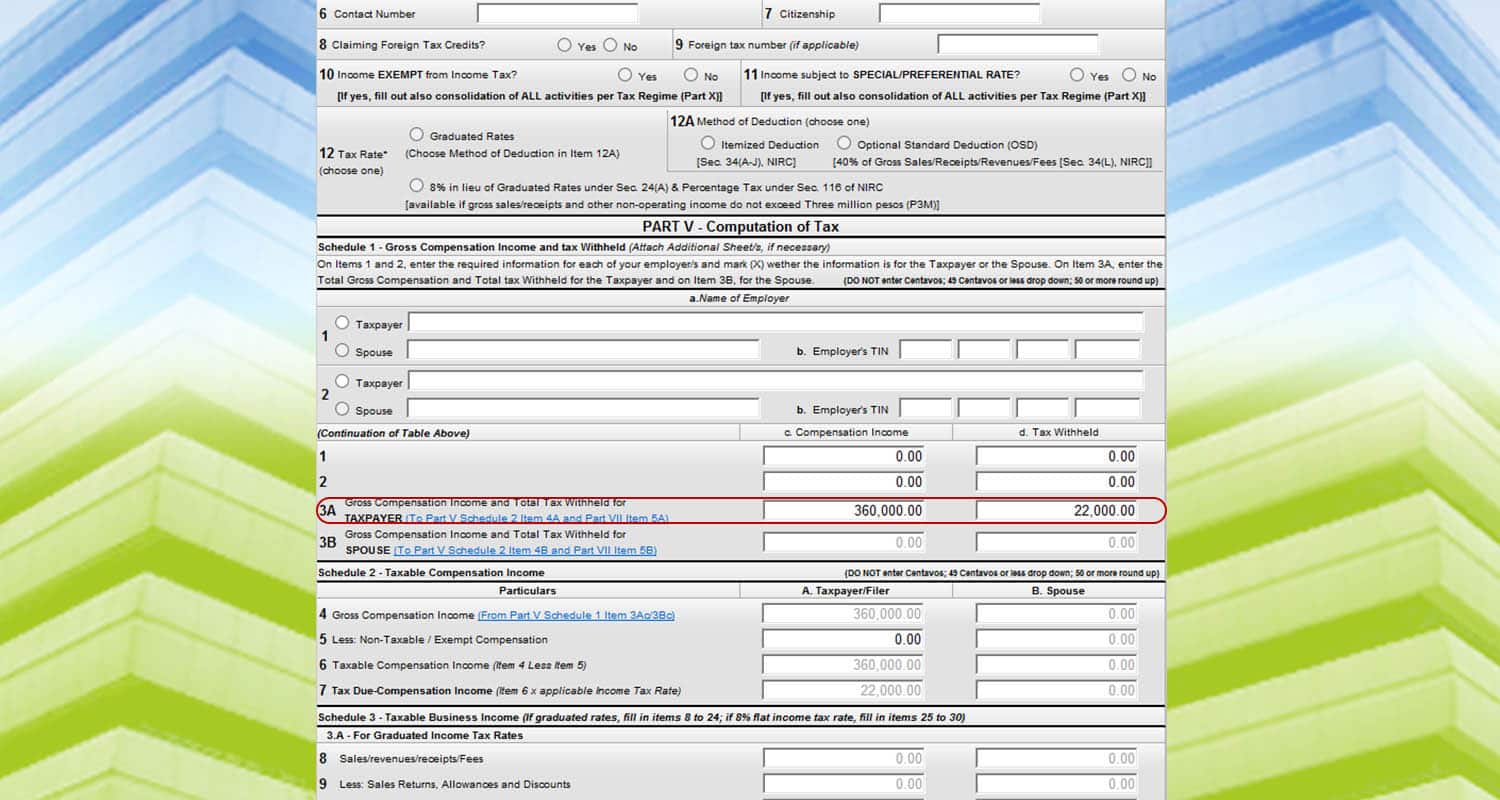

Go to page 2. And then look for Part V- Computation of Tax. Let’s say you are working as an employee with a salary of 30,000 PHP per month. Roughly, you will get a 360,000 PHP annual salary and a withholding tax of 22,000 PHP. This information is on your BIR Form 2316.

Input this information in “line item 3A.”

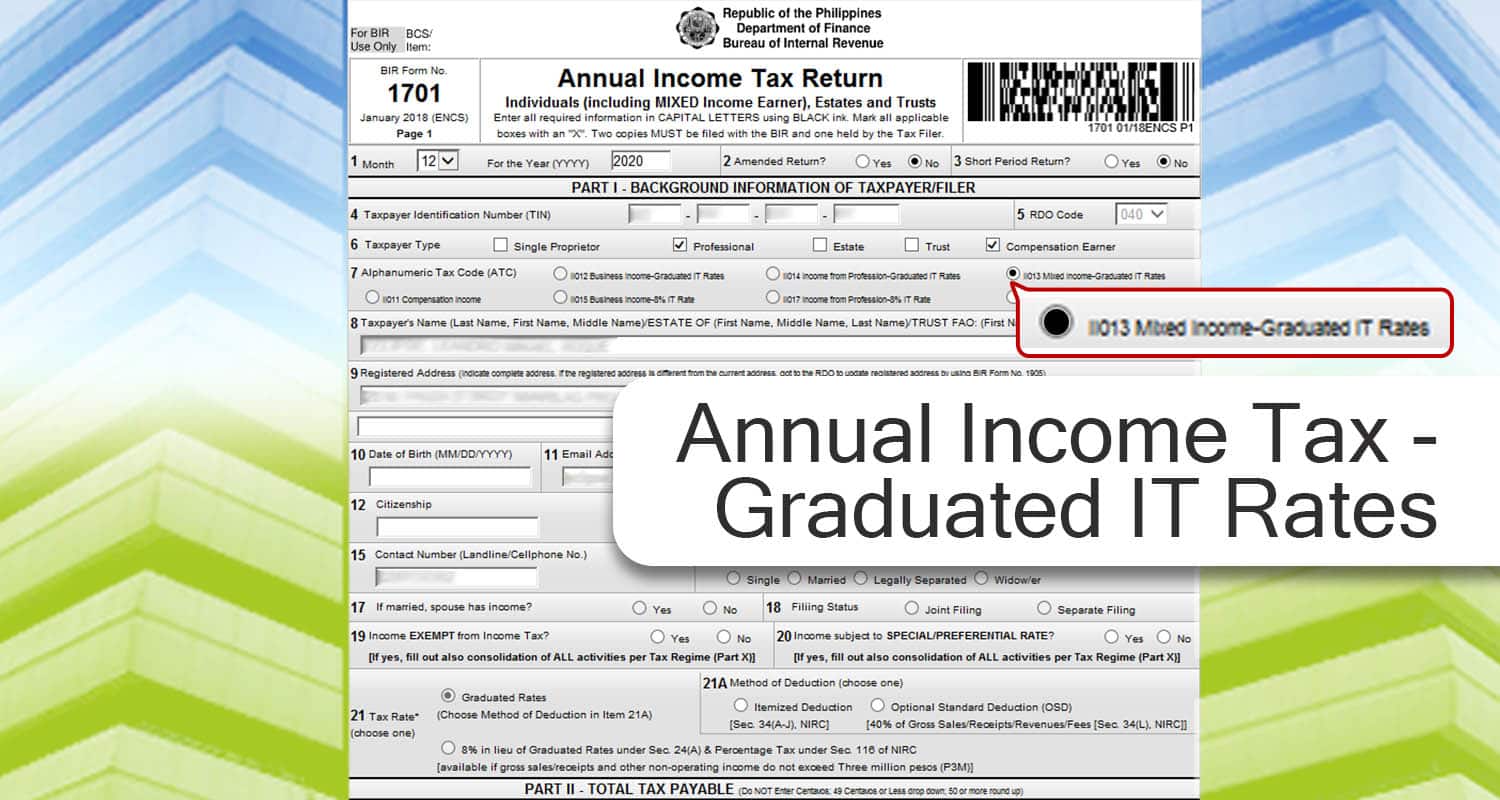

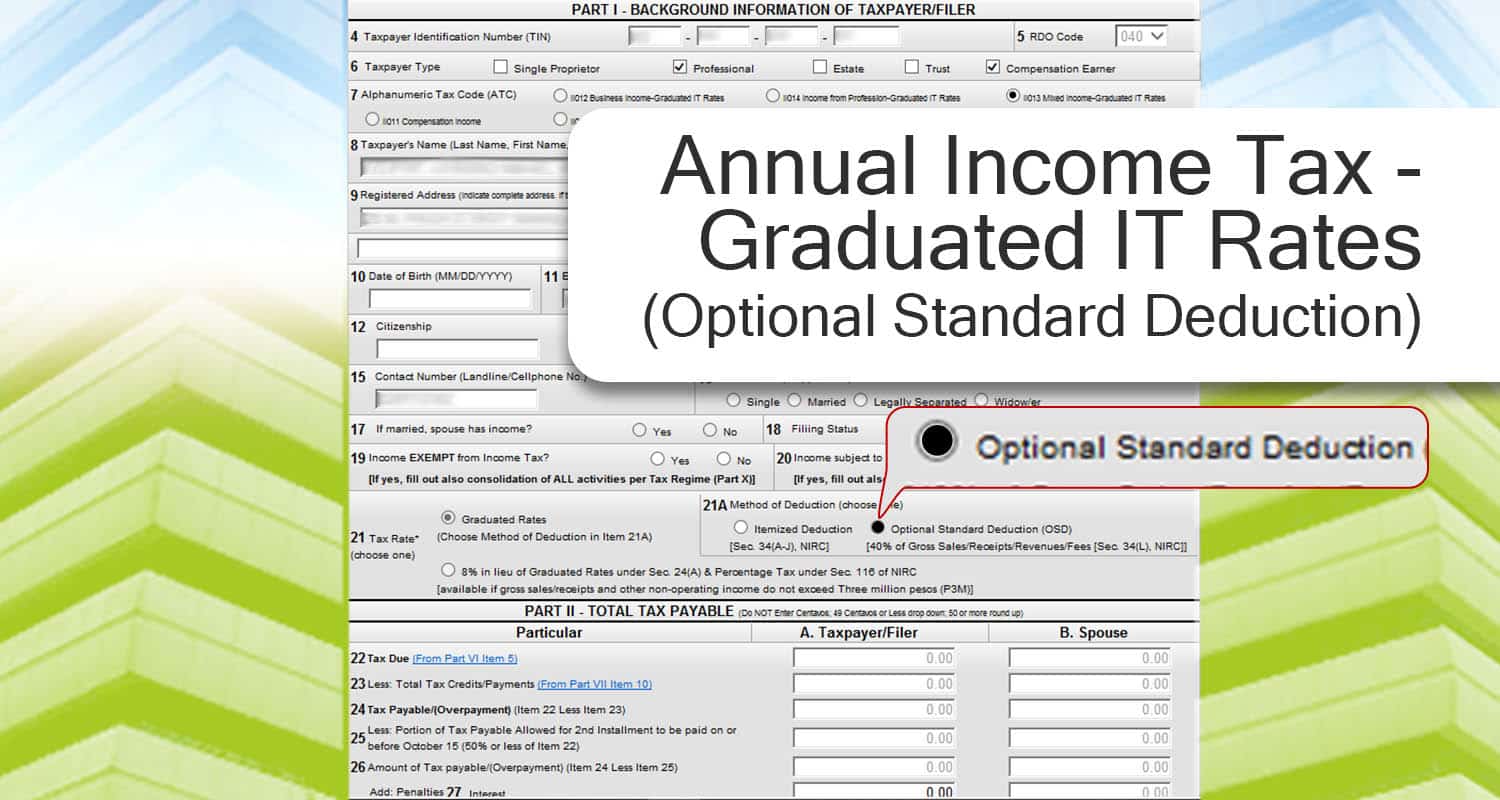

Annual Income Tax – Graduated IT Rates

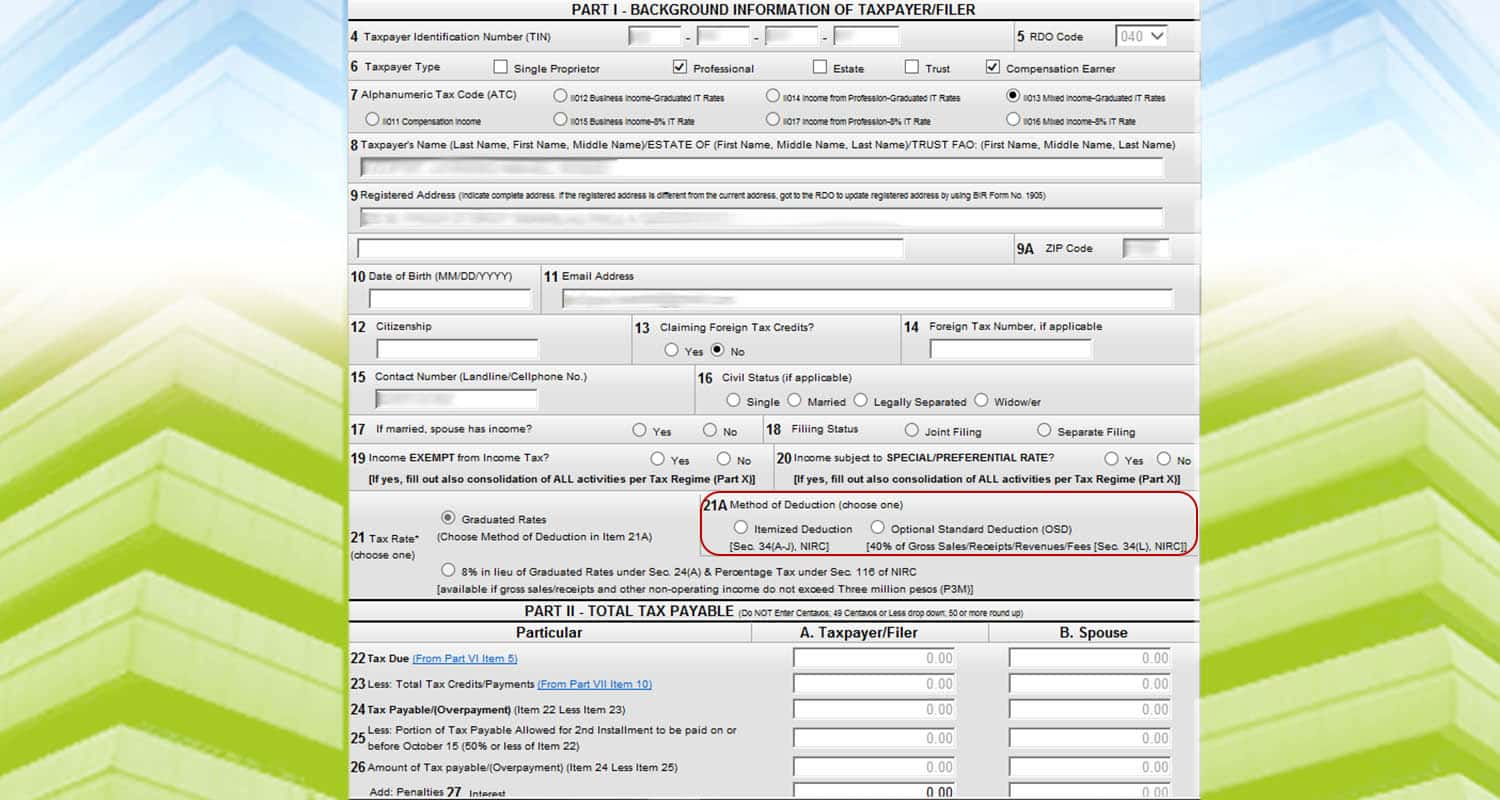

If you choose the graduated IT rates, here are the next steps.

You have to pick what method of deduction you should use for your taxes in line item 21A. It’s either “Itemized Deduction” or “Optional Standard Deduction.”

You have to pick what method of deduction you should use for your taxes in line item 21A. It’s either “Itemized Deduction” or “Optional Standard Deduction.”

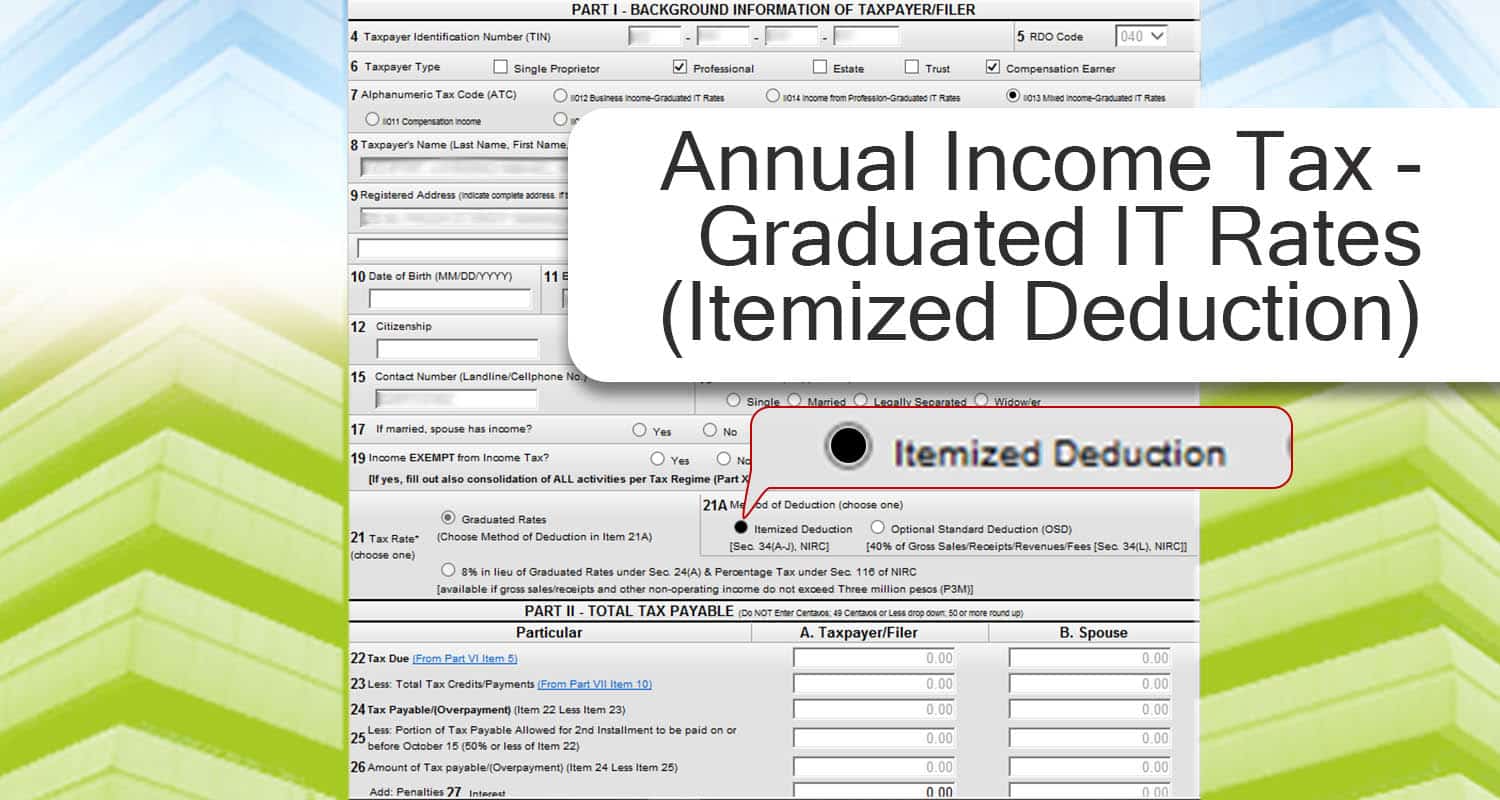

Annual Income Tax – Graduated IT Rates (Itemized Deduction)

If you choose itemized deductions, here’s what you need to do next.

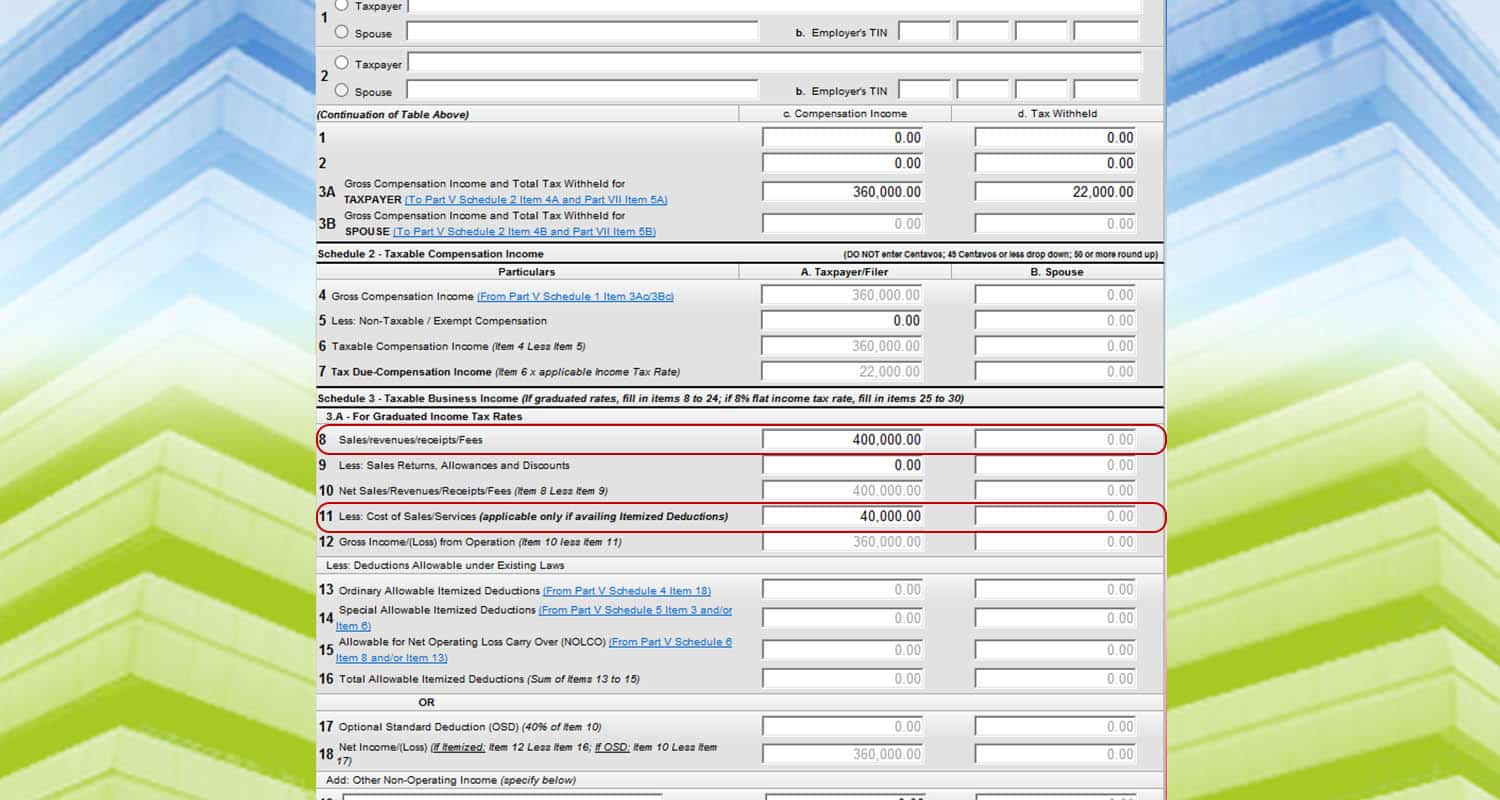

Let’s say your yearly income from your side hustle is 400,000 PHP, and your total expenses are 40,000 PHP. Go to “Schedule 3 – Taxable Business Income.” And then, input 400,000 PHP on line item 8. And then include the expenses on line item 11.

Let’s say your yearly income from your side hustle is 400,000 PHP, and your total expenses are 40,000 PHP. Go to “Schedule 3 – Taxable Business Income.” And then, input 400,000 PHP on line item 8. And then include the expenses on line item 11.

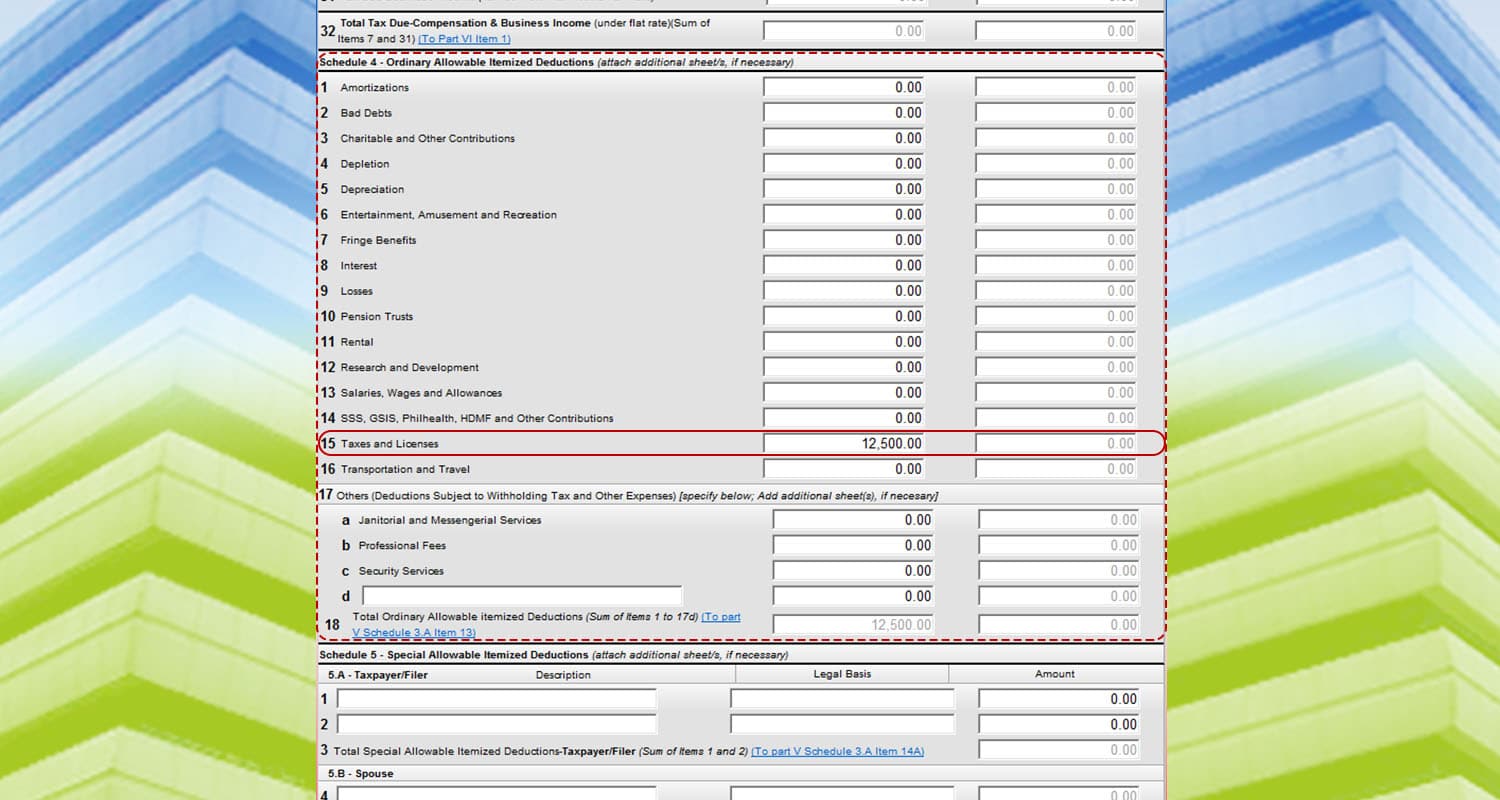

For this example, let’s say you paid for the BIR registration and the percentage taxes amounting to 12,500 PHP. Go to “Schedule 4 – Ordinary Allowable Deductions.” And then input your additional expenses on the categories.

For this example, let’s say you paid for the BIR registration and the percentage taxes amounting to 12,500 PHP. Go to “Schedule 4 – Ordinary Allowable Deductions.” And then input your additional expenses on the categories.

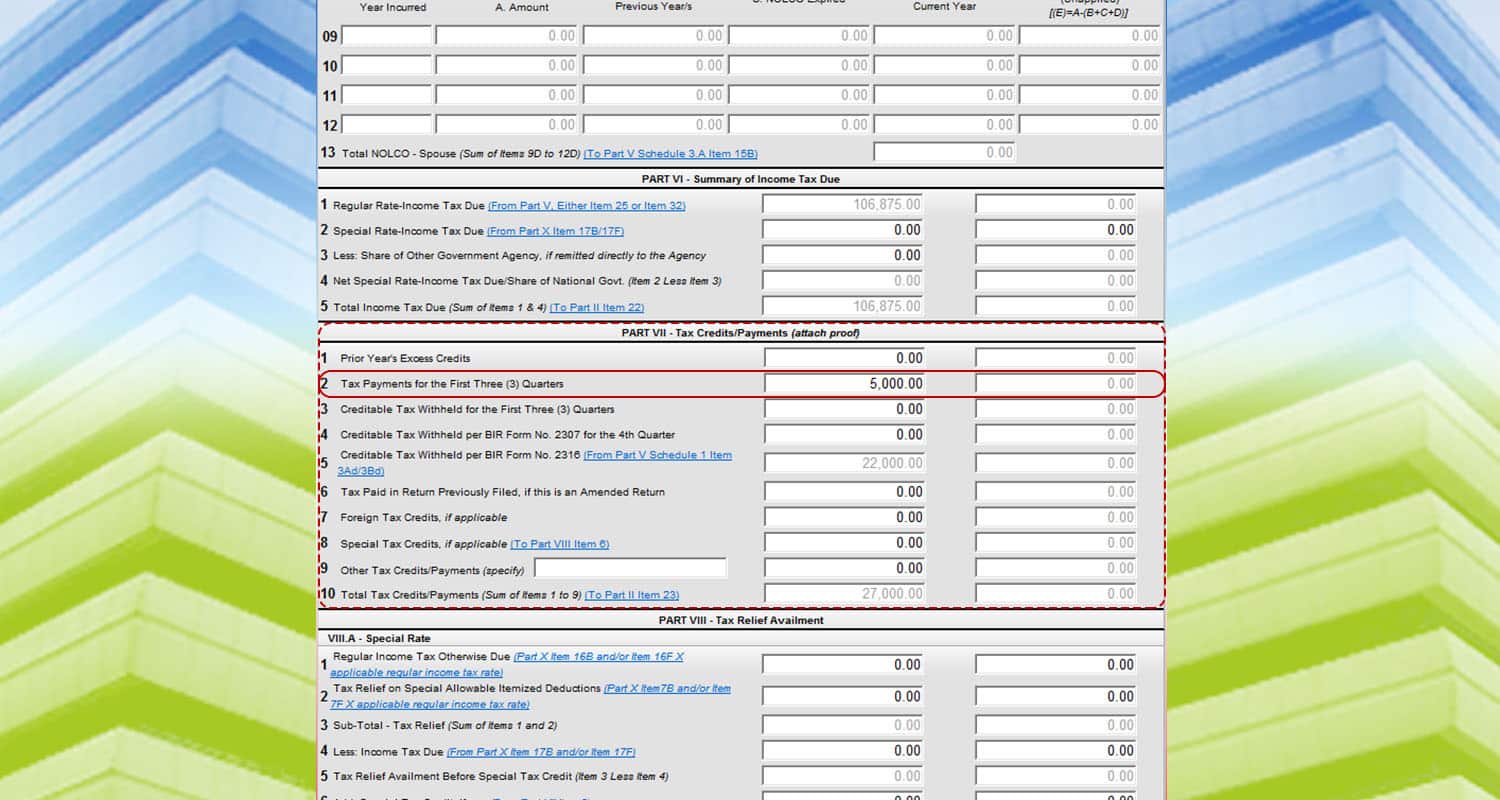

Go to “Part VII – Tax Credits/Payments.” And then, input your tax payments from the previous quarters. In this example, let’s say it’s at around 5,000 PHP.

Go to “Part VII – Tax Credits/Payments.” And then, input your tax payments from the previous quarters. In this example, let’s say it’s at around 5,000 PHP.

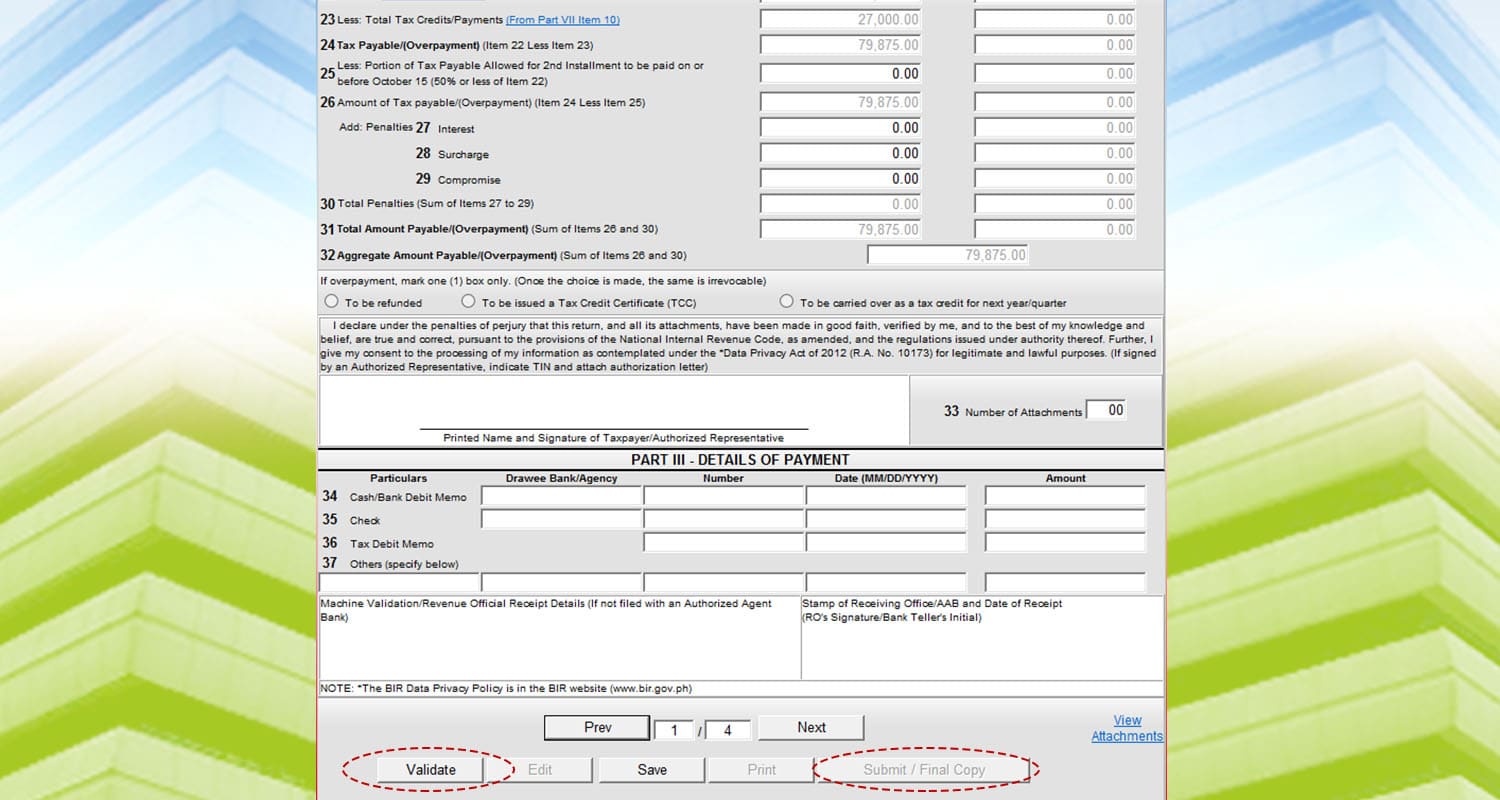

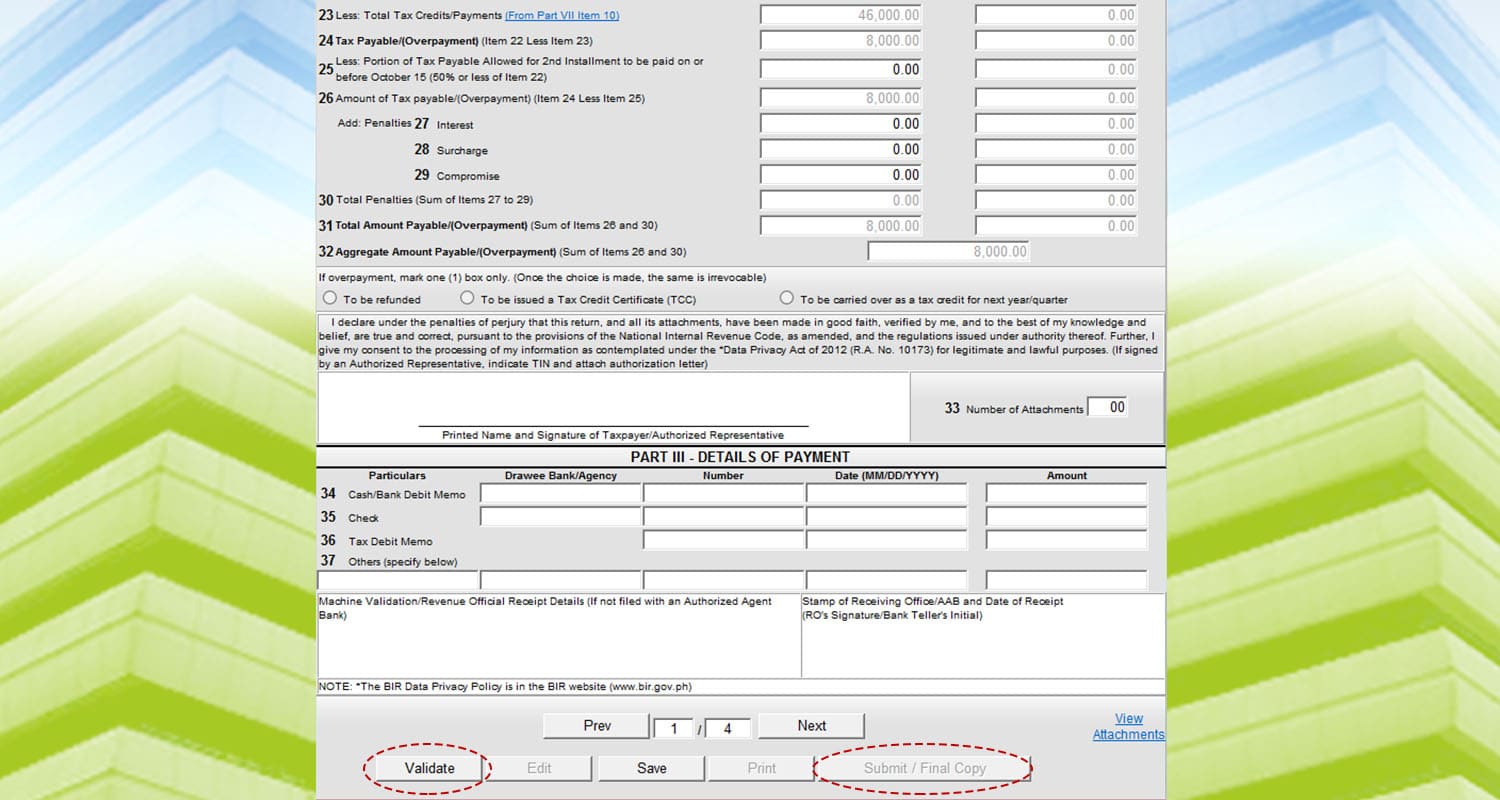

Go back to the first page, and you will see the computation of your tax due for that year. Afterwards, click “Validate” and then “Submit / Final Copy.”

An email will be sent to you for the filing. This will serve as a confirmation and can be used as proof when you submit this file to government requirements.

An email will be sent to you for the filing. This will serve as a confirmation and can be used as proof when you submit this file to government requirements.

Annual Income Tax – Graduated IT Rates (Optional Standard Deduction)

If you choose the optional standard deduction, it’s relatively easier compared to the previous option. Here’s how to file.

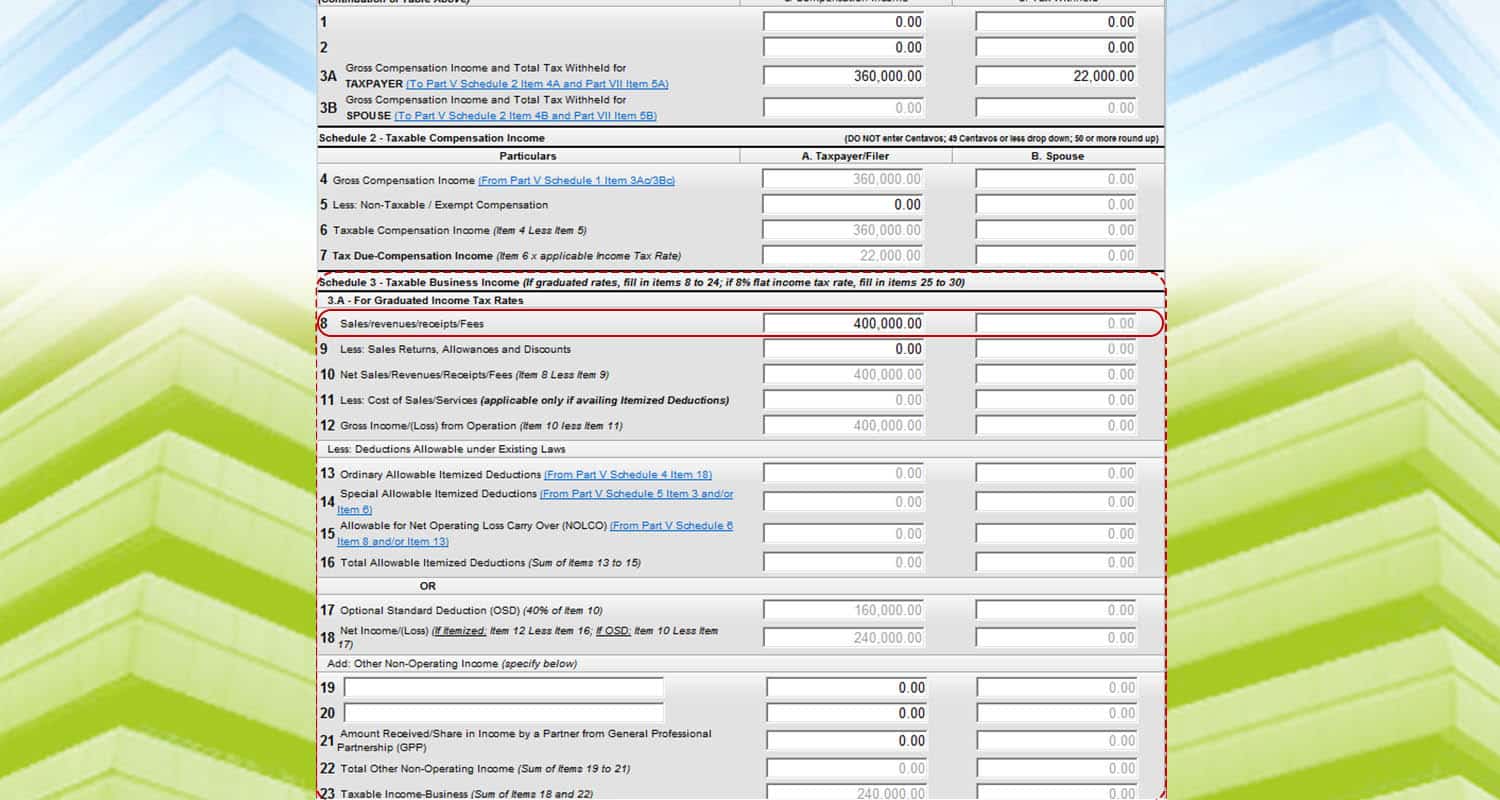

Let’s say that you have a 400,000 PHP annual income from your side hustle. Just input the amount on Schedule 3, line item 8. Compared to the itemized deduction, you just need to input the sales. And it’s assumed that your expenses will be 40% of your sales regardless of your actual expense.

Let’s say that you have a 400,000 PHP annual income from your side hustle. Just input the amount on Schedule 3, line item 8. Compared to the itemized deduction, you just need to input the sales. And it’s assumed that your expenses will be 40% of your sales regardless of your actual expense.

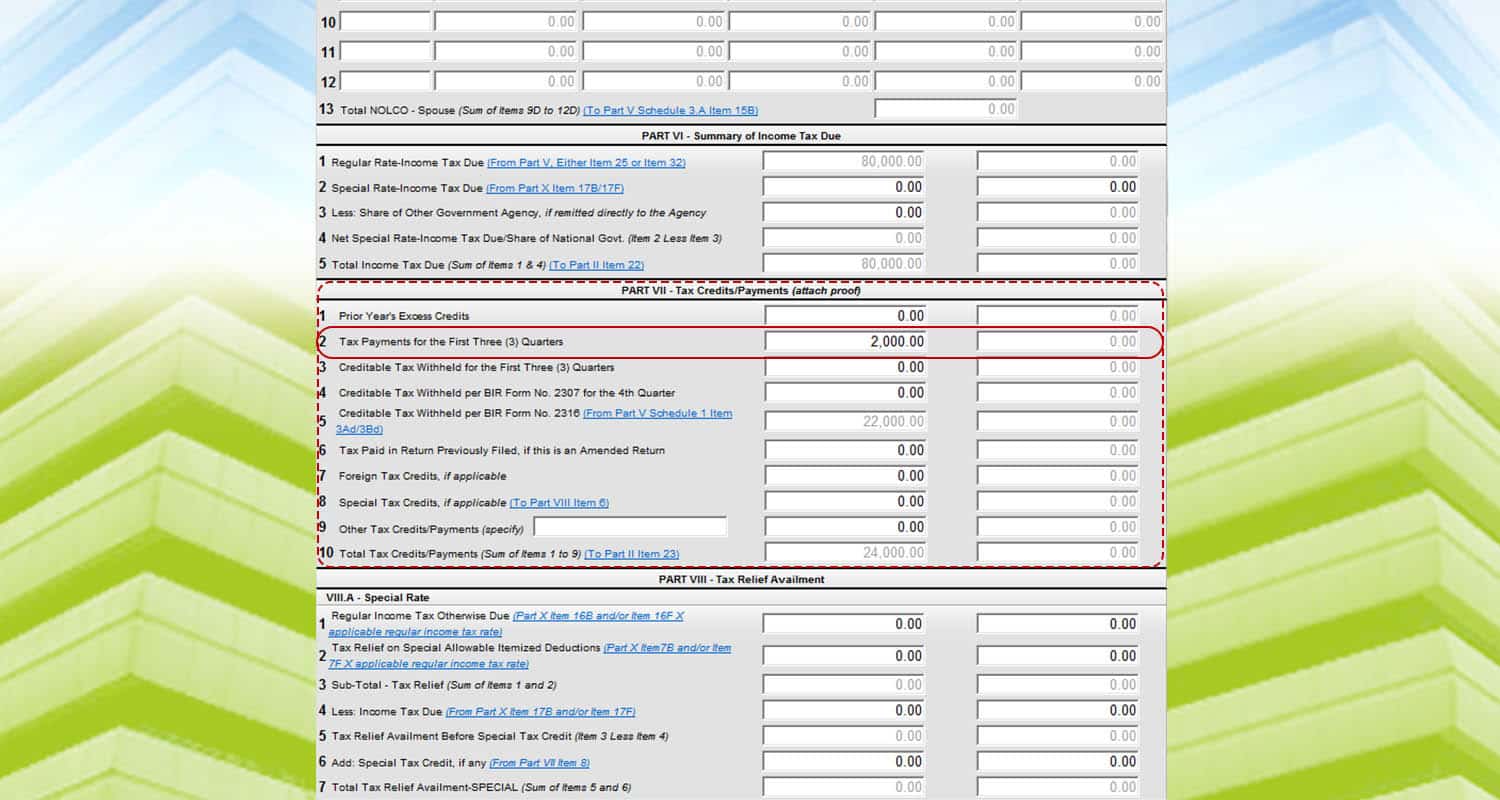

Next, if you have paid any quarterly income taxes from the previous periods, go to “Part VII – Tax Credits/Payments” and input it on line item 2. In this example, 2,000 PHP was inputted on the fields.

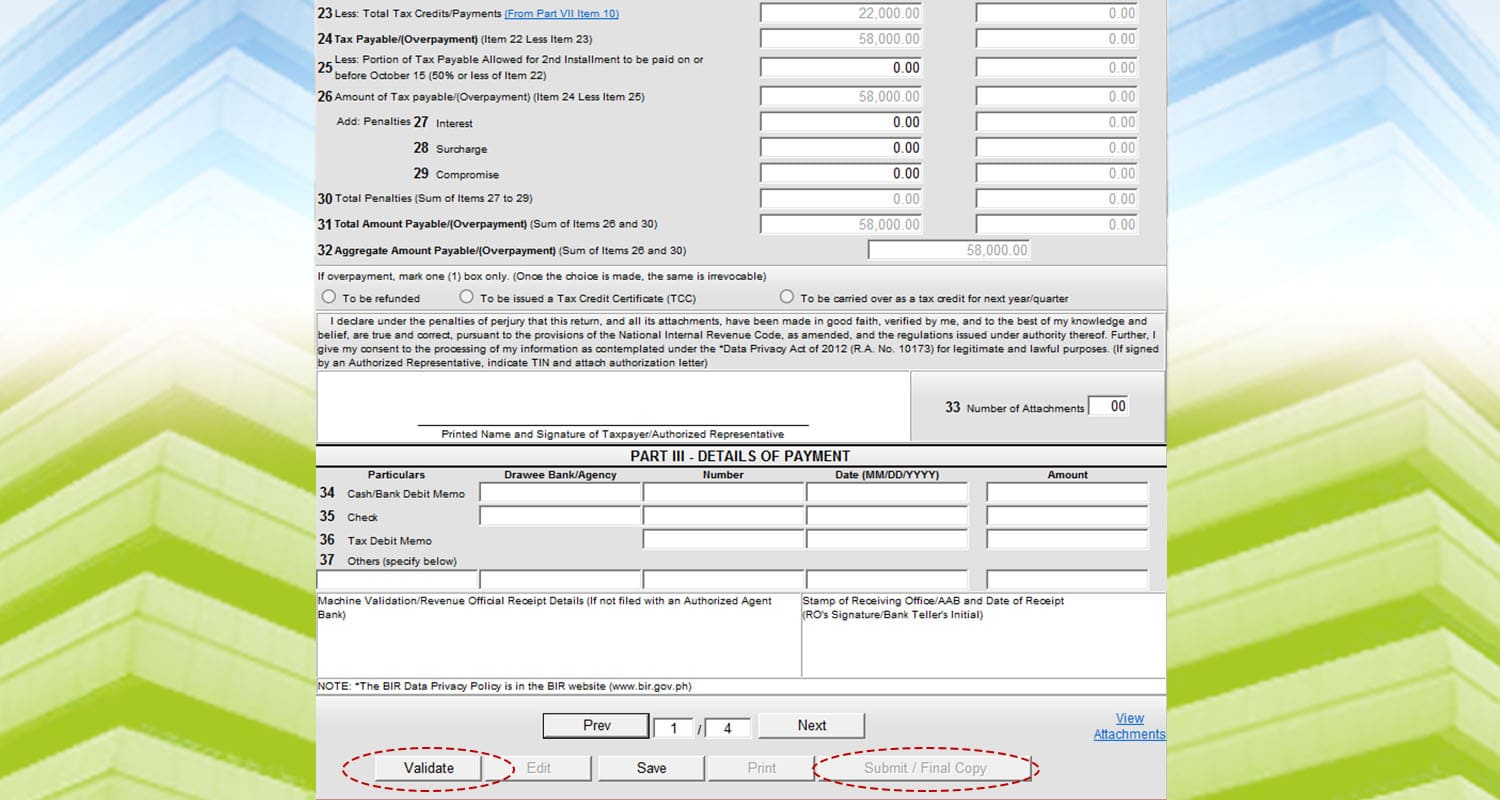

Lastly, go to the first page to see the summary of your tax due. And then, click “Validate” and “ Submit/Final Copy” to file your taxes.

Lastly, go to the first page to see the summary of your tax due. And then, click “Validate” and “ Submit/Final Copy” to file your taxes.

An email will be sent to you for the filing. This will serve as a confirmation and can be used as proof when you submit this file to government requirements.

An email will be sent to you for the filing. This will serve as a confirmation and can be used as proof when you submit this file to government requirements.

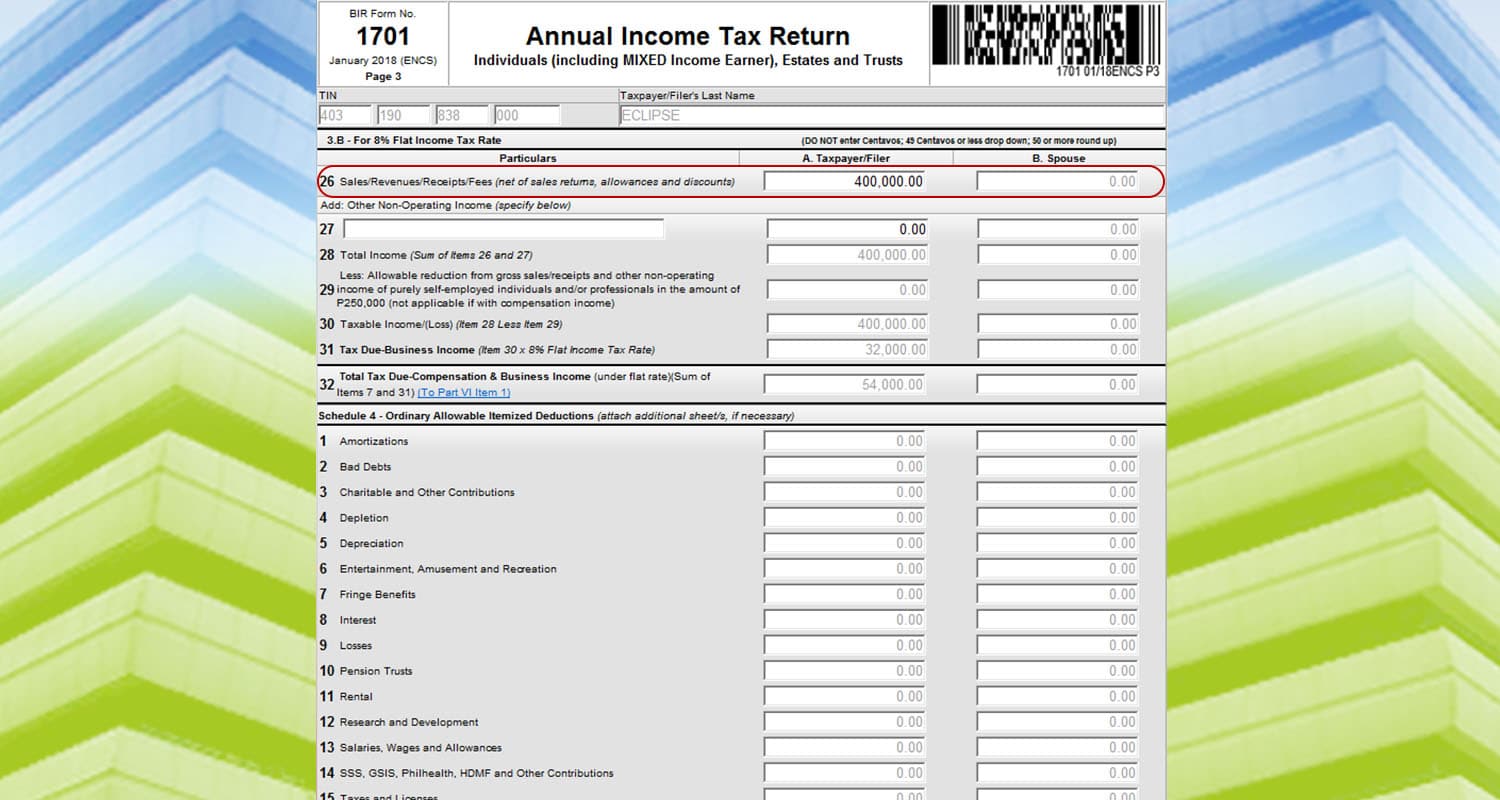

Annual Income Tax – 8% Rate

Out of all the options, the 8% tax rate might be the easiest and less costly. And here’s how to do it.

Let’s say that your income for the year is at 400,000 PHP. Go to page 3, and then look for line item 26. Input the amount and the program will automatically compute the tax due.

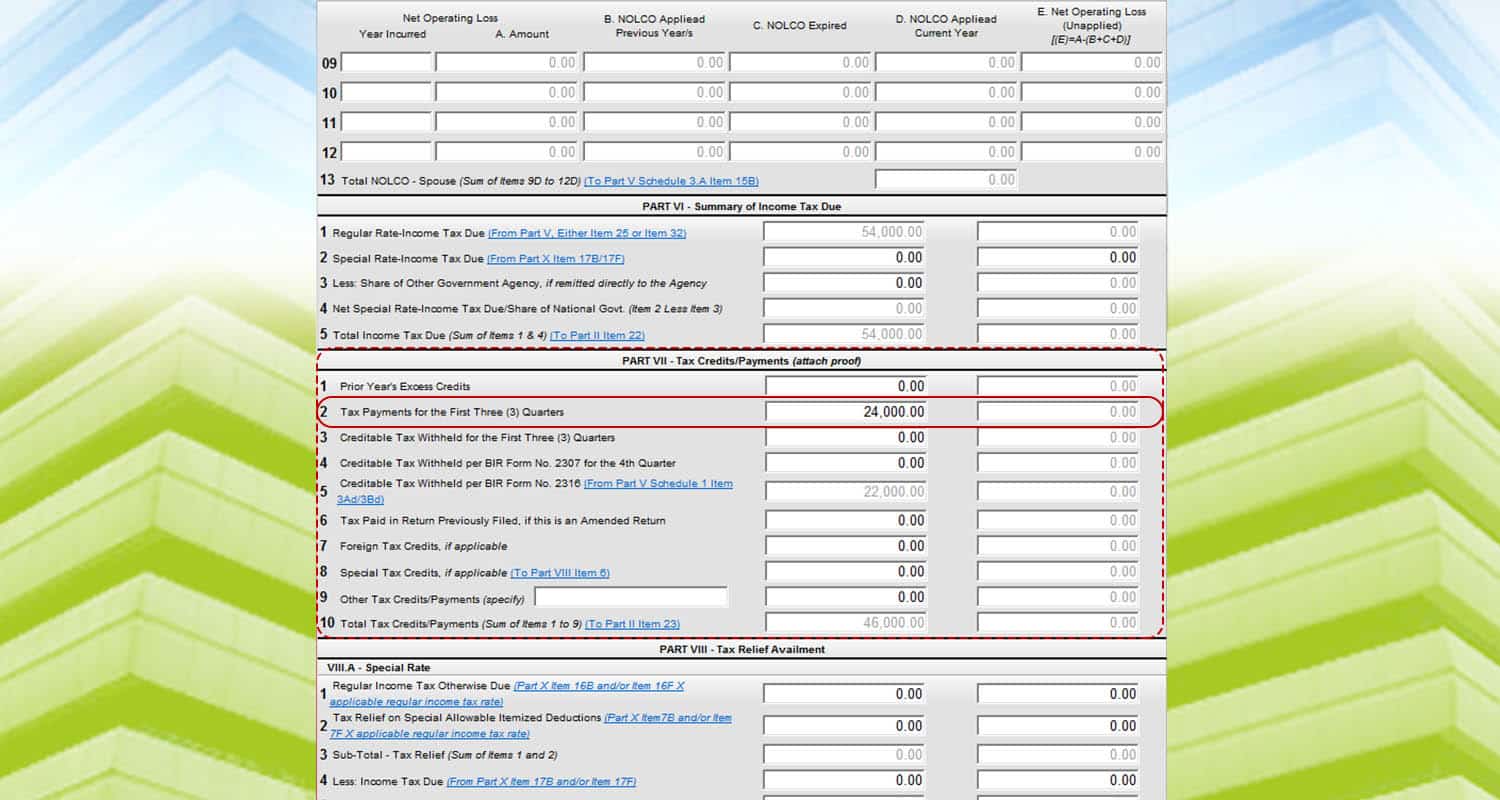

Afterwards, go to page 4. And then, look for “Part VII – Rax Credits/Payments.” For example, you have paid 24,000 PHP worth of taxes for the past quarters. Input the amount on line item 2.

Afterwards, go to page 4. And then, look for “Part VII – Rax Credits/Payments.” For example, you have paid 24,000 PHP worth of taxes for the past quarters. Input the amount on line item 2.

And then, go back to page 1 to see the total taxes due. Click “Validate” and then “Submit/Final Copy.”

And then, go back to page 1 to see the total taxes due. Click “Validate” and then “Submit/Final Copy.”

Afterwards, you will get an email confirmation for the filing. You can use this as proof of filing for government requirements.

Afterwards, you will get an email confirmation for the filing. You can use this as proof of filing for government requirements.

Conclusion

There you have it! Enjoy your multiple sources of income while paying for your tax obligations. Cheers!