Introduction

Starting June 1, 2025, the Philippine government will roll out a 12% value-added tax (VAT) on digital services—often referred to as the digital tax in the Philippines.

This move aims to keep up with the growing digital economy—but it’s already causing great consternation among freelancers, agency owners, e-commerce entrepreneurs, and even the best digital banks serving Filipino consumers..

Reactions across the industry are mixed. Freelancers worry their take-home pay will decrease, especially if platforms like Upwork and Fiverr pass the added VAT onto users.

Agency owners are left puzzling over how to adjust their pricing, manage compliance, and talk clients through potential rate hikes.

Meanwhile, e-commerce entrepreneurs are alarmed as to how the new rules will affect online sales, payment systems, and cross-border transactions.

Some even compare it to the CMEPA 20% Tax, since both measures reshape how businesses and digital platforms handle taxation in a rapidly evolving digital economy.

This isn’t just another tax. It’s a big step into an area that was mostly unregulated and hard for the Philippine government to control – until now.

With June 1 fast approaching, here’s everything you need to know about this latest kind of VAT so you can cushion your business or job from its impact.

What Is the 12% VAT on Digital Services All About?

The 12% VAT on digital services is the Philippine government’s way of taxing—or at least trying to regulate—the fast-growing online economy.

It seeks to level the playing field—both local and foreign offering digital services now pay VAT.

Before the new ruling, Filipino VAT-registered companies had to charge VAT on their digital services—while many foreign companies offering the same services did not.

This created an uneven playing field, which the new Value-Added Tax on Digital Services Law aims to fix.

Overview of BIR RR 3-2025 and RR 14-2025

To implement the new VAT on digital services, the Bureau of Internal Revenue (BIR) released two key regulations:

Revenue Regulation 3-2025

RR 3-2025 outlines how the 12% VAT in the Philippines applies to digital services. It defines what counts as a digital service, who needs to register, and sets a ₱3 million gross sales threshold for mandatory VAT registration.

Revenue Regulation 14-2025

RR 14-2025 provides more detailed rules for compliance.

It explains how both local and foreign digital service providers should register, issue invoices, collect VAT, and file returns.

It also covers invoicing requirements and the timeline for registration, especially for non-resident companies.

Timeline: When does the 12% VAT take effect?

The 12% Value-Added Tax in the Philippines for digital services is set to take effect on June 1, 2025.

According to the Bureau of Internal Revenue (BIR), foreign digital service providers (DSPs) must register with the BIR by June 1, 2025, and begin charging and remitting the 12% VAT from June 2, 2025

Who will be affected by the VAT changes and what should they look out for?

Based on the regulations above, anyone providing digital services to consumers in the Philippines—whether local or foreign, individual or corporate—may be affected.

However, it’s not only the digital service providers (DSPs) that will feel the impact, but also their end-users.

Most businesses won’t absorb the VAT; instead, they’ll pass the added cost on to users, making digital services more expensive.

Here are some of the people likely to feel the impact:

Freelancers and Independent Contractors

These are self-employed professionals—like writers, graphic designers, consultants, and developers—who work online or on-site and deal directly with clients.

Technically, those earning over ₱3 million annually have always been required to register as VAT taxpayers.

However, with the government now putting more focus on digital services, even small and mid-sized freelancers can expect tighter monitoring and stricter enforcement.

At the same time, any digital tools or platforms they use—like design software, cloud storage, or invoicing apps—may also become more expensive once VAT is added.

Online Job Workers (Platform-based Workers)

These include virtual assistants, data entry workers, or customer service agents who find work through platforms like Upwork, Fiverr, or OnlineJobs.ph.

With the introduction of VAT on online platforms in the Philippines, the service providers behind these websites may start adding 12% VAT to service fees or membership plans, which could reduce workers’ take-home pay.

If the VAT cost is passed on to clients, workers might also face more pressure to lower their rates to stay competitive in the market.

Owners of VA Agencies and Online Staffing Firms

If you run an agency that provides virtual assistants or remote staff—whether to local or international clients—you’ll need to take a closer look at how the new VAT rules apply.

For clients based in the Philippines, you’ll need to charge 12% VAT if your annual revenue exceeds ₱3 million and/or you’re VAT-registered.

However, for overseas clients, services may be classified as zero-rated under Section 108(B)(2) of the Philippine Tax Code, which treats services rendered to clients abroad as “export sales” subject to 0% VAT—provided the payment is in foreign currency and properly accounted for under BSP rules.

Note: Even if the subscription or service is billed to a foreign entity, it may still be subject to VAT if the service is used in the Philippines—for example, if accessed from Philippine IP addresses or used for Philippine operations.

This is especially important for cross-border digital transactions, where proper VAT treatment ensures compliance and maximizes tax benefits.

That said, you still need to be VAT-registered and keep proper documentation to prove your client is outside the country.

Business Owners in E-Commerce and Digital Services

Entrepreneurs who run online stores, sell digital products (like ebooks or courses), or offer digital services (like marketing or web development) will feel the biggest impact.

Even before this law, VAT already applied to businesses earning over ₱3 million per year.

What’s changing now is stricter enforcement of VAT on e-marketplaces—especially for those selling to Filipino consumers online.

In addition, the government is paying close attention to electronic marketplaces’ VAT to ensure all digital transactions are properly taxed.

This also affects services provided to foreign businesses.

When digital services are sold to foreign clients and paid for in foreign currency, these may qualify as “export sales” and be taxed at 0% VAT under the Philippine Tax Code.

However, if the service is mainly used by people in the Philippines, the BIR may treat it as a locally rendered service and charge VAT accordingly.

For example, a foreign company might subscribe to an online tool (e.g., for project management or design software) from a Filipino provider for their employees based in the Philippines.

While this would normally be zero-rated for VAT, the BIR could still impose VAT if most of the users are located in the Philippines—even if the contract and payment come from abroad.

Also, if you’re not VAT-registered but close to the threshold, expect more scrutiny.

Moreover, if you’re already registered, you’ll need to start applying 12% VAT to digital sales and services, update your invoices, and make sure your pricing reflects the added tax.

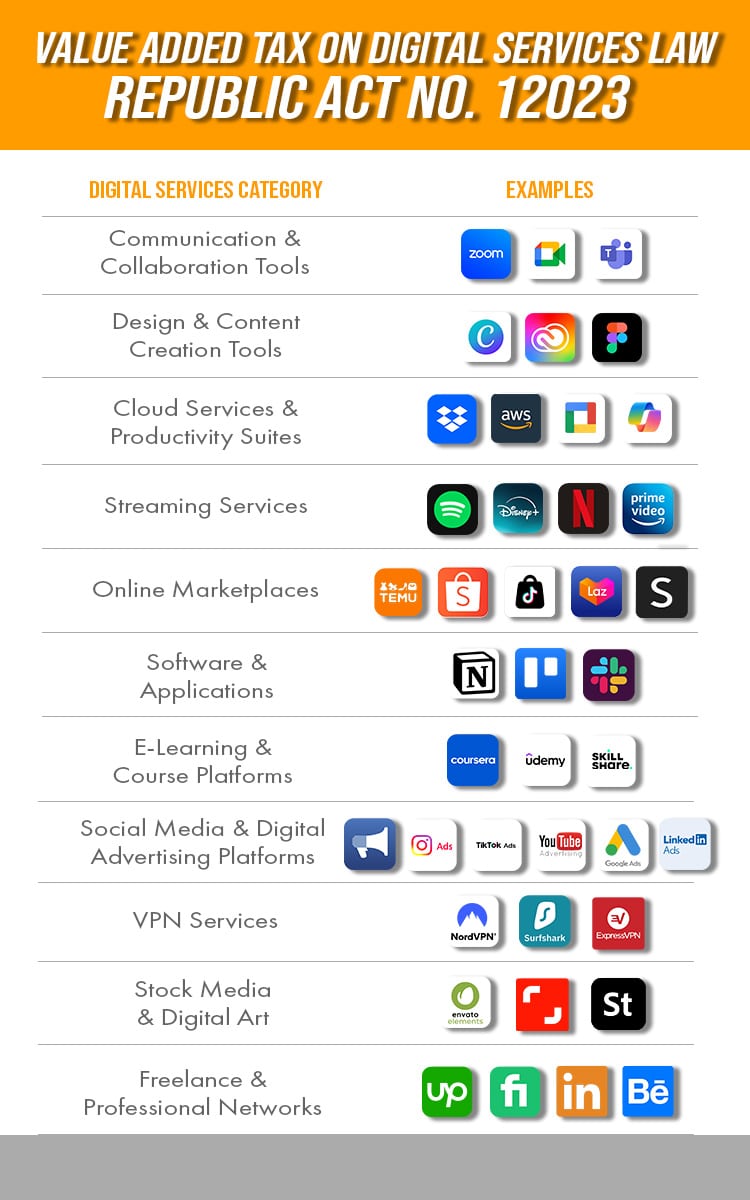

What Digital Services Are Affected?

Not all online services are treated the same under the new VAT rules.

This section breaks down which types of digital services are covered—so you can see if your business or the platforms you use are affected.

Common platforms and services subject to VAT (e.g., Zoom, Canva, Google Workspace)

The 12% VAT in the Philippines applies to a wide range of digital platforms and services used by Filipinos for work, entertainment, communication, and business.

This includes cloud storage tools, design apps, collaboration software, e-commerce platforms, and social media ad services.

One of the biggest areas of impact will be the VAT on subscriptions.

Whether you’re a freelancer, a small business owner, or a casual user, you may start seeing higher prices for the digital tools and software you rely on. Most providers plan to raise their subscription fees to pass the tax on to consumers.

If your business depends on paid advertising or cloud-based tools, it’s important to start budgeting for these higher costs.

Consider reviewing your current subscriptions, prioritizing what’s essential, and watching for updated pricing from service providers.

Here are some commonly used platforms and services that may be affected:

Communication & Collaboration Tools:

- Zoom

- Google Meet

- Microsoft Teams

Design & Content Creation Tools:

- Canva

- Adobe Creative Cloud

- Figma

Cloud Services & Productivity Suites:

- Google Workspace (Gmail, Drive, Docs, etc.)

- Microsoft 365

- AWS (Amazon Web Services)

- Dropbox

Streaming Services:

- Netflix

- Disney+

- Spotify

- Prime Video

Online Marketplaces:

- Lazada

- Shopee

- TikTok Shop

- Temu

- Shein

Software & Applications:

- Notion

- Trello

- Slack

E-Learning & Course Platforms:

- Coursera

- Udemy

- Skillshare

Social Media & Digital Advertising Platforms:

- Facebook Ads (Meta)

- Instagram Ads

- TikTok Ads

- YouTube Ads

- Google Ads

- LinkedIn Ads

VPN Services:

- NordVPN

- Surfshark

- ExpressVPN

Stock Media & Digital Art:

- Envato Elements

- Shutterstock

- Adobe Stock

Freelance & Professional Networks:

- Upwork

- Fiverr

- LinkedIn Premium

- Behance

Foreign digital service providers and how they’ll be taxed

Starting June 1, foreign companies that sell digital services to people in the Philippines—such as Netflix, Google, Meta, or Canva—will be required to register with the BIR and charge a 12% VAT on foreign digital services.

Even if these companies don’t have a physical office in the Philippines, they must comply if they earn over ₱3 million annually from Filipino users. This rule aims to create a level playing field by ensuring foreign providers pay VAT just like local businesses do.

If you subscribe to paid apps, digital ads, or online services from these foreign companies, expect prices to increase. Most of these providers will likely pass the VAT on to consumers.

To meet tax compliance for DSPs, these companies must:

- Register with the BIR

- Charge 12% VAT on sales to Filipino users

- Issue receipts

- File VAT reports regularly

If they don’t abide by these rules, authorities could fine them or even block them in the Philippines.

Local implications for service subscriptions and software use

For individuals and businesses in the Philippines, the 12% VAT on foreign digital services will mean higher costs for many digital tools and subscriptions.

Whether you’re using design software, cloud storage, project management apps, or video conferencing tools, prices are likely to increase as providers pass on the tax. This applies to both foreign and local services.

However, if you’re VAT-registered, the reverse charge VAT mechanism may allow you to claim input VAT on these services—so it’s important to keep receipts and accurate records.

Note: Only local businesses registered for VAT in the Philippines can claim input VAT. Foreign companies without a local presence cannot, so they have to shoulder the 12% as an extra cost..

Example: If a U.S.-based marketing agency uses a Filipino video editing tool, they’re still subject to 12% VAT, which they can’t claim as input VAT.

Foreign companies can only claim input VAT if they have a registered office in the Philippines—like a branch or subsidiary.

Overall, it’s time to review your subscriptions, prioritize essential tools, and check if there are VAT-inclusive alternatives to manage your costs more effectively.

Clarifying Common Misconceptions About the 12% VAT on Digital Services

The 12% VAT in the Philippines for digital services has sparked plenty of questions and misconceptions.

Let’s clear up what it really means for digital businesses and consumers in the Philippines:

“Only foreign platforms are affected”

New digital service taxes or online regulations can affect both foreign and local platforms.

Since local businesses abide by the rules governing gross sales VAT in the Philippines, adding VAT to foreign services helps level the playing field.

This might even encourage the growth of homegrown alternatives—local platforms that can now compete when it comes to pricing and services.

“Clients or platforms will automatically shoulder the VAT cost”

The truth is, the 12% VAT in the Philippines isn’t always covered by the client or platform. In many cases, the freelancer, seller, or even the end customer bears the extra cost.

For example, a platform might deduct VAT from your payout or raise prices for buyers instead of shouldering the cost themselves.

So it’s important to check how each platform handles VAT, lest you get taken aback by unforeseen deductions or higher selling prices.

“Paying VAT is optional if you don’t earn a lot.”

Not exactly. Under the digital services tax Philippines’ rules, VAT is only required if you earn over Php3 million per year—but that doesn’t mean you’re automatically tax-exempt if you earn less.

You may still need to register as a non-VAT taxpayer and pay other taxes like percentage tax or income tax, for instance.

This is part of the government’s broader effort towards digital economy taxation, ensuring that everyone in the digital space, big or small, contributes fairly to the tax system.

So while your earnings might not fall under VAT, you would still be subject to other taxes.

“Digital services are already taxed through income tax.”

Income tax and VAT are two different things. You pay income tax on your earnings or profits, while businesses add VAT to the price of goods or services sold.

Just because a digital service provider pays income tax doesn’t mean their services are exempt from VAT.

If they hit the VAT threshold or offer VAT-covered services, both taxes can apply.

Examples:

- A freelance video editor earning Php 4 million a year from international clients must pay income tax on their profit and charge 12% VAT on their services because they exceed the Php 3 million threshold.

- A local digital marketing agency that sells ad services online and earns over Php 3 million must also pay income tax on its net income and apply B2B digital service VAT on each client invoice.

How to Prepare Before June 1

New VAT rules for digital services will apply soon. Here’s how freelancers, online sellers, and digital businesses can get ready for the Philippine VAT implementation:

Review your digital tools and subscriptions

Check which online tools, apps, or platforms you use the most—like design software, cloud storage, or project management tools.

If they’re billed from abroad, they may now include 12% VAT starting June 1. So factor that into your expenses and/or pricing.

Explore organic sales channels

Selling through direct referrals, personal websites, or private communities (like Facebook groups or email lists) may help reduce your reliance on large digital platforms that pass on VAT costs.

While you’re still subject to other taxes, these organic channels may not trigger the same tax treatment as platform-based services.

If possible, you can also consider using fewer paid ads. Since advertising services—especially from foreign providers—are now subject to VAT, cutting back on ad spend could help lower your overall costs and reduce tax exposure.

Talk to your accountant or tax advisor

If you’re unsure about how the new VAT rules affect you, consult a professional.

They can help you understand your tax obligations, update your registration if needed, and make sure you’re filing everything correctly.

Communicate price adjustments to clients, if needed

If the new VAT rules will affect your pricing, let your clients know ahead of time.

Be clear and transparent about why the change is happening to maintain trust and avoid confusion.

Monitor updates from the BIR

Stay updated on the latest VAT rules by regularly visiting the BIR website and checking the “Announcements” section.

Final Thoughts

The 12% VAT on digital services marks a major shift in the Philippine digital economy. It will affect freelancers, agency owners, and online entrepreneurs across the country (and ultimately, all other end users).

Starting June 1, 2025, both local and foreign digital service providers must comply—leading to possible price changes, tighter tax enforcement, and more reporting requirements.

While these changes may feel overwhelming, they also level the playing field.

It could also create more opportunities for homegrown platforms to grow.

For many Filipino professionals engaged in remote work, now is a good time to reassess your setup.

With the increasing use of remote collaboration tools, work-from-anywhere policies, and the demand for a flexible work environment and stable virtual workplace, having the right support matters more than ever.

If you’re looking for stability during this transition, Remote Staff offers online jobs with built-in support.

We help remote workers stay compliant by providing proper documentation and assistance with tax obligations.

Register with Remote Staff today and enjoy peace of mind while working from anywhere.