Many Filipinos are now reconsidering when they should retire.

With more proposals to lower the early retirement age, the idea of leaving work earlier, even before the age of 60, is becoming more popular.

The Concept of Retirement Age in the Philippines Is Changing

Proposals for a new retirement age reflect how Filipinos are changing their view of retirement.

As of this writing, 60 is the earliest age Filipinos can officially retire under the law, with 65 being the age for mandatory retirement.

However, some lawmakers want to lower the optional retirement age to 56 to give public sector workers more time after years of service, should they choose to.

This idea is gaining support, especially from government employees who routinely endure heavy workloads and long hours for years.

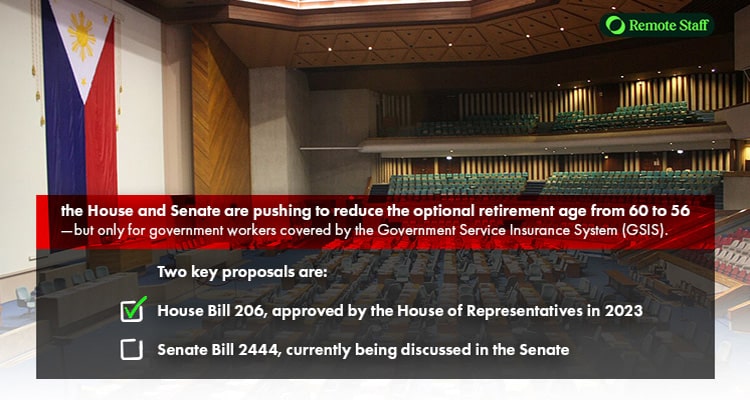

Senate and House Bills Lowering the Optional Retirement Age to 56

Lawmakers in both the House and Senate are pushing to reduce the optional retirement age from 60 to 56—but only for government workers covered by the Government Service Insurance System (GSIS).

The goal is to help public servants retire with dignity and relatively good health after many years of service, especially those in stressful or physically demanding roles.

Two key proposals are:

- House Bill 206, approved by the House of Representatives in 2023

- Senate Bill 2444, currently being discussed in the Senate

However, we should note that these proposals are still pending. Until they are passed and signed into law, the retirement age remains at 60 (optional) and 65 (mandatory) for public sector workers.

Why It’s Gaining Support Across Sectors

Workers in both the public and private sectors are facing long hours, heavy workloads, and rapidly changing job demands.

Whether in classrooms, hospitals, offices, factories, or construction sites, many employees report feeling exhausted and burned out after years of service.

Supporters of the early retirement bill in the Philippines believe that:

- Early retirement can help protect workers’ physical and mental well-being

- Long-serving employees deserve more time to rest and enjoy life after work

- Many jobs today are more demanding than they were in the past

While the current proposals apply only to government employees, private sector workers, especially those in physically demanding jobs, are also expressing interest in similar options.

For many, early retirement feels like a practical and fair choice.

What the Proposed Retirement Bill Means for Workers

If you’re a government employee thinking about retiring early, this proposed change could directly affect your options.

The bill doesn’t just lower the earliest possible retirement age under law—it may also impact how government retirement benefits are claimed, how early pension access is granted, and who qualifies.

These retirement age policy changes aim to give public servants more flexibility, but they also come with important considerations.

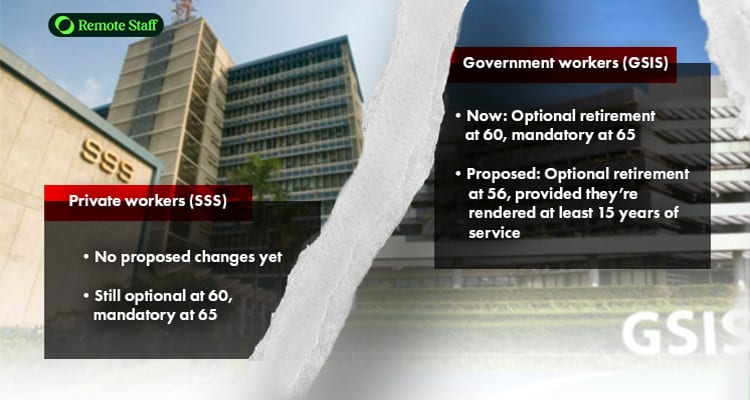

Here’s what public sector workers under GSIS need to know, and how the changes compare to private sector rules under SSS:

Current vs Proposed Retirement Ages (SSS vs GSIS)

Government workers (GSIS):

- Now: Optional retirement at 60, mandatory at 65

- Proposed: Optional retirement at 56, provided they’re rendered at least 15 years of service

Private workers (SSS):

- No proposed changes yet

- Still optional at 60, mandatory at 65

Learn more about how SSS benefits work in this guide.

Who Qualifies and What It Means

You must be a GSIS member, at least 56 years old, with 15 years of service under your belt.

You can choose:

- A lump sum equal to 5 years’ worth of pension, with monthly pension payments after those 5 years.

- Or receive a lump sum worth 18 months of pension upon retirement, with monthly pension payments beginning immediately afterward.

Things to consider:

- Retiring earlier means a smaller pension, since you paid fewer contributions

- Any outstanding loans from GSIS will be deducted

- Less time for promotions or salary increases may also reduce your pension

Why More Filipinos Are Targeting Age 45 for Retirement

A growing number of Filipinos now see retirement at 45 as attainable, not just because of legal changes, but due to cultural and personal shifts.

A recent InLife survey found that many younger Filipinos aspire towards saving for retirement at 45, with over a third saying they want to retire from formal employment before age 55.

For many, the benefits of retiring early include having more control over your time, lowering stress from work, and exploring new careers or personal goals.

This change in mindset is fueling the talk about the new retirement age in the Philippines, not just for public workers but for anyone rethinking when and how to retire.

Rise of the FIRE Movement in the Philippines

The FIRE movement, which stands for Financial Independence, Retire Early, has also been gaining ground in the Philippines.

Filipinos in their 20s and 30s are aggressively saving and cautiously investing, often aiming to retire by 45 through passive income, dividends, and online ventures.

One real-life example comes from a Filipino who retired at 45 and shared his journey.

He built a rental portfolio of five condo units, living in one and renting out the rest.

The income (about USD 2,200 per month) covered his expenses for the first five years of retirement. Later, his government pension kicked in, further boosting his financial stability.

Over time, he also invested in a beach property, a farm lot, and a guesthouse—all funded by savings and rental profits.

Desire for Work-Life Balance and Alternative Income

Many Filipinos who retire early don’t stop working completely—they just want more freedom and less stress.

Instead of regular office jobs, they shift to freelancing, passion projects, or remote work that gives them more control. A lot are exploring online work from home, web-based careers or other e-work opportunities to earn while enjoying a better work-life balance.

Even after reaching their financial goals, many still look for purpose or structure, via starting a small business, mentoring, or doing creative work they enjoy.

With more digital platforms available today, finding these flexible online jobs is easier than ever, helping early retirees stay active and engaged without being tied down by a full-time job.

Economic and Mental Health Drivers Behind Early Retirement Trends

Higher costs of living, rising healthcare needs, stress, and burnout are major reasons pushing people to consider exiting the workforce sooner.

Many prefer to enjoy their well-being and family life while they’re still relatively healthy, rather than working themselves to the bone until the traditional retirement age.

This has led to more discussions about the possibility of senior citizen age reduction and better access to retirement financial advice to help make early retirement achievable.

Financially Preparing for Retirement at 45 or 56

Early retirement is doable, but it takes careful planning and smart financial decisions.

Whether you’re aiming to retire at 45 or 56, understanding your retirement readiness is essential.

Here are key steps to help you get there:

Build Multiple Income Streams While Still Employed

Start side hustles, invest in rental properties, or explore web-based careers. The goal is to cultivate a healthy cash flow that continues even when you stop working full-time.

Maximize SSS/GSIS Contributions, Pag-IBIG MP2, and Your PERA Account

Make the most of your government benefits. Contribute consistently to SSS or GSIS, and set aside extra savings in Pag-IBIG MP2 for higher, tax-free returns.

You can also open a PERA (Personal Equity and Retirement Account), a voluntary retirement savings program that offers tax incentives and grows your money long-term.

Moreover, you can check the Best Digital Banks in the Philippines for convenient saving and investing options that make money management easier.

Build Healthcare and Emergency Funds

You need to stay healthy if you want to enjoy early retirement to the fullest. Set aside money for medical needs, and build an emergency fund that covers at least 6 to 12 months of living expenses.

If you’re not sure where to start, you can follow this simple guide to build your emergency fund.

Gradually Shift to Low-Cost Living and Sustainable Lifestyles

Cut down on unnecessary spending.

Consider living in a more affordable area, downsizing, or adopting simpler habits that reduce long-term costs.

For more ideas, check out our practical tips for successfully planning your retirement.

The Unexpected Challenges of Early Retirement in the Philippines

Retiring early isn’t just about having money in the bank.

With talk of a new retirement age in the Philippines, more people are considering early retirement, but they also need to consider long-term challenges that require careful planning and emotional readiness.

Inflation, Cost of Living, and Long-Term Budgeting

Over time, prices go up, so your savings today won’t have the same purchasing power in the future.

So planning for 30+ years of retirement means setting a realistic budget and sticking to it, even as daily costs and living expenses continue to rise.

As a rule of thumb, your savings should earn at least 3–5% annually, through interest or investments, to stay ahead of inflation.

Healthcare Access Post-Employment

Leaving work early often means losing employer-provided health coverage.

You’ll need to secure your own health plan, which can be costly and hard to maintain as you age.

Emotional Adjustment: Coping With the Lack of Daily Structure

Early retirement doesn’t mean you have to stop working completely. After all, some retirees feel bored or lost if they go too long without some form of structure.

Staying mentally active and engaged with your community through passion projects, remote work, or part-time roles can bring purpose and routine to your days.

FAQ: Early Retirement for Filipinos

Here are some common concerns and what you need to know before leaping into early retirement (or preparing for it).

Can I work again after early retirement from government service?

Yes. Retired government workers can still work in the private sector or take on freelance or contractual roles.

These do not affect your GSIS pension, so your monthly benefits will continue uninterrupted.

However, returning to government service is a different story. Under the current GSIS rules, you’ll be treated as a new employee, and your previous service won’t be credited toward future pension calculations.

You won’t lose your original pension, but you cannot combine your old and new service records to increase your benefits later on.

For example:

Ana retired from a government agency at age 56 and began receiving her GSIS pension. A year later, she took a private-sector job as a consultant—her pension continued without interruption.

However, if Ana had rejoined another government agency instead, she would have started fresh under GSIS and wouldn’t be able to add her previous 20 years of service to her new record.

What happens to my GSIS or SSS pension if I retire early?

If you meet the early retirement qualifications, you may choose from pension options such as a lump sum with delayed monthly pension or a smaller lump sum with pension starting right away.

Make sure to meet GSIS or SSS requirements for continuous eligibility.

Your retirement pay entitlement depends on your years of service and contributions.

Are there programs for post-retirement income or business?

Yes. Several government programs support post-retirement income, such as DTI’s small business support, TESDA skills training, and online work opportunities.

Many retirees also explore digital freelancing, cyber job listings, remote jobs, or small-scale entrepreneurship.

You can also visit these reliable websites to build skills for remote or freelance work.

Conclusion: Retirement at 45 or 56 – A New Chapter, A New Opportunity

Retirement today isn’t just about quitting work, it’s about gaining the freedom to live the second half of life your way.

Whether you plan to retire at 56 through government service or aim for financial independence by 45, early retirement is now a real option for many Filipinos.

With discussions around the new retirement age in the Philippines, more people are evaluating what’s possible – and what’s next.

More Filipinos are exploring the implications of retiring at age 45, especially those pursuing early financial independence.

Smart retirement planning in the Philippines means building multiple income streams, growing your savings through government and private programs, and living a simpler, more sustainable lifestyle—so you’re ready, whatever your age.

Need help jumpstarting your retirement savings or creating flexible income streams?

Remote Staff offers online jobs that can help you earn from home or anywhere.

This is perfect for supplementing your income as you prepare for or transition into early retirement.

Register with Remote Staff and explore flexible work options that fit your goals.