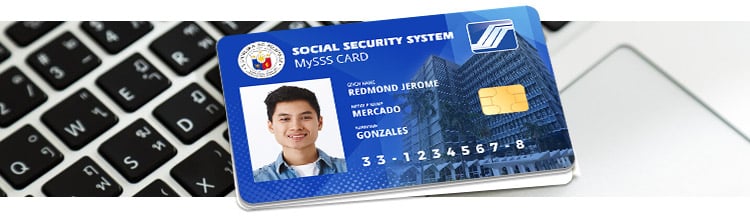

Filipinos can now enjoy a more convenient way to access their SSS benefits with the new MySSS Card, an upgraded ID that doubles as a debit card.

It promises faster transactions, easier withdrawals, and secure fund management, especially for pensioners and members claiming benefits.

However, while the MySSS Card offers plenty of perks, it’s important to understand its limitations before you sign up.

What Is the MySSS Card?

The MySSS Card is the Social Security System’s upgraded ID. It’s an EMV-equipped, dual-function card that combines identification and banking features.

It serves as a UMID card replacement, allowing members to receive SSS benefits, loans, and other proceeds directly through a linked savings account.

As of now, the SSS card is being issued exclusively through SSS partner banks, with RCBC (via its DiskarTech digital arm) as the first implementer.

Key Features and Benefits of the MySSS Card

The MySSS Card is more than just an ID. It’s the key to faster, safer, and more convenient SSS transactions.

Here are its main features and benefits every member should know:

Dual Functionality

The MySSS Card is a dual-function SSS card, serving both as a debit and official SSS ID card.

Members can easily access their SSS benefits, pensions, and loans, and withdraw cash through any RCBC or BancNet-affiliated ATM nationwide.

Secure EMV Chip Technology

Equipped with an EMV chip card, it ensures stronger protection against skimming and fraudulent transactions.

This makes it a safer option for members compared to traditional magnetic stripe cards.

Easy Access to SSS Loans and Benefits

No more long queues or delayed processing.

Funds from SSS loans, pensions, and benefit claims are directly credited to the cardholder’s linked RCBC DiskarTech card, providing faster and more convenient access.

Convenient Use as a Debit Card

The MySSS Card isn’t limited to withdrawals.

As an SSS debit card, members can shop online, pay bills, and make in-store purchases anywhere debit cards are accepted.

This gives users more flexibility and control over their funds while enjoying the convenience of direct access to their SSS benefits.

How to Apply for a MySSS Card

Getting your MySSS Card is pretty straightforward—once the rollout is active, eligible SSS members can apply online through the My.SSS portal.

Here is a step-by-step walkthrough to guide you through your MySSS card application:

Step-by-Step Guide to Get the SSS card

Log in to your My.SSS account

Access the My.SSS portal or use the MySSS mobile app. If you don’t have an account, you’ll need MySSS registration first.

Update your contact and bank details

Go to your profile or “Member Info” section.

Make sure your mobile number, email, mailing address, and bank account are current. This is crucial for receiving your MySSS Card and for direct crediting of benefits.

Choose an accredited partner bank

Select from SSS-accredited partner banks.

As of now, RCBC (via its DiskarTech digital arm) is the first implementer. Other banks may be added in the future.

Submit your application

Follow the on-screen prompts to apply. You’ll need to consent to SSS verifying your identity with the National ID eVerify system and using your National ID photo.

Claim and activate the card

Once issued, you’ll be notified by SSS and/or your selected partner bank. Follow the instructions to claim and activate your MySSS Card.

The Catch — What You Need to Know Before Using It

While the MySSS Card offers plenty of convenient features, it also has certain limitations you should know about before using it:

Transaction and Withdrawal Limits

At present, the MySSS Card is linked to RCBC DiskarTech, which functions as a basic deposit account.

This means there’s a Php 50,000 maximum balance limit, and daily withdrawal or transaction limits may also apply.

You can only withdraw or spend up to a certain amount each day, depending on bank rules.

Possible Bank Fees or Maintenance Charges

The SSS card does not charge members for the card itself, but RCBC DiskarTech may apply small fees for ATM withdrawals, balance inquiries, or account maintenance.

Always check your bank’s terms to avoid unexpected deductions.

Security and Privacy Concerns

The MySSS Card has an EMV chip for added protection, but users should still be careful.

Avoid sharing your card details, use only trusted ATMs, and monitor your transactions to prevent unauthorized use.

Partner Bank Availability and Access Issues

For now, RCBC DiskarTech is the only partner bank offering the MySSS Card.

Not all banks support SSS card integration yet, so members should check for updates on additional partner banks before applying.

However, future banks expected to join include Asia United Bank (AUB), China Bank, and UnionBank savings account.

Common Questions About the MySSS Debit Card

Here are the most frequently asked questions about the MySSS Card to help members understand its features, limits, and usage:

Can I use the MySSS Card as a regular ATM card?

Yes. The MySSS Card functions as a dual-purpose SSS debit card, allowing you to withdraw cash from ATMs and perform other banking transactions, just like a regular SSS official ID with debit card access.

It’s like an upgraded SSS UMID Pay Card.

Keep in mind that daily and monthly withdrawal limits may apply, especially under RCBC DiskarTech, which currently manages the card.

Is there a fee when withdrawing cash?

While the digital banking in SSS does not charge for issuing the MySSS Card, your partner bank may apply fees for ATM withdrawals, balance inquiries, or account maintenance.

It’s a good idea to review your bank’s fee schedule to avoid unexpected deductions.

What happens if I lose my card?

If your MySSS Card is lost or stolen, report it immediately to your partner bank (currently RCBC DiskarTech) and to SSS.

You can request a replacement card, but some banks may charge a small fee.

Prompt reporting helps prevent unauthorized access to your funds.

Can I link it to GCash or other e-wallets?

Currently, linking the MySSS debit card to e-wallets like GCash may be possible depending on the partner bank’s policies.

As of now, RCBC DiskarTech supports certain digital transactions, but full e-wallet integration may vary.

Always check with your bank before attempting to link the card.

Who is eligible to apply for the new card?

Eligible applicants include active SSS members and pensioners who are Filipino citizens aged 18 or older.

You must also have a registered My.SSS account and comply with partner bank requirements, such as RCBC DiskarTech account registration and identity verification.

Other SSS News and Initiatives

Keep up to date with important SSS programs, policies, and announcements that could impact your SSS member benefits, pensions, loans, and overall membership.

SSS net income to exceed ₱100B in 2025

The SSS expects its net income to surpass ₱100 billion in 2025, highlighting the fund’s financial stability and its ability to sustain benefits for members.

SSS to roll out 3-year pension hike

A 3-year pension increase is planned to improve retirement benefits, ensuring that pensioners receive higher monthly payouts starting in 2025.

SSS to revise rules on calamity loans

The SSS will update its calamity loan policies, providing faster and more flexible financial support to members affected by natural disasters or emergencies.

Making the Most of Your MySSS Card

The MySSS Card gives Filipino members a convenient, secure, and flexible way to access SSS benefits.

As a dual-function SSS card, it combines official identification with debit card capabilities, allowing faster withdrawals, QRPH payments, online purchases, and direct crediting of loans and pensions.

It’s important to stay aware of the catch. Features like daily withdrawal limits, possible bank fees, and partner bank availability (currently only RCBC DiskarTech) may affect usage as well.

The Php 50,000 maximum balance limit applies specifically to DiskarTech accounts, and future partner banks may have different limits or policies.

Understanding these details helps avoid unexpected fees or complications.

For members looking to maximize their income and financial flexibility, Remote Staff offers legit online jobs that can be done from home while managing your SSS benefits conveniently.

Sign up with Remote Staff today!