Many Filipinos are worried that the new 20% interest tax under the Capital Markets Efficiency Promotion Act (CMEPA) will eat into their savings.

Social media posts and headlines have sensationalized the new law and thus contributed to the confusion, leading many to conclude that their very savings will be taxed directly. However, that’s not the case.

In reality, the CMEPA law standardizes the tax on interest earnings from bank deposits—not your actual savings or principal.

The 20% final withholding tax (FWT) has existed for years (yes, even for top digital banks in the Philippines), but CMEPA removes exemptions and applies it more uniformly.

Just like the recently implemented 12% VAT on Digital Services, the goal is not to punish ordinary Filipinos but to close loopholes, expand the tax base, and make the system fairer across industries.

Let’s break down what this law really means, who it affects, and how you can legally minimize its impact on your finances.

What Is the 20% Final Tax on Interest Income?

The 20% interest income tax rate isn’t new.

It was part of the tax code even before CMEPA. The difference is the law removed exemptions and set a flat 20% tax on all bank deposits starting July 1, 2025.

Understanding the Existing Tax Rule Under the National Internal Revenue Code

Before CMEPA, the tax on time deposits and other interest-bearing accounts depended on how long you kept your money in the bank:

- Less than 3 years – taxed at 20%

- 3 to less than 4 years – taxed at 12%

- 4 to less than 5 years – taxed at 5%

- 5 years or more – tax-free, as long as the deposit was BSP-certified

However, this tiered system of maturity period tax rates will be removed. All interest income will be taxed at a flat 20%, no matter how long the deposit is held.

So even if you lock in your money for 5 years or more, the interest you earn will still be taxed at 20%, unless the deposit was made before July 1, 2025.

How to compute the 20% tax on your interest:

Unlike your compensation income where you might use a withholding tax calculator Philippines tool to estimate deductions, computing the 20% tax on your bank interest is straightforward.

First, calculate the interest earned based on your principal (the amount you deposited), then multiply the interest by 20%.

Example:

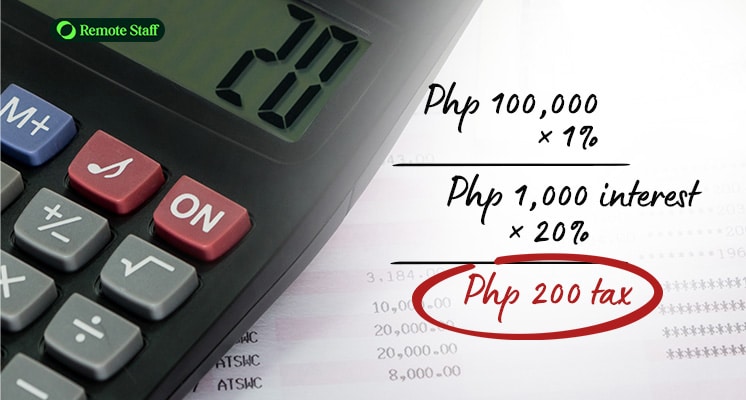

If you deposit Php 100,000 in a time deposit that earns 1% annual interest, you’ll earn:

Php 100,000 × 1% = Php 1,000 interest

To compute the tax, simply multiply the interest earned by 20% as shown:

Php 1,000 × 20% = Php 200 tax

You’ll thus receive Php 800 in net interest after the bank withholds the tax.

When and How the Tax Is Deducted from Bank Interest

The 20% tax on interest income falls under passive income taxation and is automatically deducted at the source by your bank before you receive any earnings

Who Is Affected by the Rule? Individuals vs. Corporations

The 20% FWT mainly affects individual depositors, including:

- Regular savings account holders

- Customers with time deposits

- Retirees or OFWs storing money in long-term bank products

Corporations, on the other hand, are subject to a different set of rules:

If the interest income is from peso or foreign-currency bank deposits, it is usually subject to a 20% FWT, just like for individuals. The bank deducts the tax, and it’s no longer included in their taxable income.

However, if the interest comes from other sources (like loans, bonds, or investments not covered by FWT), it becomes part of the corporation’s gross income and is taxed at the corporate income tax rate—either 25%, or 20% for small businesses.

In short:

- Individuals are taxed 20% on interest income on all their deposits.

- Corporations may either be taxed at source (FWT) or under their regular income tax, depending on the type of interest earned.

Which Savings and Investments Are Affected by the 20% Interest Tax?

Many of the savings and investments previously exempt are now subject to the same 20% tax under CMEPA:

Peso Savings and Time Deposits in Local Banks

All interest earned from peso-denominated savings accounts and time deposits in Philippine banks is now subject to the flat 20% final withholding tax, regardless of how long the money is kept in the account.

Even if you lock in your deposit for five years or more, the interest will still be taxed at this rate – unless it was placed before July 1, 2025, in which case the old tax rules still apply.

Dollar Deposits and Foreign Currency Accounts

Interest earned from foreign currency deposit units (FCDUs), such as dollar savings or time deposits, is also taxed at 20% FWT under CMEPA.

This applies to both individual and corporate accounts unless specific exemptions apply (e.g., certain offshore investors or special accounts under Philippine banking laws).

Long-Term Investments and Bonds That May Be Affected

Previously, long-term deposits and bonds (like government or corporate bonds with maturities of 5 years or more) were exempt from tax if they were BSP‑certified and held until maturity.

However, starting July 1, 2025, CMEPA will change how long-term deposit taxation works, removing the exemption for new placements made on or after this date.

So, even if you invest for more than 5 years, the interest income will be taxed at 20%, unless your investment was made before the law takes effect and thus qualifies under the old rules.

Which Investment Instruments Are Exempt from the 20% Tax?

Under the Department of Finance tax policy and the CMEPA, most savings and investments now have a flat 20% tax on interest income.

However, some instruments remain exempt—either fully or under certain conditions—such as:

Long-Term Government Bonds

Interest from Philippine government-issued securities, such as Treasury Bonds (T-bonds), Treasury Notes, and Retail Treasury Bonds (RTBs), is tax-exempt for qualified investors with a valid Certificate of Tax Exemption from the BIR.

These are usually pension funds, cooperatives, tax-exempt institutions, or government-accredited organizations.

Unfortunately, retail or individual investors—including ordinary citizens—must pay the 20% flat tax on their interest income from these bonds.

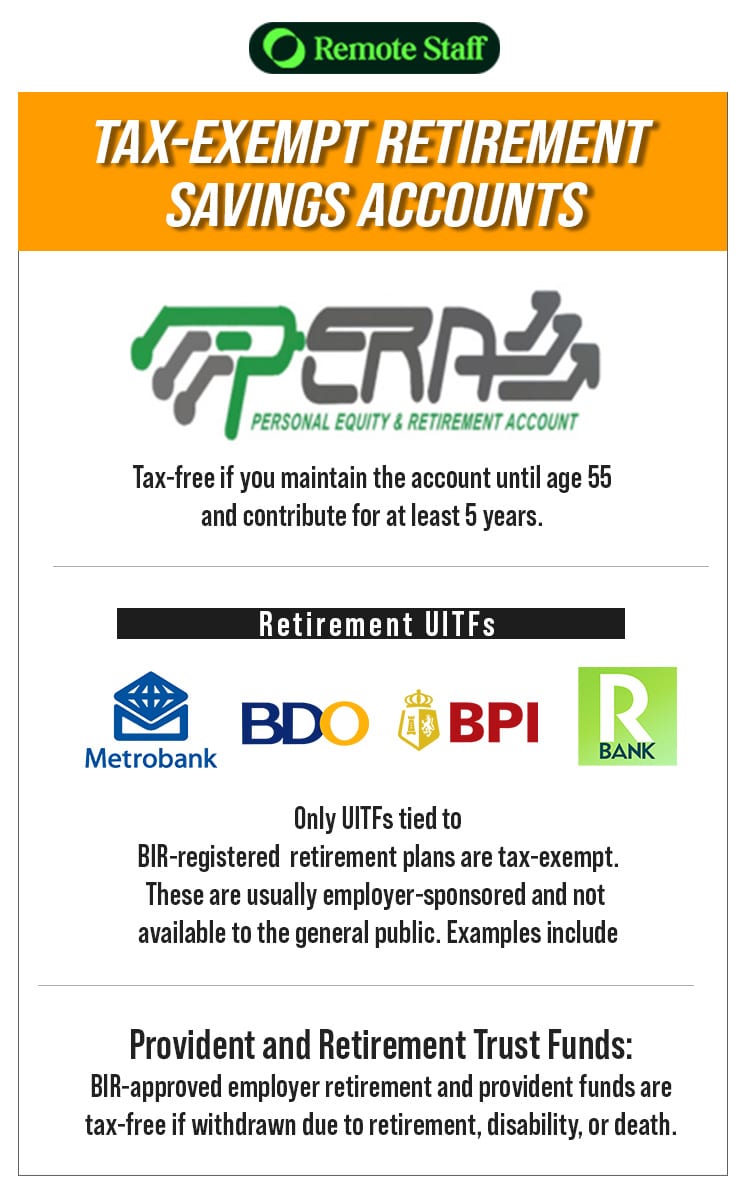

Tax-Exempt Retirement Savings Accounts

Some retirement savings options are exempt from the 20% tax, as long as they follow BIR rules:

- PERA (Personal Equity and Retirement Account): Tax-free if you maintain the account until age 55 and contribute for at least 5 years.

- Retirement UITFs: Only UITFs tied to BIR-registered retirement plans are tax-exempt. These are usually employer-sponsored and not available to the general public. Examples include:

- BPI Retirement Income UITF

- BDO Peso Retirement Fund

- Metrobank Retirement Pay UITF

- Robinsons Bank Retirement Pay UITF

- Provident and Retirement Trust Funds: BIR-approved employer retirement and provident funds are tax-free if withdrawn due to retirement, disability, or death.

These options are designed to encourage long-term financial planning by providing a tax exemption on savings when used correctly.

Pag‑IBIG MP2 Savings Program

Aside from housing loans and other benefits, Pag-IBIG offers savings programs that are non-taxable.

Dividends from the Pag‑IBIG MP2 program are completely tax-free, provided the savings are held for the full five-year term.

For example, the Pag-IBIG MP2 dividend rate 2024 was declared at 7.05%, far higher than most bank deposit interest rates.

This makes the program one of the most attractive options for Filipinos who want to grow their Pag-IBIG savings without worrying about taxes eating into their earnings.

Cooperative and Rural Bank Savings (Conditional)

Some deposits in cooperatives and rural banks may qualify for exemption from the bank savings tax, but only under strict conditions:

Cooperatives

Interest earnings are tax-exempt only if the cooperative is registered and meets BIR qualifications under the Cooperative Code of the Philippines (RA 9520).

Generally, the exemption applies to:

- Member-depositors only

- Cooperatives with not more than ₱10 million in accumulated reserves and savings

- Must be certified tax-exempt by the BIR

Take Sorosoro Ibaba Development Cooperative (SIDC), for instance – it’s one of the largest agri-based cooperatives in the Philippines with BIR-issued tax exemption rulings for qualified member-deposit interest.

Rural Banks

Rural banks may offer some tax perks, but most of the time, your interest earnings are still taxed under the Philippine bank deposit tax.

To qualify for an exemption, the rural bank must have a BIR ruling—usually tied to special programs or development funding.

For example, Card SME Bank (a rural bank) and 1st Valley Bank have partnered with cooperatives or programs that may provide tax-exempt savings for members under special arrangements.

However, deposits in rural banks or cooperatives are not usually automatically tax-free.

Always check with the institution if their deposit products are covered by a BIR tax exemption ruling.

Public Misconceptions and Controversies Around the 20% Interest Income Tax

While the 20% final withholding tax on bank interest has existed for years, recent changes under CMEPA have reignited debates – and inadvertently sparked confusion.

Here’s a closer look at the most common myths and ongoing concerns:

“It’s a Tax On 20% of Our Savings”

This is a widespread concern, but the 20% tax applies only to the interest earned, NOT the total savings or principal.

For example, if your time deposit earned Php 1,000 in interest, the tax withheld would be Php 200, which is 20% of the interest earned—not 20% of the time deposit’s principal amount itself.

“It’s a New Tax Law”

The 20% interest income tax isn’t new. It’s been part of the Tax Code since the 1990s.

What CMEPA did was remove most exemptions, applying the tax more broadly to all bank deposit products, including some that were previously tax-free.

“It Applies to All Investments”

Many believe the tax applies to all forms of saving and investing. In reality, some instruments remain tax-exempt, including:

- Long-term government bonds for qualified investors

- Retirement UITFs

- PERA accounts

- Select cooperative savings and rural bank products (with conditions)

“You’re Being Double-Taxed”

Many people worry that they’re being taxed twice on their interest income—once when it’s earned, and again when they file their annual income tax return.

That’s not the case.

The 20% is a final withholding tax. It means the tax is automatically deducted by your bank before the interest is credited to your account.

You’ve already paid the full tax due on that interest income—so you don’t need to declare it again in your annual ITR (unless you’re exempt or a corporation).

Example:

If your time deposit earns Php 1,000 in interest, your bank withholds Php 200 (20%) and gives you Php 800. That Php 200 is already the tax you paid on the income earned via interest.

The interest income here won’t be taxed again at year-end, so you don’t need to report it in your annual ITR.

“OFWs and Seniors Will Get Hit Hard.”

It’s true—many Overseas Filipino Workers and retirees are affected by this policy. They often place their savings in time deposits or long-term accounts. Now that exemptions are gone:

- The interest income on their hard-earned savings will be fully taxed at 20%.

- Senior citizens who rely on interest for passive income will have less to live on.

As of this writing, there’s no distinction made for vulnerable groups as well.

“This Increases the Tax Burden on the Middle Class.”

Critics argue that flat taxes like this one hit middle-income savers more than high-net-worth investors. Common concerns include:

- Small savers now pay the same rate as large depositors

- No tiered or progressive tax relief

- Reduced incentive for long-term savings among average Filipinos

Some lawmakers and groups want fairer rules—like exemptions or lower rates—for low- to middle-income savers who rely on banks to grow their money.

Future tax reforms might bring back exemptions for seniors, OFWs, or small depositors.

How to Legally Minimize Your Tax Exposure

Even with the 20% tax on most forms of interest income from savings accounts, there are legal ways to reduce your exposure.

With smart planning, you can keep more of your money AND grow your savings.

Shift to Long-Term Investments That Are Tax-Exempt

Consider putting your money in instruments like long-term government bonds, PAGIBIG MP2, or PERA accounts.

These options offer tax-free interest if you meet certain conditions—like holding periods or contribution timelines.

Maximize Use of Cooperative Banks (if applicable)

Some savings and time deposits in accredited cooperatives may be exempt from the 20% withholding tax, especially if the cooperative falls within the BIR’s exemption thresholds.

Always check if your membership and the institution qualify.

Consult Financial Advisors for Portfolio Diversification

You can also consult a licensed financial advisor.

They can help you re-allocate your savings across taxable and tax-exempt options, so you protect your returns while staying within the rules.

Frequently Asked Questions (FAQ)

Understanding how the 20% interest income tax works can help you make better financial decisions.

Here are answers to some of the most common questions people have:

Is my bank automatically deducting the 20% interest tax?

Yes. Banks automatically deduct the 20% flat tax on deposit interest.

Are savings accounts in rural banks taxed too?

Most rural bank deposits are also subject to the 20% tax.

However, certain accounts may qualify for exemptions if the bank has a valid certificate of tax exemption under specific conditions. Check with your bank directly.

What if I keep my money in a digital bank?

Digital banks regulated by the Bangko Sentral ng Pilipinas (BSP) follow the same rules as traditional banks.

If your digital savings earn interest, the 20% tax is still applied automatically.

How do I know if my investment is exempt from the tax?

Look for these common tax-exempt savings and investment options:

- Long-term government bonds

- PERA (Personal Equity and Retirement Account)

- BIR-approved retirement UITFs (e.g., BDO Pension 360, Metrobank Maxi-Saver Retirement Fund)

- Qualified cooperative deposits or rural bank accounts (with special certifications)

When in doubt, ask your bank or investment provider directly.

Does this tax apply to joint or custodial accounts?

Yes. The 20% tax is applied based on the account’s interest earnings, regardless of who owns it.

Whether the account is individual, joint, or custodial (e.g., for a minor), interest is taxed in the same way.

Conclusion: Stay Informed and Smart With Your Savings

The 20% final tax on interest income may seem overwhelming at first, but once you understand how it works, it becomes more manageable.

Only the interest you earn is taxed—not your total savings—and your bank already withholds this amount. So, you’re not being taxed again at year-end.

Still, this is a good time to explore better ways to grow your money. Some options like long-term bonds, PERA, Pag-IBIG MP2, and certain cooperative savings accounts may be tax-free.

Looking to boost your income? Remote Staff offers flexible online jobs that you can do from home.

Whether you’re exploring part-time work or full-time virtual assistant jobs, it’s a great way to earn more while keeping your savings safe.

Register today with Remote Staff and start working online!