Understanding Your Financial Starting Point

Moving out for the first time is a big life change. It can feel exciting—you finally get your own space and more freedom.

However, it can also be a little scary, especially when you think about all the costs involved.

Rent, bills, groceries, and other daily expenses quickly add up. That’s why it’s important to evaluate your finances before you move.

Do you have a steady income? How much do you spend each month? Are you saving up enough for an emergency fund?

Here are some key areas to help you determine where your finances are more accurately – so you can identify what you need to work on before your big move.

Income Evaluation

Start by looking at how much money you make each month. Do you have a stable job or regular source of income?

Knowing exactly what comes in each month helps you figure out what you can afford so you can plan how much to save to move out.

Make a list of all your income sources—your salary, freelance work, side gigs, or allowances. Add them up to get your total monthly income.

Then, make sure your income can cover rent, bills, and food expenses, while still leaving room for savings.

If your income fluctuates, calculate your average earnings from the last 3–6 months to get a more realistic view.

Steady, reliable income is key to living comfortably on your own.

Expense Analysis

Next, take a close look at where your money goes each month.

List all your regular expenses—like food, transportation, phone bills, subscriptions, and any money you give to family or save.

Don’t forget the small stuff. Coffee runs, takeout, and online shopping can really add up.

Knowing the average cost of these expenses helps you see how much you spend each month.

Once you’ve calculated your total monthly spending, compare it to your income.

Are you spending more than you earn? If so, you may need to cut back and reassess your budget before moving out.

Debt Assessment

If you have any debts—like credit card balances, student loans, or personal loans—it’s important to factor them in.

These monthly payments are a fixed part of your budget and can affect how much you can afford to spend on rent and other living costs.

List all your debts and monthly payments, then add them up for the full total.

If your debt payments take up a big part of your income, it might be a good idea to pay them off first before you move out.

Savings Evaluation

Savings are your safety net when moving out. You’ll need money not just for rent and bills, but also for the upfront costs like a security deposit, furniture, and moving fees.

A good emergency fund includes at least 3 to 6 months’ worth of living expenses saved before you move out.

This should be part of your saving goals before leaving home so that you have a buffer in case of emergencies, like losing your job or unexpected costs.

If you don’t have that much yet, start small and save consistently. Even a few thousand pesos can make a big difference.

Following a clear savings plan will also help you reach your goals more easily.

Credit Score Check

In the Philippines, most landlords don’t usually check your credit score when you rent a place. Instead, they often ask for proof of income (e.g., a payslip), a certificate of employment, or personal references.

However, if you’re planning to buy a property or enter a rent-to-own agreement, your credit history becomes more important.

Banks and financing companies will look at your credit standing to decide if they’ll approve your loan. (Pro-tip: You can check your credit scores on apps like Lista.)

Even if credit scores aren’t usually a prerequisite for leasing properties, paying bills on time and managing debt increases your chances of getting loans or other financial services approved later.

Estimating Initial Moving Out Costs

Before you move out, it’s important to plan for the upfront costs—not just your monthly rent. These include essential expenses like your rent deposit and moving costs.

Here are some of the most common initial moving out expenses:

Rent and Security Deposits

Before you can move in, most landlords will ask for an advance (usually 1–2 months of your monthly rent) and a security deposit (often 1 month’s worth). This means you’ll need to pay at least 2–3 months’ worth of rent upfront.

The advance rent usually covers your first few months, while the security deposit is withheld as a surety against damage or unpaid bills.

You usually get it back when you move out, as long as the place is in good condition and any required repairs (deducted from the deposit) are carried out.

Transportation and Moving Fees

Transferring your things can come with extra costs, so it’s important to create a moving expenses estimate before the big day.

You might need to hire a moving truck, rent a van, or pay for fuel if you’re using your own vehicle.

If friends or family are helping, consider setting aside a small budget for food or a thank-you gift.

Setting Up Your New Home (Furniture, Internet, etc.)

Once you move in, you’ll need to buy the basics—like a bed, table, kitchen items, and cleaning supplies. If your place is unfurnished, this can consume a big part of your budget.

You can also check these essential appliances for your first solo living space.

Also, don’t forget setup costs like installing internet, buying appliances, or availing a water delivery service if needed.

Start with essentials first, then slowly add more items as your budget allows.

State or City-Specific Cost Differences (mention Metro Manila vs. provinces)

Where you choose to live can greatly affect your living expenses.

For example, Metro Manila tends to have higher rent, food, and transportation costs compared to provincial areas, where everyday living is often more affordable.

If you have full-time or part time jobs online, you have more flexibility.

You can live in a lower-cost area while still earning the same income, which can help you save more.

Just make sure your location has a stable internet connection and a good work environment.

For instance, in Metro Manila, there’s the convenience that comes with fast internet, nearby service centers, and a variety of comfortable work spaces—like trendy cafes, restaurants, and other coworking spaces.

In the province, you benefit from fresh air, peaceful surroundings, and a space that’s free of distractions to help you concentrate, plus lower costs of living that make it easier to save up.

Some even travel to nearby towns or nature spots for a change of scenery and to stay inspired while working remotely.

It all depends on your preferences and lifestyle.

Monthly Living Expenses You Should Prepare For

Once you’ve covered the upfront costs, it’s time to think about your monthly living expenses.

Budgeting for your first apartment means planning for monthly bills to keep your lifestyle affordable and manageable.

These are the typical expenses you’ll need to pay off every month:

Rent or Mortgage

Rent or mortgage payments will likely take up the biggest part of your monthly budget, and ideally, they should be no more than 30% of your monthly income to keep your finances manageable.

Utilities (Electricity, Water, WiFi)

Utilities like electricity, water, and WiFi are essential monthly costs that can vary depending on your usage and location.

Generally, you should set aside around 5% to 10% of your monthly income for these.

Food and Groceries

Food and groceries can take up around 10-15% of your monthly income, but you can manage costs with these money-saving tips:

- Plan your meals for the week to avoid impulse buys.

- Buy in bulk for staples like rice, canned goods, and toiletries.

- Cook at home more often instead of ordering takeout.

- Shop during sales or promos at supermarkets, online stores, and local markets.

- Use a grocery list and stick to it to avoid unnecessary purchases.

- Buy seasonal produce, which is often cheaper and fresher.

- Avoid shopping when hungry—it can lead to overspending.

Transportation Costs

Getting around also takes up a significant position of your living expenses. Whether you commute daily or only occasionally, transportation can account for around 5-10% of your income.

Here’s how to keep it manageable:

- Use public transportation when possible—it’s cheaper than owning a car or hailing rides regularly.

- Consider walking or biking for short trips to save on fares and fuel.

- Look for ride-sharing options to split costs with others.

- If working remotely, limit travel to occasional trips or errands to reduce expenses (and your carbon footprint)!

Healthcare and Insurance

Healthcare and insurance are essential monthly costs that cover medical needs and emergencies, so try to set aside around 5-10% of your income for them.

This money can go toward insurance premiums, doctor visits, or medicines, so you’re prepared in the event of a medical emergency.

Personal & Lifestyle Expenses

Personal and lifestyle expenses include things like clothes, hobbies, entertainment, and dining out.

These costs can vary a lot depending on your habits, but it’s helpful to budget around 10-15% of your monthly income.

Keeping track of these expenses helps you enjoy your lifestyle while staying within your budget.

Savings and Debt Repayment Plans

Setting aside money for savings and paying off any debts is essential for financial stability. Aim to allocate at least 10-20% of your monthly income for these goals.

This helps you build an emergency fund, prepare for future expenses, and reduce debt, making it easier to manage your finances over time.

Miscellaneous & Unexpected Costs

It’s important to set aside about 5-10% of your monthly income for unexpected expenses like small repairs, gifts, or emergencies.

If you don’t end up using this money, just sock it away in your savings to grow your emergency fund or reach future goals faster.

Summary of Ideal Budget Breakdown:

Up to 30% Rent or Mortgage

10% to 15% Food and Groceries

5% to 10% Utilities (Electricity, Water, WiFi)

5% to 10% Transportation

5% to 10% Healthcare and Insurance

10% to 15% Personal & Lifestyle Expenses

10% to 20% Savings and Debt Repayment

5% to 10% Miscellaneous & Unexpected

For starters, try to stay within your monthly income by following the suggested percentages above—this helps you build good habits and keeps your budget on track from the beginning.

Prioritize building savings and setting aside money for unexpected expenses to avoid financial stress down the road.

However, if your expenses start to creep above your income, don’t panic — simply look for ways to cut back or boost your earnings so you can stay on track with your budget.

Setting Your Savings Goal

Before moving out, it’s important to decide how much money you need to save.

This step is a key part of financial planning for independence to avoid unnecessary stress later on.

Here’s how you can start planning and tracking your savings effectively, so you feel more prepared and confident about living on your own.

How Much to Save Before Moving Out? (Rule of thumb: 3–6 months of expenses)

A good rule of thumb is to save at least 3 to 6 months’ worth of your living expenses before moving out.

This emergency fund acts as a financial cushion in case of unexpected events like job loss, medical bills, or urgent repairs.

On top of that, don’t forget to account for your initial moving costs—such as advance rental payments, security deposits, and basic household essentials.

Example:

If your estimated monthly living expenses (including rent, utilities, food, transportation, insurance, and debt payments) total Php 25,000, you should aim to save at least:

- Php 75,000 to Php150,000 for your emergency fund (3 to 6 months of expenses)

- Php 30,000 to Php 50,000 for initial moving costs (e.g., advance rent, deposit, furniture, and basic appliances)

Total suggested savings before moving out: Php 105,000 to Php 200,000

This gives you a sufficient buffer to cover both one-time and recurring expenses while you settle into your new place.

Monthly Savings Milestones (e.g., Php 10,000/month strategy)

To make your savings goal less daunting, break it down into smaller monthly targets.

For example, if you aim to save Php 120,000 before moving out and you have 12 months to achieve this, you would need to set aside about Php 10,000 per month:

- Set a clear monthly target: Decide how much you can realistically save each month based on your income and expenses.

- Automate your savings: Consider setting up automatic transfers to a separate savings account right after you receive your income.

- Track your progress: Use budgeting apps or a simple spreadsheet to monitor your savings and stay motivated.

- Adjust as needed: If unexpected expenses come up, adjust your monthly target but try to stay consistent overall.

By consistently setting aside a fixed amount each month, you’ll gradually build the funds you need in a more sustainable way with far less pressure.

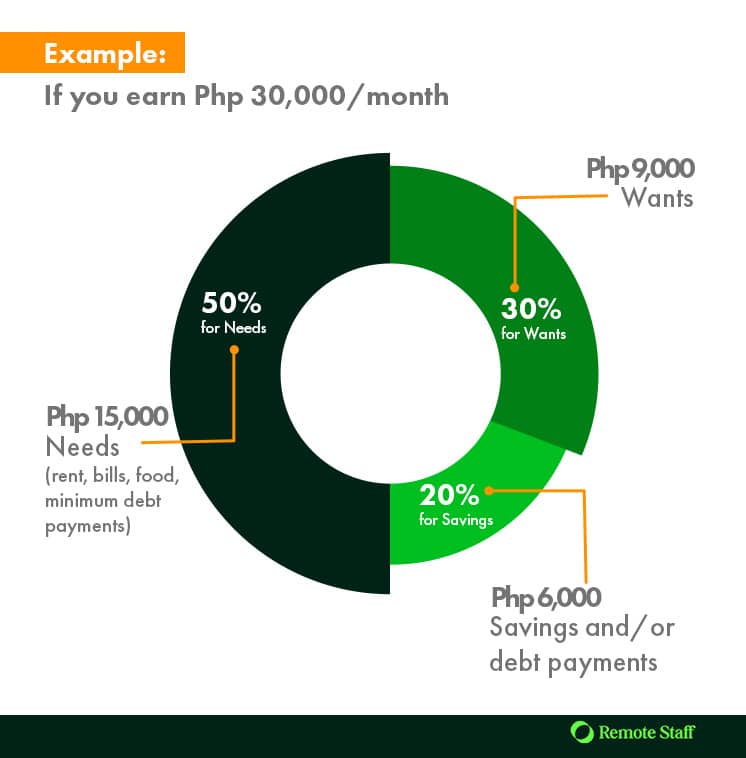

The 50/30/20 Budgeting Rule

To help you reach your savings goal, the 50/30/20 rule is a simple and effective method often recommended for money management for young adults.

It helps you stay in control of your spending while helping you build financial independence.

- 50% for Needs – This covers your essentials like rent, utilities, groceries, transportation, and minimum debt payments (such as credit card minimum dues or monthly loan installments).

These are the non-negotiable expenses you must pay each month.

- 30% for Wants – This includes lifestyle choices like dining out, subscriptions, shopping, hobbies, or travel—things you enjoy but can live without if needed.

- 20% for Savings and Extra Debt Payments – Use this for building your emergency fund, saving up for initial moving costs, and paying off your debt faster.

If you’ve already built your emergency fund and still have significant debt, you can use this portion of your income to aggressively pay off the same and reduce interest costs.

Example:

If you earn Php 30,000/month:

- Php 15,000 – Needs (rent, bills, food, minimum debt payments)

- Php 9,000 – Wants

- Php 6,000 – Savings and/or debt payments

You can adjust these percentages accordingly—for example, temporarily reducing your “wants” to boost savings if you plan to move out sooner or need to build a larger emergency fund.

This method keeps your spending balanced while helping you stay on track with both short-term needs and long-term financial goals.

Tools & Apps to Help You Budget

Managing your money becomes much easier when you use budgeting tools or apps to track your income, expenses, and savings goals.

Here are some popular tools to help you stay on top of your finances:

- Moneygment – Great for freelancers or self-employed individuals. It lets you track expenses, pay bills, and even remit contributions to SSS, Pag-IBIG, and PhilHealth.

- GCash – While primarily a mobile wallet, GCash also helps you track your spending, save money with GSave, and invest through GInvest.

- Maya – A digital wallet that offers high-interest savings, detailed spending insights, and even separate “Save Goals” accounts so you can budget for specific needs like rent, travel, or your emergency fund.

- Lista – A local money management app ideal for individuals and small business owners. It helps you monitor expenses and debt, and you can even request your credit score directly through the app.

Building Your Safety Net: Why You Need an Emergency Fund

An emergency fund is money saved for unexpected events like job loss or medical bills. It gives you peace of mind and helps you avoid debt during tough times.

How Much Should You Save?

The size of your emergency fund depends on the peso amount that gives you the most peace of mind.

For most Filipinos, a good starting point is around Php 30,000 to Php 100,000 based on their living expenses.

For example, if your monthly expenses are Php 15,000, saving at least Php 45,000 can cover three months of essentials like rent, food, and transportation.

This gives you enough time to recover from emergencies without added stress and is a practical goal for young adults building financial independence.

Strategies to Build It Quickly While Working Part-Time

You can build your emergency fund quicker with part-time work. Here’s how:

- Set a fixed monthly savings goal – Aim for a specific amount, like Php 2,000 – Php 5,000 per month, and treat it as a non-negotiable expense.

- Open a separate savings account – Keep your emergency fund separate from your ATM account. Make it harder to access so you don’t get tempted to touch it.

- Cut back on non-essentials – Reduce spending on things you don’t really need or can do without (like takeout or subscriptions) and redirect that money into your fund until you reach your target amount.

- Save bonuses and extra income – Any bonuses, tips, or freelance gigs can give your savings a quick boost.

- Track your progress – Use a simple spreadsheet or budgeting app to monitor how close you are to your goal.

The key is to start small and stay consistent. Every peso counts, and building your fund little by little is better than not starting at all.

You can also check these simple tips to build an emergency fund, even as a freelancer.

Earning Extra While Preparing to Move Out

Looking to boost your savings before moving out?

Earning extra on the side can help you reach your financial goals faster without relying solely on your main income.

Explore Part-Time Jobs Online

A feasible way to earn more is through part-time work online.

In the Philippines, you can explore platforms like Remote Staff to find freelance or virtual assistant roles that match your skills.

Popular Gigs:

- Virtual assistant (admin support, calendar management, email handling)

- Social media manager

- Online tutor or ESL teacher

- Transcriptionist or data entry specialist

- Website tester

- Freelance writer

- Graphic designer or video editor

Managing Time Between Work and Side Hustles

Balancing a day job with a side hustle is challenging, but not impossible.

Find some free time during the week for flexible gigs like microtasks or freelance jobs.

Set clear goals, follow a routine, and don’t take on more than you can handle to avoid burnout.

With good time management, you can grow your savings faster and feel more confident about moving out.

Real Talk: Things to Know Before Moving Out

Moving out for the first time means shouldering the cost of living on your own, so it’s smart to learn from others and avoid common mistakes.

Talk to Your Parents

Even if you’re ready to be independent, have an honest talk with your parents. They might offer advice, support, or point out things you haven’t considered.

Get Tips and Stories From Online Communities

Filipinos who’ve already made the move often share helpful financial tips for moving out, like:

- Don’t overspend on furniture – Stick to the basics first and add more later.

- Groceries cost more than expected – Especially if you’re not used to cooking or meal planning.

- Small things add up – Like cleaning supplies, lightbulbs, or kitchen tools.

You can also check the following online communities for further details:

Reddit Communities:

Facebook Communities:

Frequently Asked Questions (FAQ)

Got questions about moving out, budgeting, or living independently for the first time? Here are quick answers to some:

How much money should you save up before moving out in the Philippines?

A good target is to save at least Php 30,000 to Php 100,000, depending on your lifestyle.

This should cover initial moving costs (like deposit and advance rentals), basic furnishings, and at least 3 months’ worth of living expenses to give you a financial cushion while you adjust to independent living.

What is the average cost of living alone in the Philippines?

When setting up a new apartment, it’s key to know the cost of living on your own.

As of this writing, the average cost of living prices in the Philippines are around Php 22,000 to Php 67,000 or more per month, depending on your location and lifestyle.

You can also explore these cities outside Metro Manila that are great for remote work.

Here’s a simple breakdown of typical monthly expenses for one person:

Rent (1-Bedroom Apartment)

- City Center: Php 17,200 to Php 50,000

- Outside City Center: Around Php 9,900

Utilities (Electricity, Water, etc.)

- Around Php 6,100

Mobile and Internet

- About Php 1,700 each per month

Groceries

- Php 5,000– Php 6,000/month: Basic groceries (rice, eggs, vegetables, canned goods, occasional meat or fish)

- Php 7,000 – Php 10,000/month: With more variety (fresh meat/fish, fruits, snacks, occasional imported items, healthier options)

How can I save money while preparing to move out?

Here are practical ways to save money while preparing to move out:

- Create a Moving Budget – Plan all your expected expenses (and make allowances for unexpected ones) to avoid costly surprises.

- Cut Non-Essential Spending – Pause subscriptions and limit eating out to save more.

- Sell Unused Items – Declutter and earn extra cash before moving.

- Cook at Home – Preparing meals yourself is cheaper than ordering food.

- Use Public Transportation – Avoid taxis and ride-hailing apps unless absolutely necessary. Take buses, jeepneys, trains, carpool with friends or coworkers, bike, or walk whenever possible.

- Buy Secondhand – Look for used furniture and appliances to lower costs.

- Share a Place – Find a roommate to split rent and bills with if you can.

- Track Your Spending – Use budgeting apps or spreadsheets to monitor every peso spent. Awareness helps avoid unnecessary expenses.

Conclusion

Moving out for the first time is an exciting step toward independence, but it’s important to plan your finances carefully to pull it off smoothly.

First, identify your income, expenses, debts, and savings. Make sure you have steady income and a budget that covers rent, bills, food, and other costs and aim to save 3 to 6 months’ worth of expenses, plus extra for deposits and furniture.

Since moving can be expensive, finding ways to boost your income can make a big difference.

Consider remote work.

Platforms like Remote Staff connect you with real part-time or full-time jobs—such as virtual assistant roles or freelance gigs—that fit your schedule and help you save faster.

Register today!